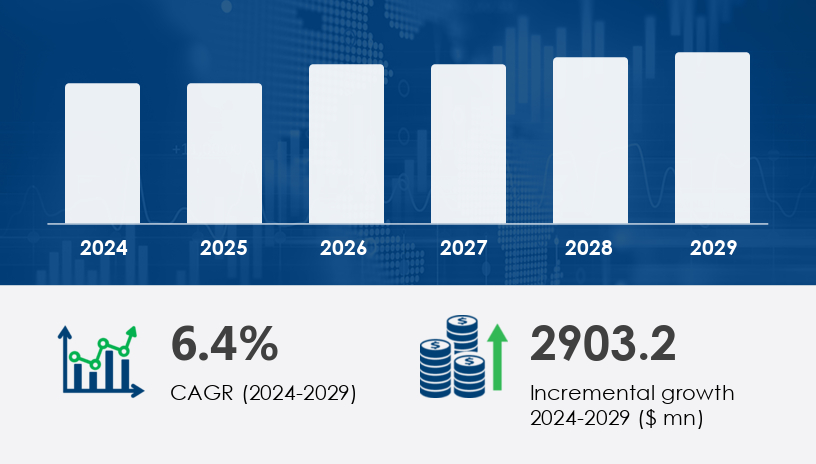

The global toilet care market is poised for significant expansion, with projections indicating an increase of USD 2.9 billion between 2025 and 2029, reflecting a robust compound annual growth rate (CAGR) of 6.4%. This growth trajectory underscores a paradigm shift in consumer behavior and demand for cleaning products, emphasizing hygiene, sustainability, and premium product offerings.

For more details about the industry, get the PDF sample report for free

A primary driver fueling growth in the Toilet Care Market is the surge in demand for eco-friendly and premium products. Consumers across developed economies like the US, UK, Canada, and Japan are increasingly opting for toilet care items that combine sustainability with high performance. This shift is not just aesthetic—modern buyers are prioritizing convenience, advanced packaging, and antibacterial properties. For example, liquid toilet cleaners and rim blocks are being reformulated to include disinfectant agents that combat germs and odors. According to analysts, this transition enables manufacturers to offer value-added products at higher price points, improving profit margins and encouraging innovation across household and commercial applications.

Among the most significant emerging trends is the expansion of sanitation infrastructure, particularly in developing regions. Governments and organizations are launching programs such as the WASH initiative in schools and open-defecation-free campaigns (e.g., in Nigeria), driving widespread adoption of toilet care solutions. Additionally, there's a growing interest in automated dispensing mechanisms and smart fragrance technologies, which not only enhance convenience but also align with the health-conscious preferences of millennial and urban consumers. The demand for DIY natural cleaners using materials like vinegar and baking soda further highlights the industry's tilt toward sustainability and healthier living.

The Toilet Care Market is evolving rapidly, with increasing focus on innovation, hygiene, and environmental sustainability. Key product segments such as liquid toilet cleaners, toilet rim blocks, automatic cleaners, and toilet bowl cleaners dominate the residential and commercial markets. Rising demand for eco-friendly products has led to the widespread use of natural ingredients like citric acid, which offer effective germ elimination and stain removal without harsh chemicals. Traditional disinfectants such as chlorine bleach are still prevalent, especially in industrial cleaners and commercial cleaners used in public restrooms. Additionally, the integration of wetting agents and anti-bacterial agents supports superior toilet hygiene, helping to ensure long-term hygiene maintenance in both private and high-traffic environments.

The Toilet Care Market is segmented as follows:

By Application

Household

Commercial

By Product

Liquid Toilet Cleaners

Toilet Rim Blocks

Others

By Type of Packaging

Bottles

Pouches

Others

The household segment stands out as the leading contributor to market share and is projected to grow significantly through 2029. In 2019, this segment was valued at USD 3.82 billion, and it has shown consistent upward momentum. Products such as toilet bowl cleaners—available in liquid, gel, and tablet formats—are popular for their ability to eliminate stains, limescale, and bacteria. Additionally, rim blocks offer a continuous cleaning solution that appeals to households prioritizing long-term hygiene. Analysts note that this segment's growth is largely attributed to consumers' increasing concern for in-home sanitation, particularly after the heightened awareness brought on by global health crises.

Regions covered in the Toilet Care Market:

North America (U.S., Canada)

Europe (Germany, UK, France, Italy)

APAC (China, India, Japan)

South America (Brazil)

Middle East and Africa

Asia-Pacific (APAC) is the frontrunner, projected to contribute 50% of the total market growth between 2025 and 2029. With rapid urbanization and population expansion, countries like China, India, and Japan are witnessing heightened demand for toilet care products. Rising disposable incomes and a growing middle class are enabling more consumers to invest in hygiene and premium household items. Additionally, public facilities—such as schools, hospitals, and offices—are increasingly focused on sanitation, leading to wider use of products like liquid cleaners, rim blocks, and air fresheners. Technavio analysts highlight that the region’s economic momentum and lifestyle upgrades are core factors driving robust market penetration.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Despite positive momentum, the Toilet Care Market faces challenges from non-traditional solutions such as bidets, wet wipes, and DIY natural cleaners. As consumers become more environmentally conscious and budget-aware, alternatives like vinegar and baking soda gain traction due to their affordability and perceived safety. This trend is putting pressure on conventional toilet care manufacturers to innovate and adapt. Furthermore, scent technology and automated dispensers, while popular, raise production and adoption costs, especially in price-sensitive markets. Analysts emphasize that competition from these substitutes could slow market share gains for traditional toilet care products unless brands differentiate effectively.

Market trends show a rise in demand for convenient and innovative toilet care formats, including gel cleaners, foam cleaners, tablet cleaners, and urinal blocks. Consumers are increasingly seeking hands-free cleaning and automated systems that reduce manual effort. The use of air fresheners, toilet fresheners, and toilet deodorizers with odor neutralizers has expanded as households prioritize not only cleanliness but also ambience. Furthermore, scented cleaners and fast-acting cleaners offer added benefits like immediate odor removal and quick application. Premium and low-maintenance cleaners are gaining traction in modern households, while eco-conscious packaging and water-based cleaners highlight growing awareness around sustainability. These shifts reflect a broader move toward sustainable products and more holistic toilet care solutions.

Detailed analysis of the toilet care market reveals significant opportunities in niche segments focused on health and environmental impact. Non-toxic cleaners and natural ingredients are being heavily favored by eco-conscious consumers seeking safe alternatives for their families. Advanced toilet disinfectants featuring bacteria removal and limescale remover capabilities are essential for maintaining sanitary conditions, particularly in shared or commercial spaces. Innovation is also seen in surface cleaners that complement core products, as well as premium products that combine aesthetics with functionality. The trend toward long-lasting fresheners and sustainable products shows strong potential for brand differentiation. As the market becomes more health- and environment-oriented, the demand for advanced, multifunctional toilet care items continues to expand globally.

In response to evolving market dynamics, key players are implementing strategic alliances, product launches, and regional expansions to strengthen their foothold. Companies like Reckitt Benckiser Group Plc, Henkel AG, and Procter & Gamble are actively investing in automated dispensing technologies and scent-enhanced cleaners. These innovations address consumer demands for freshness, hygiene, and convenience, especially in commercial settings. Some brands are launching eco-friendly formulations and biodegradable packaging to align with sustainability goals. Online retail channels and targeted digital marketing campaigns are also playing a pivotal role, allowing brands to reach new audiences and enhance brand loyalty.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Channel

6.1.1 Dine-in

6.1.2 Takeaway

6.2 Product

6.2.1 North American

6.2.2 Italian

6.2.3 Mexican

6.2.4 Others

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted