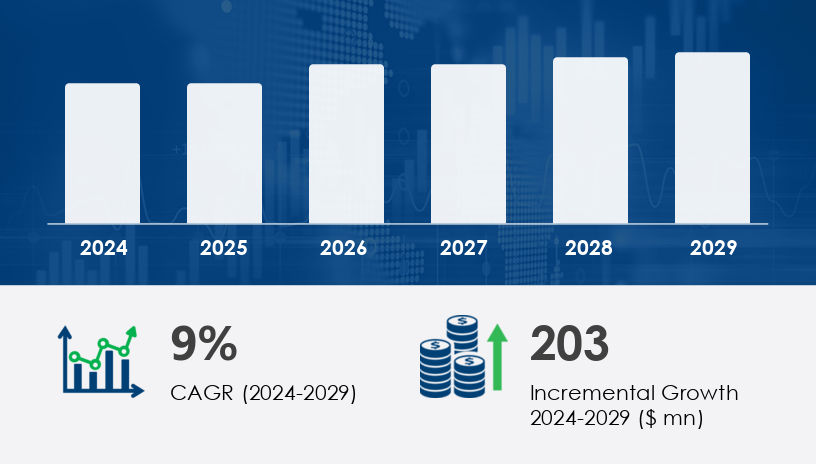

The India Fruit Pulp Market is poised for significant growth, driven by increasing consumer demand for healthy and convenient food options. Valued robustly in 2024, the market is forecast to grow by USD 203 billion by 2029, progressing at a CAGR of 9% during the period. This growth reflects shifting dietary habits, increased urbanization, and a strong push toward organic and nutritious products in both the food and beverage sectors.

For more details about the industry, get the PDF sample report for free

A primary driver behind the India Fruit Pulp Market’s expansion is rising urbanization and changing consumer lifestyles. As urban populations increase and disposable incomes rise, consumers are gravitating toward processed fruit products that offer both health benefits and convenience. Items such as fruit juices, smoothies, jams, and desserts made with pulp are in high demand due to their nutrient-rich profiles. Fruit pulp provides key health benefits, including calcium and zinc content, stress relief, and immune system support. Additionally, organized retail infrastructure, supported by modern storage and quality control systems, ensures the year-round availability of fruit pulp products. According to analysts, the combination of these factors is reshaping consumer purchasing patterns and fueling steady demand growth across both online and offline channels.

One of the most prominent trends shaping the India Fruit Pulp Market is the expanding organized retail landscape. The increased presence of supermarkets, hypermarkets, and specialty stores has significantly boosted consumer access to a wide array of fruit pulp products. This includes offerings such as organic juices, marmalades, jellies, and fruit-based desserts. Furthermore, advancements in storage facilities and adherence to food safety regulations ensure product quality and freshness. With health consciousness at an all-time high, consumers are now seeking fruit pulps for their role in preventing conditions like osteoporosis, hypertension, and heart disease. The market is also seeing increased competition for shelf space, prompting companies to develop innovative, value-added products that align with consumer preferences.

The India Fruit Pulp Market is witnessing significant growth due to rising demand for natural and healthy food ingredients. Popular varieties like mango pulp, strawberry pulp, apple pulp, guava pulp, and pineapple pulp dominate the segment, alongside emerging options such as banana pulp, orange pulp, and papaya pulp. These pulps serve as core ingredients for a wide range of applications, including fruit juice, smoothie base, ice cream, yogurt flavor, and fruit puree. With the increasing trend toward convenience and ready-to-use products, jam filling, jelly base, and fruit syrup have also become common uses. In India’s diverse food industry, mixed fruit, citrus pulp, and exotic offerings like dragon fruit, lychee pulp, and passion fruit are driving innovation and flavor diversity across segments.

