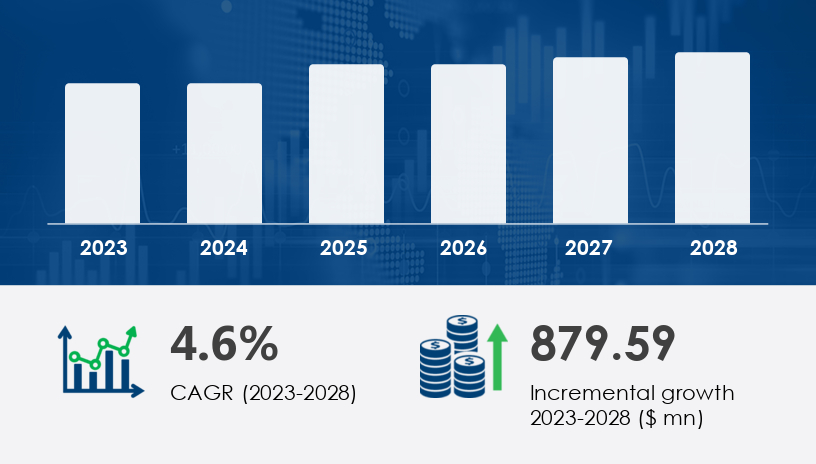

The US energy bar market is poised for substantial growth, with projections indicating an increase of USD 879.59 million between 2024 and 2028, reflecting a compound annual growth rate (CAGR) of 4.6%. This surge is primarily driven by the escalating demand for convenient and nutritious sports nutrition solutions, as consumers increasingly seek quick and easy sources of sustenance to complement their active lifestyles..For more details about the industry, get the PDF sample report for free

Offline: This segment is anticipated to witness significant growth during the forecast period. Supermarkets and hypermarkets dominate the retail landscape, offering a wide range of products and convenient shopping experiences. Organized retail channels, including convenience stores and discount stores, are also contributing to the market's expansion by catering to consumers seeking quick, on-the-go snacking options.

Online: Online retailing is gaining traction due to its convenience, allowing consumers to purchase energy bars from the comfort of their homes. This channel offers a wider selection of brands, flavors, and formulations, catering to diverse preferences and dietary needs.

Conventional Energy Bars: These remain popular among consumers seeking traditional energy-boosting snacks.

Organic Energy Bars: There is a growing demand for organic options, reflecting a broader consumer shift towards natural and health-conscious products.

Protein Bars: Favored by fitness enthusiasts and athletes for their high protein content.

Nutrition Bars: Designed to provide a balanced mix of nutrients for general health.

Cereal Bars: Often consumed as breakfast alternatives or quick snacks.

Fiber Bars: Targeted towards consumers seeking digestive health benefits.

Increasing Demand for Sports Nutrition: The market is experiencing significant growth due to the rising consumption of convenience foods, especially among urban consumers. Energy bars cater to the demand for healthy, on-the-go snacking options, making them popular among individuals focused on wellness and fitness.

Rising Product Innovation: Manufacturers are focusing on producing bars with reduced sugar content and micronutrient-rich ingredients to cater to health-conscious consumers.

Growing Online Retailing: The convenience of online shopping is making energy bars more accessible, with platforms offering a wider selection of brands and formulations.

Availability of Substitutes: The market faces challenges from substitutes like fresh fruits and vegetables, and the perception that energy bars contain excessive amounts of sugar.

United States: The US market is witnessing significant growth, driven by increasing consumption patterns of convenience foods and the demand for healthy, on-the-go snacking options.

Get more details by ordering the complete report

The US Energy Bar Market is evolving rapidly, driven by growing demand for convenient and nutrient-dense snacks among health-conscious consumers. Core offerings such as protein bars, nutrition bars, and energy snacks now serve dual purposes—as pre- and post-workout fuel as well as on-the-go meal replacement options. Innovative formulations are being introduced in the form of fiber bars, snack bars, and energy gels, often paired with complementary products like protein powder and enhanced by functional ingredients such as chia seeds, whey protein, and plant protein. To boost taste and nutritional value, brands are blending almond butter, peanut butter, dark chocolate, hemp seeds, flax seeds, and quinoa grain into their products. Key carriers like oat fiber and coconut oil improve texture, while cashew nuts and pumpkin seeds add crunch and micronutrient value, all reflecting a trend toward clean-label formulations tailored to performance, convenience, and taste.

The competitive landscape of the US energy bar market features several prominent companies:

Abbott Laboratories

Better Carob

Element Bars Inc.

Empact Bars

Garuka Bars

General Mills Inc.

Hormel Foods Corp.

Kates Real Food

Kellogg Co.

Lotus Bakeries NV

Mars Inc.

Mondelez International Inc.

Nestle SA

NuGo Nutrition

Post Holdings Inc.

PROBAR LLC

The Balance Bar Co.

The Simply Good Foods Co.

Torq Performance Nutrition

PepsiCo Inc

For more details about the industry, get the PDF sample report for free

As the US market diversifies, energy bar brands are incorporating novel superfoods and natural sweeteners such as soy protein, rice crisp, honey syrup, agave nectar, and date paste. Plant-based ingredients like almond milk, cocoa powder, vanilla extract, and sea salt are rising in popularity for their flavor and clean profile. Functional enhancements come from sunflower seeds, maple syrup, and brown rice, often fortified with trending proteins like pea protein and adaptogens such as maca powder and spirulina powder. Gourmet inclusions such as cacao nibs and hazelnut butter are carving a premium niche, while flax oil and tapioca starch support structure and nutrition. The addition of dried fruit, nut butter varieties, and diverse seed mixes positions energy bars as a staple in both active and wellness-driven lifestyles. This strategic ingredient innovation continues to shape consumer preferences in the increasingly competitive and health-oriented US Energy Bar Market.

Safe and Secure SSL Encrypted