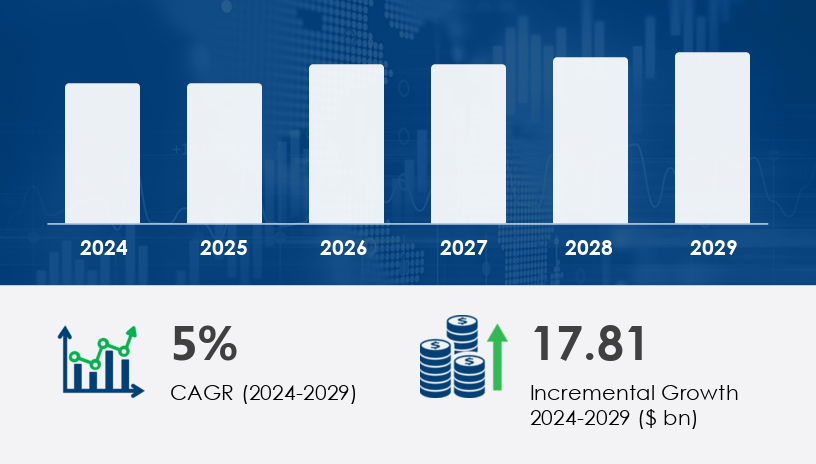

The Household Cleaning Products Market is expected to grow at a CAGR of 5% during 2024 and 2029. During this period, the market is also expected to show a growth of USD 17.81 billion. In developed economies such as the US, the UK, Canada, and Japan, there is a burgeoning demand for high-end household cleaning products. Consumers in these markets prioritize convenience, superior packaging, and aesthetic appeal when making purchasing decisions.

For more details about the industry, get the PDF sample report for free

A significant driver of market growth is the rising demand for natural and eco-friendly cleaning products. Consumers are becoming more conscious of the environmental and health impacts of traditional cleaning agents, leading to a shift towards products formulated with plant-based ingredients and biodegradable materials. This trend is particularly evident among younger demographics, such as millennials and Gen Z, who prioritize sustainability and wellness in their purchasing decisions.

The market is experiencing a notable shift towards multi-purpose and concentrated cleaning solutions. These products offer convenience and efficiency, catering to the fast-paced lifestyles of modern consumers. Additionally, there is a growing preference for refillable packaging, which aligns with the increasing emphasis on sustainability and waste reduction. Manufacturers are responding to these trends by innovating their product offerings to meet the evolving needs of consumers.

The Household Cleaning Products Market is experiencing steady growth driven by heightened hygiene awareness and increased demand for specialized cleaning solutions. Common staples include dishwashing liquid, laundry pods, toilet bowl cleaner, and glass cleaner, all essential for daily household upkeep. Premium products like floor polish, fabric softener, stain remover, and bleach alternative cater to deeper and more fabric-sensitive cleaning needs. The market has also seen a significant uptick in the use of green formulations, including natural detergent, eco-friendly cleaner, and plant-based surfactant options. Consumers are increasingly opting for biodegradable packaging, refillable bottles, and concentrated formula formats to minimize environmental impact. Innovative items like gel detergent, powder detergent, and dishwasher tablets continue to serve a range of washing preferences. Tools and accessories such as microfiber cloths and lint removers enhance product performance, while the growing popularity of fragrance-free soap and hypoallergenic detergent addresses sensitivities and allergies. Enhancing indoor air and surface hygiene, products such as disinfectant wipes, hand soap, antibacterial spray, and all-purpose cleaner remain market mainstays.

The household cleaning products market is segmented based on:

Product Type: Surface cleaners, dishwashing products, toilet cleaners, and others.

Distribution Channel: Offline and online channels.

Price Range: Budget, mid-range, and premium products.

Formulation: Eco-friendly and chemical-based formulations.

The surface cleaners segment is expected to witness significant growth during the forecast period. This is attributed to increasing consumer awareness about hygiene and the effectiveness of surface cleaners in eliminating germs and bacteria. In developing regions like South America and APAC, the adoption of surface cleaners for daily use is on the rise, making it a thriving segment.

The household cleaning products market is analyzed across the following regions:

North America

Europe

Asia Pacific (APAC)

South America

Middle East and Africa

Rest of World (ROW)

North America holds a significant share of the household cleaning products market, driven by high consumer spending and a strong preference for eco-friendly products. In the United States, there is a growing trend towards natural and organic household cleaners, with consumers prioritizing health and environmental safety in their cleaning choices. This shift is particularly pronounced among younger demographics, who are more inclined to scrutinize product ingredients and seek out brands that align with their values of sustainability and wellness.

A key challenge facing the household cleaning products market is the rising cost of raw materials. Manufacturers are under pressure to balance production costs with the demand for high-quality, eco-friendly products. The increasing prices of ingredients and packaging materials can impact profitability and pricing strategies, posing a challenge to companies striving to maintain competitive pricing while meeting consumer expectations for sustainability and performance.

Research shows increasing consumer preference for functional and multipurpose solutions, with growth in demand for specialized cleaners such as degreaser spray, oven cleaner, carpet shampoo, upholstery cleaner, grout cleaner, and mildew remover. To meet niche requirements, manufacturers are offering targeted products like rust cleaner, wood polish, stainless steel cleaner, and soap scum remover, which cater to specific surfaces and maintenance needs. Additionally, natural cleaning agents like lemon extract, vinegar cleaner, baking soda scrub, and essential oils are gaining traction for their safety and efficacy. Homeowners are also seeking odor-neutralizing and air-enhancing solutions, such as air freshener, pet odor eliminator, and hard water descaler. The rise of multi-surface spray products reflects the shift toward convenience and versatility in cleaning routines. Market strategies now focus on sustainability, wellness, and efficiency, with innovation spanning both product formulation and packaging solutions.

In-depth analysis of the household cleaning products market reveals a strong alignment between consumer values and product development, especially in the areas of eco-friendliness, health safety, and convenience. Brands investing in natural ingredients, concentrated formulas, and sustainable packaging are positioning themselves favorably among increasingly informed consumers. The future of the market is expected to revolve around smart packaging, refill models, and adaptive products that meet the needs of diverse household demographics and lifestyles.

Unilever: Launched Cif Infinite Clean, a probiotic cleaning spray that continues cleaning for several days after application, targeting both hard and soft surfaces while remaining safe for pets and children.

Procter & Gamble (P&G): Introduced a new line of eco-friendly household cleaning products under its brand, Method, in collaboration with Walmart, aiming to cater to the growing demand for sustainable household cleaning solutions.

Clorox: Received approval from the U.S. Environmental Protection Agency (EPA) for its new disinfectant, SaniClor Max, which claims to kill the SARS-CoV-2 virus, significantly boosting the company's market position during the ongoing pandemic.

Unilever: Announced a €1 billion investment in its European manufacturing sites to increase production capacity and improve sustainability, aiming to meet the growing demand for its household cleaning products and support its commitment to reducing carbon emissions.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.1 Surface cleaners

6.1.2 Dishwashing products

6.1.3 Toilet cleaners

6.1.4 Others

6.2 Distribution Channel

6.2.1 Online

6.2.2 Offline

6.3 Price Range

6.3.1 Budget

6.3.2 Mid-range

6.3.3 Premium

6.4 Formulation

6.4.1 Eco-friendly

6.4.2 Chemical-based

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

6.5.6 ROW

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted