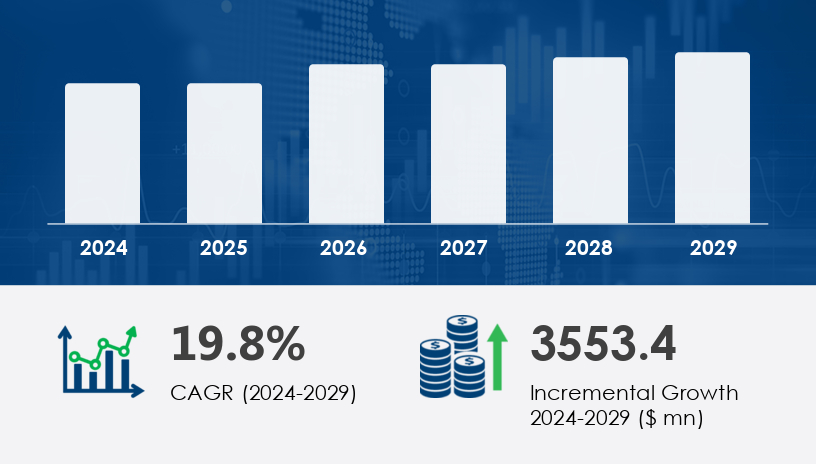

The GIS In Utility Industry Market is poised for robust expansion, with the market size projected to grow by USD 3.55 billion between 2025 and 2029. This surge reflects a compelling compound annual growth rate (CAGR) of 19.8%. In 2024, the market demonstrated strong momentum, setting the stage for significant advances through 2029, driven by the escalating demand for geospatial technologies in managing complex utility infrastructures.

For more details about the industry, get the PDF sample report for free

The primary driver of the GIS In Utility Industry Market is the increasing integration of Geographic Information Systems (GIS) into utility operations to improve efficiency, planning, and decision-making. Utility companies across sectors—electric, gas, water, and telecommunications—are leveraging GIS for functions like network optimization, outage management, and asset tracking. For example, Environmental Systems Research Institute's ArcGIS software facilitates detailed geospatial modeling and analysis, enabling utilities to conduct land use planning, integrate renewable energy sources, and optimize grid performance. By adopting GIS, utility providers can reduce operational costs, enhance data accuracy, and improve infrastructure reliability—critical factors in capital-intensive and service-critical industries.

A notable trend shaping the GIS In Utility Industry Market is the accelerating use of GIS in water management. As utilities face pressure to optimize water distribution and minimize non-revenue water losses, GIS provides advanced capabilities for spatial analysis, real-time monitoring, and resource planning. Moreover, the integration of GIS with IoT sensors, smart metering systems, and mobile platforms enhances precision in field data collection, enabling faster response times and improved customer service. GIS’s expanding role in environmental impact assessments, groundwater mapping, and smart agriculture underlines its growing importance in sustainability and regulatory compliance within the utility sector.

The GIS in Utility Industry Market is experiencing significant growth as utilities increasingly adopt geospatial data and utility mapping tools to enhance their operational capabilities. The integration of GIS is pivotal to the development of smart grids, allowing for improved infrastructure planning, efficient asset management, and continuous network monitoring. Advanced GIS software supports utilities with real-time spatial analytics, helping drive grid modernization efforts. By optimizing utility operations and incorporating location intelligence, organizations can improve service delivery while minimizing disruptions. Through advanced data visualization, GIS empowers utility teams to make data-driven decisions in asset deployment and network maintenance. Technologies like predictive modeling and real-time monitoring also play a vital role in anticipating failures and ensuring grid resilience. These advancements in digital mapping directly contribute to the effective management of complex utility networks.

Segmentation Categories:

By Product:

Software

Data

Services

By Deployment:

On-premises

Cloud

Among the product segments, software dominates the GIS In Utility Industry Market in both value and growth potential. Valued at USD 541.50 billion in 2019, the software segment continues to witness strong adoption due to its ability to centralize asset management, streamline infrastructure planning, and enhance energy distribution networks. GIS software empowers utilities with capabilities like demand forecasting, spatial statistics, and outage management. Analysts note that utilities increasingly favor tailored GIS applications that support smart grid technologies, renewable energy integration, and location intelligence, enabling data-driven operational decisions across expansive networks.