The India Fruit Pulp Market is segmented by:

Type: Mango, Strawberry, Apple, Guava, Others

Application: Food, Beverage

Distribution Channel: Online, Offline

Form: Liquid, Powder

Among the segmentation categories, the mango segment dominates the India Fruit Pulp Market, expected to witness significant growth throughout the forecast period. Mango pulp, derived from fresh and organic mangoes, is utilized across numerous products like syrups, juices, marmalades, and cake fillings. The segment includes three primary grades—Alphonso, Kesar, and Totapuri—each tailored to different taste profiles and applications. Mango pulp is highly favored not just for its flavor but also for its long shelf life and ease of storage and transport, which are critical for manufacturers. Analysts note that the mango segment continues to thrive due to India’s abundant mango cultivation, increasing export demand, and strong domestic consumption in the food and beverage industries.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite its growth potential, the India Fruit Pulp Market faces challenges related to stringent food safety regulations and quality standards. Companies must comply with various guidelines to ensure that fruit pulp products are free from artificial additives and adhere to hygiene protocols. This is particularly critical given the health-oriented positioning of the market. Additionally, managing transportation and storage costs remains a pressing issue, especially for companies without access to advanced cold-chain logistics. High operational costs can reduce profitability, particularly in a price-sensitive market. Consumers’ growing preference for organic and natural products puts further pressure on producers to maintain high-quality raw materials, which can be difficult to source consistently due to seasonal and climatic variations.

Market research reveals a growing demand for fruit pulp in processed foods and beverages, driven by health-conscious consumers and evolving dietary preferences. Premium varieties like peach pulp, kiwi pulp, blueberry pulp, raspberry pulp, cherry pulp, and pomegranate pulp are gaining traction in both domestic and export markets. These are extensively used in dessert topping, beverage concentrate, fruit nectar, and bakery filling applications. Further downstream, products such as confectionery paste, fruit sauce, milkshake mix, and cocktail mixer are integrating high-quality fruit pulp for enhanced flavor and natural appeal. Additionally, consumer segments like baby food, fruit snack, and energy drink manufacturers are focusing on natural, pulp-based formulations that align with wellness trends.

From a research perspective, product innovation and preservation technology are key areas of focus in the India fruit pulp market. Segments like organic pulp, aseptic pulp, frozen pulp, and canned pulp are witnessing strong investment due to their extended shelf life and utility in various formulations. The development of pulp concentrate, natural sweetener, fruit extract, and pulp powder is addressing the needs of food processors seeking versatility and stability in their supply chains. These formats support broader usage in functional foods and nutraceuticals. As technology evolves, improvements in processing methods and packaging will continue to drive efficiency and expand the applicability of fruit pulp in India’s dynamic food and beverage sector.

In response to evolving market dynamics, companies in the India Fruit Pulp Market are deploying a range of strategic initiatives, including partnerships, product launches, and geographic expansion. Innovations in product formulation—such as the use of organic and preservative-free pulp, or blends for functional beverages—are helping brands capture niche market segments.

ABC Fruits, for instance, has focused on supplying high-quality banana and red papaya pulp, while others like Aditi Foods India Pvt. Ltd. and Mysore Fruit Products Pvt. Ltd. are expanding their footprint through enhanced processing capabilities. There is a growing trend among manufacturers to improve their packaging and shelf-life technologies, enabling them to reduce waste and reach broader markets. Analysts highlight that online distribution channels are becoming increasingly important, allowing companies to lower logistics costs and offer direct-to-consumer services.

With more consumers turning to fruit pulp products for their health benefits, flavor diversity, and convenience, leading firms are also investing in value-added offerings such as fruit yogurts, baby food, and natural dessert bases. These developments, along with a commitment to food safety compliance and supply chain efficiency, are shaping the next phase of competition and growth in the India Fruit Pulp Market.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Type

6.1.1 Mango

6.1.2 Strawberry

6.1.3 Apple

6.1.4 Guava

6.1.5 Others

6.2 Application

6.2.1 Food

6.2.2 Beverage

6.3 Distribution Channel

6.3.1 Online

6.3.2 Offline

6.4 Form

6.4.1 Liquid

6.4.2 Powder

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted