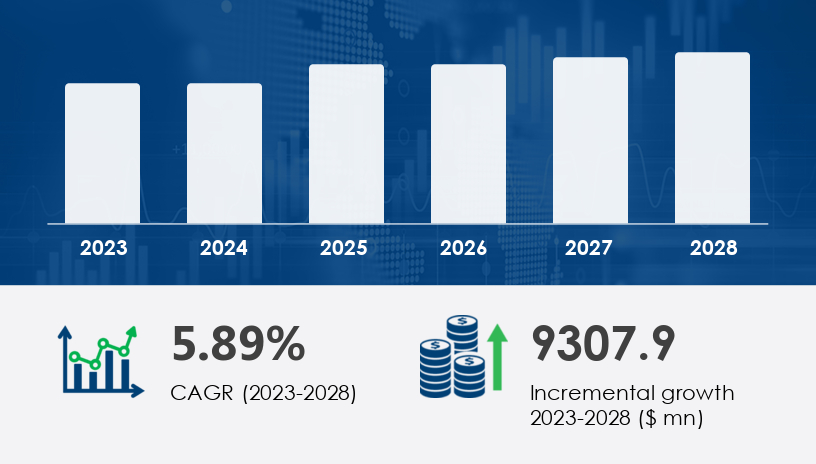

The seasonal chocolates market is poised for significant expansion between 2024 and 2028, with projections indicating an increase of USD 9.31 billion at a compound annual growth rate (CAGR) of 5.89%. This growth is driven by heightened consumer demand during festive occasions, the rise of e-commerce retailing, and innovations in product offerings. However, challenges such as rising competition from premium brands and fluctuations in raw material prices present ongoing considerations for industry stakeholders.

For more details about the industry, get the PDF sample report for free

Then (2019–2023):

From 2019 through 2023, the seasonal chocolates market followed familiar rhythms—spikes around holidays like Halloween, Easter, and Christmas, followed by off-peak periods. Product ranges were largely dictated by tradition, and consumer expectations stayed modest. Sales were anchored in brick-and-mortar retail, and product differentiation leaned on packaging more than content.

Now (2024):

The landscape has changed. With the seasonal chocolates market forecast to grow by USD 9.31 billion between 2024 and 2028 at a CAGR of 5.89%, transformation is well underway. Online retailing is rewriting the rules of accessibility and assortment. Consumers now demand dark, white, milk, and mixed chocolates that do more than satisfy cravings—they must be healthier, ethically sourced, and uniquely flavored (think pumpkin spice, gingerbread, or salted caramel). Brands are shifting toward personalization and high-quality ingredients like cocoa butter, cream cheese, and whole eggs, aligning with wellness trends.

Next (2025–2028):

By 2028, the seasonal chocolates market won’t just revolve around calendars—it will orbit around customer-centricity. Expect AI-curated flavor drops, sustainable packaging mandates, and a seamless blend of in-store and online retail experiences. Innovations will expand into personalized gifting, low-sugar options, and even functional chocolates with mood-enhancing properties.

Legacy Disruption:

Previously relegated to niche appeal, dark chocolate was seen as a mature, acquired taste with limited seasonal relevance.

New Strategy Emerging:

Health consciousness has elevated dark seasonal chocolate into a hero segment. With 50%–60% cocoa content, these chocolates are rich in flavanols, iron, magnesium, and zinc, offering cardiovascular and cognitive benefits. Consumers now actively seek these health-forward options during holidays.

Analyst Insight:

“Dark chocolate’s health halo has transformed it into a premium gift option, particularly among millennials and wellness-focused shoppers,” notes Technavio.

Business Case:

Cadbury Bournville in India has successfully repositioned dark chocolate as a rich, indulgent yet healthy alternative during Diwali, featuring elegant packaging and festive limited editions.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Legacy Disruption:

Filled chocolates were once dominated by sugar-laden cream fillings, lacking diversity and sophistication.

New Strategy Emerging:

Now, filled seasonal chocolates feature gourmet elements: think hazelnut praline, liquor infusions, or vegan ganache. This segment thrives during premium gifting occasions like Valentine’s Day and Mother’s Day, where experience trumps volume.

Analyst Insight:

“Filled chocolates are no longer novelties—they’re drivers of premiumization, especially in markets like the UK and France.”

Business Case:

Hotel Chocolat introduced its Velvet Truffle Collection for Christmas 2024, combining seasonal flavors with artisanal craftsmanship, sold exclusively online and via boutique retail.

Legacy Disruption:

Seasonal chocolates were once discovered on store shelves in supermarkets and convenience stores, driven by impulse.

New Strategy Emerging:

Ecommerce is becoming the primary growth engine. Online retailers offer wide assortments, personalized bundles, and subscription options for holiday gifting. Sales are spiking in markets like Europe, where internet retailing for chocolate is flourishing.

Analyst Insight:

“The convenience and curation of online platforms are redefining how seasonal chocolates are marketed, discovered, and delivered.”

Business Case:

Blue Frog Chocolates saw a 40% year-over-year increase in Halloween-themed online orders in 2023, driven by exclusive SKUs like icy hot chocolate and solid chocolate frogs, promoted via targeted digital campaigns.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Rising consumer expectations are fueling demand for high-quality seasonal chocolates with unique ingredients and storytelling. Brands like Lindt, Ferrero, and Hotel Chocolat lead by crafting limited-edition offerings with artisanal flair.

Digital-first companies are outpacing traditional players by offering seamless shopping journeys, from mobile personalization to AI-based gifting suggestions. In regions like Europe and North America, e-retail is fast becoming the dominant channel.

As cocoa prices fluctuate and consumer consciousness rises, the pressure is on for sustainable sourcing and eco-friendly packaging. Brands are adopting recyclable wrappers and sustainably farmed cocoa beans to appeal to ethical buyers.

The Seasonal Chocolates Market is experiencing strong demand fueled by festive traditions and evolving consumer preferences for premium chocolate across occasions such as Valentine’s Day, Easter eggs, and festive occasions. A wide variety of offerings, including dark chocolate, milk chocolate, and white chocolate, appeal to different palates, with both filled chocolates and unfilled chocolates gaining traction. Popular seasonal flavors such as gingerbread flavor, salted caramel, and pumpkin spice have contributed to the appeal of limited edition and specialty chocolates. Growth is also driven by the rise of artisanal chocolatiers and handcrafted chocolate products, which often feature unique flavors and are marketed in eye-catching gift boxes or heart-shaped boxes. Attention to sustainable packaging and health-conscious choices, such as gluten-free, low sugar, and organic chocolate, further supports market expansion during key seasonal peaks.

1. Functional Chocolates for Mood and Energy:

Expect seasonal chocolates to expand into functional foods—with ingredients like ashwagandha, collagen, or adaptogens—especially during winter and high-stress seasons.

2. Hyper-Personalized Gifting:

AI-driven platforms will allow consumers to design flavor profiles and packaging for birthdays, holidays, and niche events, from Diwali to baby showers.

3. Immersive Retail Experiences:

Look for chocolate "festivals" and pop-ups blending AR/VR with tastings, reinforcing seasonal purchases as experience-based events.

Company Example:

Marks & Spencer Group plc is piloting a smart gift selector powered by consumer mood profiles and prior shopping data—a fusion of personalization and festive shopping.

Will seasonal chocolates become the next frontier in food-based personalization and wellness marketing?

Get more details by ordering the complete report

Embrace Experience-First Innovation

Seasonal products must go beyond flavor—build rituals, narratives, and gifting journeys that resonate emotionally.

Prioritize AI-driven inventory optimization for seasonal demand

Leverage predictive tools to manage spikes during Halloween, Christmas, and Easter, minimizing spoilage and maximizing sell-through.

Develop omnichannel marketing for holiday campaigns

Ensure a cohesive story across social, digital, and in-store activations to guide consumers from inspiration to conversion.

Invest in sustainable chocolate packaging trends

Respond to the growing eco-conscious buyer by reducing plastic, using compostable materials, and highlighting ethical sourcing.

Expand filled seasonal chocolate offerings with gourmet pairings

Create product lines featuring wine/chocolate pairings, exotic fillings, and premium design elements to stand out in a crowded gifting space.

Capitalize on e-commerce for festive chocolate bundles

Offer exclusive digital assortments with gift-wrapping, subscription plans, and last-minute delivery options.

In-depth analysis of the Seasonal Chocolates Market highlights the increasing importance of sourcing high-quality cocoa beans and raw material from a transparent and ethical cocoa industry. The inclusion of ingredients such as cocoa butter, vanilla flavoring, cream cheese, and whole eggs enhances the taste and texture of products designed for specific seasons. Functional benefits of chocolate, driven by cocoa flavanols, antioxidants, and their associated health benefits, are increasingly influencing chocolate consumption trends. Retail distribution continues to evolve, with a mix of ecommerce platforms, brick-and-mortar stores, and independent retailers offering seasonal selections. The emergence of chocolate bunnies during Easter or other themed items highlights the value of seasonal innovation. Furthermore, ecommerce platforms are playing a significant role in extending the reach of niche producers, while consumer preferences for authenticity and quality elevate demand for small-batch, specialty and artisanal products.

The seasonal chocolates market is no longer just about momentary indulgence—it’s a dynamic, $9.31 billion growth story unfolding through premiumization, personalization, and platform power. Health-forward options, online convenience, and sustainable innovation are defining what comes next.

Are we thinking big enough—beyond the calendar and into consumer lifestyles?

Safe and Secure SSL Encrypted