Regions Covered:

North America (US, Canada)

Europe (France, Germany, Russia)

APAC (China, India, Japan)

South America (Brazil)

Middle East and Africa (UAE)

North America leads the global GIS In Utility Industry Market, contributing an estimated 37% of overall market growth from 2025 to 2029. The United States, in particular, demonstrates high GIS adoption across its electric, gas, and water utilities, with companies like Alectra Utilities deploying advanced GIS platforms such as Hexagon Intergraph G/Technology to unify operational systems. Canada’s rapid GIS uptake in utilities further boosts regional momentum. Analysts highlight the region’s focus on grid modernization, smart metering, and renewable energy optimization as key factors driving demand for GIS. The maturity of the North American utility sector and the presence of top-tier GIS vendors reinforce its position as a global innovation hub.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

One of the primary challenges facing the GIS In Utility Industry Market is the rising competition from open-source GIS software. These cost-effective solutions are increasingly favored by small and medium-sized enterprises (SMEs) in emerging markets, particularly in the Asia Pacific region. While open-source platforms offer essential functionalities like remote sensing, asset lifecycle management, and environmental assessments, they often lack the full support, customization, and integration features of proprietary software. This growing preference for open-source GIS threatens the revenue streams of commercial GIS providers and complicates pricing strategies. Utilities must carefully weigh the trade-offs between affordability and functionality to avoid long-term limitations in scalability and support.

Market research shows that the demand for geospatial technology in utilities is driven by the need to support smart utilities and more advanced infrastructure design initiatives. The push for broader GIS integration is closely tied to the industry's focus on network resilience and long-term operational efficiency. Enhanced mapping and modeling allow for more precise tracking of utility assets, revealing valuable spatial insights that contribute to grid optimization. As utilities modernize, effective data management systems are required to process and utilize location-based data for better utility planning. The adoption of advanced geospatial solutions supports next-generation network modeling practices, aiding utilities in visualizing and planning infrastructure at both macro and micro levels. These developments are also aligned with broader smart city strategies, where geospatial intelligence drives integrated infrastructure management and urban sustainability.

In-depth research analysis highlights how utility analytics and tailored GIS applications are unlocking new levels of decision-making and planning accuracy. Tools for infrastructure visualization, along with robust asset tracking, are enabling utility companies to assess network health and prevent costly downtime. The continuous focus on grid reliability has increased reliance on high-resolution spatial data, which in turn supports clearer utility insights and streamlined operations. Emerging GIS tools offer expanded functionality for modeling network growth and ensuring network scalability to accommodate future demands. Effective operational planning is also becoming more reliant on real-time GIS dashboards, contributing to overall utility modernization efforts. Central to these advancements is the seamless data integration of systems across departments, powered by increasingly sophisticated geospatial systems designed to support utilities in achieving high performance and customer satisfaction.

Innovations and Recent Developments

Key players in the GIS In Utility Industry Market are actively enhancing their portfolios through innovation, partnerships, and strategic acquisitions.

In February 2024, Esri launched the ArcGIS Utility Network Management extension to improve data accuracy and streamline utility network operations.

May 2024 saw a strategic collaboration between Oracle and Schneider Electric, integrating GIS with the EcoStruxure platform to enhance energy network management.

In August 2025, Hexagon AB acquired Intergraph, a move expected to bolster its utility-focused GIS offerings.

Companies such as Autodesk Inc., Trimble Inc., NV5 Global Inc., General Electric Co., and Environmental Systems Research Institute Inc. are also at the forefront of innovation, investing in advanced analytics, 3D GIS modeling, and IoT integration. According to analysts, competitive differentiation will increasingly rely on the ability to deliver flexible, scalable GIS solutions that address both traditional utility challenges and emerging demands in renewable energy, real-time monitoring, and customer engagement.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.1 Software

6.1.2 Data

6.1.3 Services

6.2 Deployment

6.2.1 On-premises

6.2.2 Cloud

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted