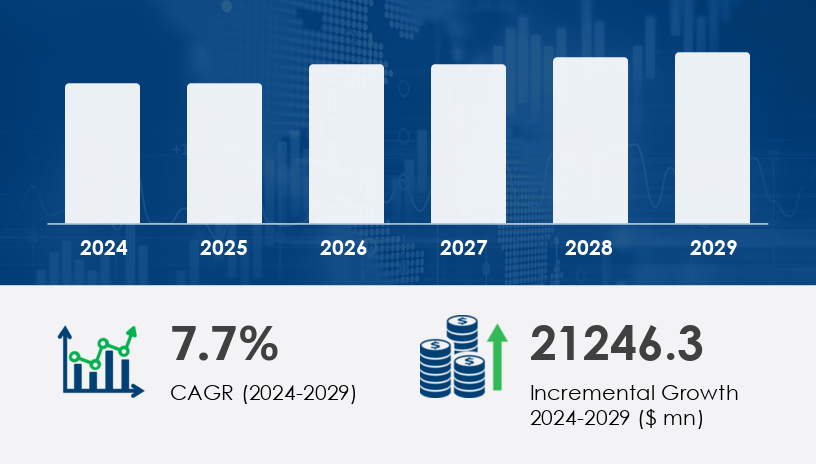

The global yoga clothing market is projected to grow by USD 21.25 billion between 2025 and 2029, accelerating at a compound annual growth rate (CAGR) of 7.7%. As North America emerges as a dominant force, accounting for 31% of the market’s expansion, U.S. business leaders and apparel companies are recalibrating strategies to harness the rising wave of wellness, sustainability, and fashion-forward performance wear.For more details about the industry, get the PDF sample report for free

Leading the innovation curve are brands like Adidas AG, ANTA Sports Products Ltd., ASICS Corp., Authentic Brands Group LLC, BasicNet Spa, Columbia Sportswear Co., Frasers Group plc, Hanesbrands Inc., Hugger Mugger Yoga Products LLC Inc., La Vie Boheme Yoga, lululemon athletica Inc., Manduka LLC, New Balance Athletics Inc., Nike Inc., PUMA SE, Ralph Lauren Corp., Under Armour Inc., VF Corp., and Yoga Direct LLC. These firms are leveraging a combination of technological innovation, celebrity endorsements, and sustainable production to stay ahead in a fragmented market.

North America—particularly the US and Canada—continues to dominate the landscape due to its entrenched fitness culture and growing consumer investment in wellness-related products. In Europe, countries like France, Germany, Italy, and the UK remain strongholds for premium yoga wear. Meanwhile, APAC nations such as China, India, and Japan are rapidly expanding their market footprint through growing urbanization and digital fitness adoption. South America, led by Brazil, and regions in the Middle East and Africa are also contributing to the market’s global momentum.

Get more details by ordering the complete report

The market is categorized into Bottom Wear, Top Wear, and Accessories, with Bottom Wear emerging as the most dominant segment. These include sweatpants, joggers, slacks, capris, and tights. The surge in demand stems from the necessity of flexible, breathable, and odor-resistant clothing that supports a wide range of motion during yoga routines. The integration of materials such as cotton-spandex blends and lightweight, quick-dry fabrics has become a staple, reflecting consumer preference for comfort, durability, and style.

By end-user, the market is segmented into Men and Women, with both demographics showing robust demand as yoga transcends gender boundaries. Distribution is split between Offline and Online channels, with the digital segment gaining traction due to the proliferation of e-commerce and fitness apps.

The Yoga Clothing Market is witnessing a surge in demand driven by the increasing adoption of yoga pants, athletic leggings, and moisture-wicking fabric for enhanced comfort and performance. With rising environmental awareness, consumers are gravitating towards eco-friendly apparel and sustainable clothing, including garments made from organic cotton, recycled polyester, and bamboo fabric. Innovations such as anti-odor technology, stretchable material, and breathable fabric are gaining traction, especially in products like seamless leggings, high-waisted leggings, and compression wear. Key categories like yoga tops, sports bras, and tank tops are driving growth, complemented by rising interest in yoga accessories such as yoga gloves, armbands, and wristbands. The infusion of technology into garments is also emerging, with the rise of smart clothing and performance apparel, aligning closely with consumer interest in athleisure wear, fitness clothing, and wellness apparel.

