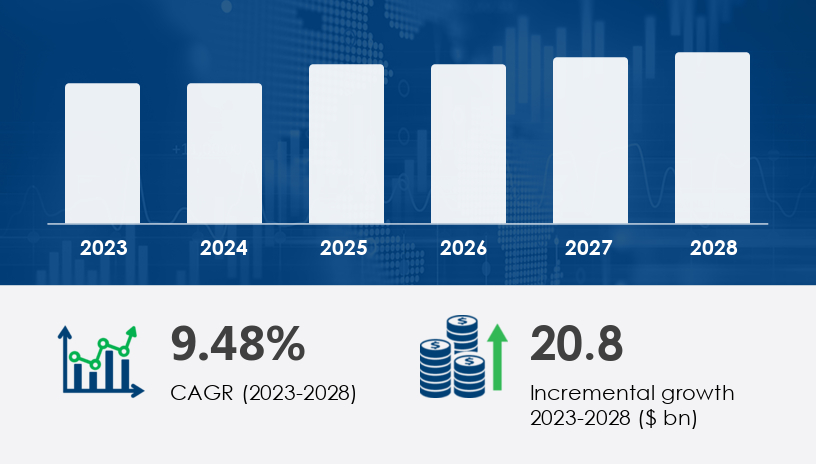

The premium chocolate market is poised for significant growth, with an expected increase of USD 20.8 billion, marking a robust compound annual growth rate (CAGR) of 9.48% from 2023 to 2028. This forecast underscores the burgeoning consumer demand for luxurious chocolate products, driven by new product innovations, evolving consumer preferences, and strategic marketing approaches. In this article, we offer a detailed analysis of the market dynamics, key trends, and growth drivers shaping the future of premium chocolate.

For more details about the industry, get the PDF sample report for free

The Premium Chocolate Market has seen robust growth driven by the increasing demand for high-quality, indulgent chocolate products. Leading product categories include dark chocolate, milk chocolate, and white chocolate, each offering distinct taste experiences. There has been a surge in popularity for artisan chocolate and gourmet chocolate, as consumers seek unique and premium offerings. The growing trend of bean-to-bar chocolates, particularly single-origin varieties, is reflective of a desire for traceable, high-quality ingredients. Specialty products such as organic chocolate, vegan chocolate, gluten-free chocolate, and sugar-free chocolate cater to health-conscious consumers, while indulgent treats like truffles, pralines, and chocolate bars remain top choices. Innovations in flavor profiles, such as chili chocolate, fruit infusion, lavender infusion, and mint chocolate, continue to captivate adventurous taste buds, while premium fillings like hazelnut praline, caramel filling, and cocoa ganache enhance the chocolate experience.

The premium chocolate market has long been associated with indulgence and luxury. However, this market is now undergoing rapid transformation, with a focus on innovation, quality, and sustainability. The global desire for high-quality, gourmet chocolates is expected to fuel the market’s expansion through 2028. As consumer preferences shift toward premium experiences, brands are responding by offering products with refined flavors, superior ingredients, and eco-conscious packaging.

The demand for premium chocolates is being propelled by several interconnected factors:

Innovative Product Offerings: New flavors, unique fillings, and limited-edition chocolates are making waves in the market. Products like Lindor truffles and Guylian chocolates, known for their luxury appeal and indulgent ingredients, exemplify the evolving consumer preferences for premium experiences. This wave of innovation is not only attracting a more affluent customer base but also appealing to younger generations keen on quality over quantity.

Increased Consumer Engagement: Today’s consumers are more informed and engaged with product offerings than ever before. This is particularly true in regions like Europe and North America, where consumers are increasingly willing to pay a premium for chocolates that offer not only indulgence but also value in terms of sourcing, taste, and experience.

Strategic Marketing: Successful premium chocolate brands are leveraging sophisticated marketing strategies that tap into emotional connections with consumers. Effective storytelling and transparent sourcing, including certifications such as Fairtrade, are gaining traction in consumer minds. Brands like ChoViva, for example, have built a loyal following by championing sustainable cocoa sourcing practices.

The primary factor driving growth in the premium chocolate market is consumer indulgence. Increasingly, people are willing to invest in chocolates that provide not just a treat but an experience. These indulgent treats are often crafted from high-quality ingredients like cocoa butter and gourmet fillings, which add to the richness and depth of the flavor.

Consumers are increasingly seeking premium chocolates made with the finest ingredients such as high-quality cocoa, hazelnuts, almonds, and even luxurious additions like raspberry pieces. Brands are capitalizing on this shift by offering products that combine gourmet textures with innovative flavors.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

While global expansion is crucial, regional dynamics also play an essential role in shaping the market’s trajectory. Europe leads the charge, contributing to an impressive 43% of market growth during the forecast period. The region boasts the highest per capita chocolate consumption in the world, with countries such as Switzerland, Germany, Belgium, and the UK having a strong affinity for premium chocolates.

In fact, the demand for premium chocolates in Europe is surpassing sales of traditional private-label chocolates, as consumers increasingly opt for better packaging, richer flavors, and higher quality.

Moreover, as chocolate gifting is an important tradition across Europe, especially during holidays, the market is primed for growth. Premium chocolates are often purchased as gifts during celebrations like Easter, Christmas, and Valentine's Day, further contributing to seasonal demand.

Despite its remarkable growth, the premium chocolate market faces significant challenges. One of the most notable threats comes from seasonal chocolates. These limited-time offerings are typically marketed around special occasions like Christmas, Easter, and Halloween, drawing attention away from year-round premium chocolate purchases.

Seasonal chocolates, such as those offered by Lindt and Godiva, enjoy surges in demand during these peak times. However, their limited availability may pose a challenge for premium chocolate brands that are trying to build consistent, year-round customer engagement. To counter this challenge, brands must innovate and offer products that captivate consumer interest outside the holiday seasons.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

For chocolate manufacturers and marketers, staying ahead of the competition requires a nuanced strategy that focuses on both sustainability and innovation.

Leverage Sustainable Sourcing Practices: As consumers grow more environmentally conscious, transparent and sustainable cocoa bean sourcing has become a major selling point. Companies that prioritize sustainability, such as Cargill Inc., are not only ensuring a better future for cocoa farmers but also appealing to a growing segment of eco-conscious consumers.

Expand Online Presence: The rise of e-commerce has reshaped how consumers purchase premium products. Brands should look to expand their online sales channels, utilizing digital marketing strategies and partnerships with online retailers to boost visibility and direct-to-consumer sales.

Innovate with Flavors and Ingredients: Consumers are constantly on the lookout for new and exciting flavors. Offering limited-edition products, exotic fillings, or chocolates infused with superfoods like blueberries and pomegranate can help brands capture the attention of trend-conscious buyers.

Pros:

High demand for indulgent, high-quality products

Growing consumer base with a focus on sustainable and ethical sourcing

Increased interest in unique and limited-edition products

Cons:

Threat from seasonal chocolates during major holidays

High production costs due to premium ingredients and sustainable practices

Competitive market with many established global players

Get more details by ordering the complete report

Lindt & Sprüngli, a leader in the premium chocolate market, offers an excellent case study of a brand that has effectively capitalized on market trends. By combining traditional Swiss chocolate-making techniques with innovative product development, Lindt has maintained a strong foothold in both offline and online markets.

The brand’s signature product, Lindor Truffles, exemplifies its commitment to luxury and indulgence. Lindt also engages in sustainable cocoa sourcing and actively participates in fairtrade initiatives, appealing to a socially responsible consumer base. Furthermore, Lindt has successfully expanded its product range, offering a variety of premium chocolate bars, truffles, and holiday-themed offerings, ensuring year-round market presence.

Research into the premium chocolate sector highlights the rise of exotic and indulgent flavor combinations, with ingredients like sea salt, ginger spice, orange zest, coffee bean, and pistachio cream enriching the consumer palette. The increasing popularity of ruby chocolate, made from specially processed cocoa beans, has added a new dimension to the market, complementing traditional dark truffle, milk truffle, and white truffle varieties. Additionally, the trend toward healthier alternatives has spurred the demand for products featuring cocoa nibs, cocoa butter, and cocoa powder, as well as chocolates made with fair-trade cocoa to support ethical sourcing. The rise of artisanal chocolates filled with nut clusters, almond brittle, toffee crunch, and raspberry ganache is contributing to market expansion, while more traditional favorites like chocolate bonbons and salted caramel continue to maintain their appeal. With increasing consumer interest in unique textures and innovative fillings, the market is diversifying to meet the tastes of a wide range of chocolate lovers.

The premium chocolate market is set to experience remarkable growth through 2028, driven by a mix of product innovation, sustainable practices, and evolving consumer preferences. As consumers demand higher quality, more luxurious experiences, chocolate brands are rising to the challenge with new flavors, ethical sourcing, and attractive packaging.

For businesses in the premium chocolate space, it is crucial to stay on top of industry trends, focus on building strong brand loyalty, and embrace both digital and physical sales channels. By strategically navigating these opportunities and challenges, brands can position themselves for sustained success in a market that continues to captivate consumers worldwide.

Safe and Secure SSL Encrypted