For more details about the industry, get the PDF sample report for free

The key growth catalyst remains the growing number of yoga practitioners, especially in North America. Yoga’s transformation from a niche spiritual practice into a mainstream health activity has attracted Millennials and Generation X, both of whom prioritize mental wellness and physical fitness. The rise of fitness apps, virtual yoga classes, and health clubs has further democratized access, reinforcing demand for performance-driven clothing.

Athleisure—the fusion of athletic and leisurewear—has expanded the yoga clothing category beyond fitness, enabling consumers to transition seamlessly from workouts to daily life. Moisture-wicking properties, breathable fabrics, and ergonomic fits are now baseline expectations. Additionally, celebrities and influencers endorsing yoga lifestyles have fueled aspirational purchases.

One of the standout trends is the integration of advanced technologies into yoga clothing. Consumers are gravitating toward garments that offer compression features, odor-reduction, and stretchability, with brands like Beyond Yoga, CorePower, and Yoga Earth leading this evolution.

Sustainability is another growing priority. With increasing awareness of environmental impact, brands are investing in eco-friendly textiles, such as organic cotton and recycled materials. Companies like Boxed Water have tapped into this sentiment, introducing sustainable yoga wear that resonates with eco-conscious buyers.

There's also a shift toward customizable yoga clothing, which caters to personal style preferences while maintaining high performance. Studios now offer branded gear, and retailers are launching experiential formats—such as Beyond Yoga’s “Club Beyond” pop-up in New York (October 2024)—to foster deeper consumer engagement.

Despite impressive growth, the yoga clothing market faces notable hurdles. Chief among them are unpredictable raw material prices, particularly for synthetic fibers like Spandex and polyester. This volatility impacts cost structures and narrows profit margins for key players such as Nike, Adidas, PUMA, and lululemon athletica.

The proliferation of counterfeit products also undermines consumer trust and erodes market share for authentic brands. Furthermore, rising competition from alternative fitness pursuits—such as cycling, mountain climbing, and water sports—creates pressure on yoga clothing firms to innovate continually.

Geopolitical complexities, including domestic tariffs and supply chain disruptions, further complicate global expansion efforts. However, many brands are offsetting these risks through local production, strategic partnerships, and geographical diversification.

September 2022: Spanx launched a new activewear collection featuring yoga pants, track pants, and tennis skirts with integrated pockets, offering enhanced utility for consumers.

October 2024: Beyond Yoga unveiled “Club Beyond,” a pop-up retail and brand immersion experience in New York, aimed at deepening brand loyalty.

December 2024: Target Australia released the Active Studio Soft collection, making affordable yoga and Pilates apparel accessible; the line quickly sold out, indicating high market demand.

January 2025: Lululemon announced plans to double its men's segment by 2026, a strategic pivot aimed at expanding its market beyond women’s activewear.

Get more details by ordering the complete report

Recent analysis in the yoga clothing market highlights trends such as the demand for custom apparel made from premium fabrics and biodegradable materials, reflecting a shift toward environmentally and socially responsible fashion. Functional elements like quick-drying fabric, UV-blocking fabric, and yoga socks with non-slip grips are increasingly popular among performance-focused users. The market is expanding its reach through gender-neutral apparel, inclusive sizing, and tech-integrated clothing powered by smart fabrics. Seasonal offerings such as yoga jackets, fleece collection, and innovations like spacedye fabric contribute to product diversification. Established and emerging activewear brands are expanding product lines that include yoga shorts, crop tops, and athletic wear, reinforcing the market's evolution from niche segments to mainstream lifestyle apparel with broad consumer appeal

Safe and Secure SSL Encrypted