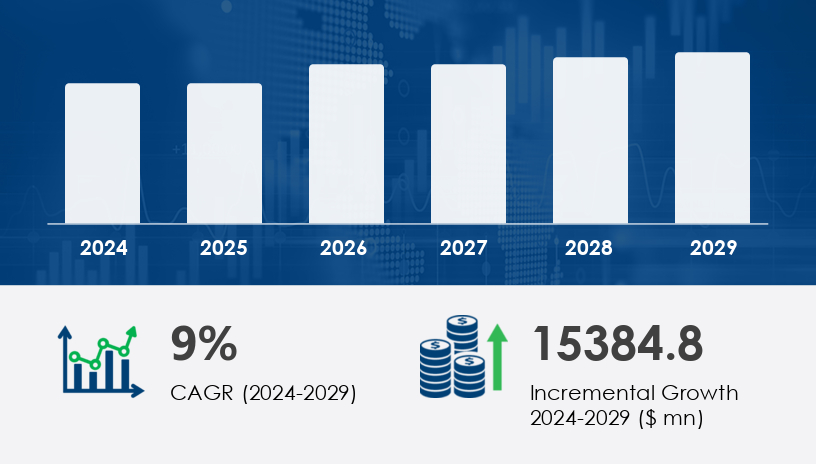

The Food Safety Testing Market is set to witness robust expansion due to growing regulatory oversight and technological integration. Ensuring food quality, preventing contamination, and safeguarding public health have made food safety testing a non-negotiable standard across food production and processing chains. As foodborne illnesses and contamination events raise consumer awareness, the industry continues to invest heavily in advanced testing protocols.The Food Safety Testing Market is projected to grow by USD 15.38 billion between 2024 and 2029, registering a CAGR of 9%. This substantial growth reflects increasing demand for food safety certification, pathogen detection technologies, and regulatory compliance, particularly in high-risk segments like meat and poultry.For more details about the industry, get the PDF sample report for free

A key driver of the Food Safety Testing Market is the involvement of government agencies and regulatory bodies in mandating stringent food safety standards. Authorities such as the European Commission and US FDA have implemented comprehensive legislation (e.g., the Food Safety Modernization Act – FSMA) aimed at preventing, rather than reacting to, contamination. These regulations mandate the regular testing of food products for pathogens, allergens, heavy metals, veterinary drug residues, and pesticides. For instance, technologies like molecular diagnostics and mass spectrometry are increasingly deployed to detect contaminants such as E. Coli, Listeria, and Salmonella—pathogens responsible for severe foodborne illnesses. As a result, businesses are integrating compliance into every aspect of their supply chain to avoid recalls, penalties, and damage to brand reputation.

One of the most transformative trends in the Food Safety Testing Market is the adoption of advanced robotics and automation. Robots are no longer confined to packaging and palletizing; they now assist in core food testing processes, minimizing human contact and reducing the risk of contamination. These systems operate efficiently even in challenging environments, such as freezing temperatures, and improve testing accuracy by eliminating variability. Moreover, data analytics tools are increasingly being employed to monitor testing outcomes, identify contamination patterns, and trace supply chain vulnerabilities. These advancements, combined with the growing need for regulatory compliance and cost efficiency, are shaping a future where automated food diagnostics and real-time contamination detection become industry standards.

The Food Safety Testing Market is crucial to safeguarding public health by identifying potential food contaminants through a range of detection and analytical technologies. Core segments of this market include pathogen testing, microbial testing, allergen testing, GMO testing, and mycotoxin testing, all of which are essential to ensuring safe food production and processing. Contaminants such as pesticide residue, heavy metals, and chemical residues are commonly screened through methods like rapid testing, PCR testing, and ELISA testing. As regulatory standards tighten, foodborne pathogens like Salmonella, Listeria, and E. coli remain high-priority testing targets globally.

The Food Safety Testing Market is segmented into:

By Type:

Meat and Poultry

Fruits and Vegetables

Processed Foods

Dairy

Others

By Technology:

Rapid

Traditional

By Product Type:

Pathogen

Genetically Modified Organism (GMO)

Allergen

Chemical and Pesticides

Others

Among all types, the Meat and Poultry segment dominates the market due to its higher risk profile and history of contamination scandals. In 2019, this segment was valued at USD 6.9 billion and has shown consistent growth since. Testing in this segment utilizes ELISA for meat identification, organoleptic checks, and microbiological testing for pathogens like Salmonella, Listeria, Campylobacter, and E. Coli. Analysts highlight that rapid diagnostics and AI-powered microbial testing have improved detection precision and reduced delays, enhancing public trust. The increased scrutiny of meat products and rising consumer expectations around food safety are likely to sustain the segment’s dominance throughout the forecast period.

North America (US, Canada)

Europe (France, Germany, UK)

APAC (China, India, Japan)

Middle East and Africa (UAE)

South America (Brazil)

Rest of World (ROW)

North America emerges as the largest contributor, accounting for 43% of global market growth during the forecast period. The US FDA’s Final Rule on Laboratory Accreditation, part of the FSMA, has led to mandatory food safety testing protocols for manufacturers, pushing adoption rates higher. The region benefits from a mature food processing sector and a robust food safety culture, driven by microbiology labs, analytical chemistry labs, and food safety training programs. Additionally, next-generation sequencing, mass spectrometry, and AI-enabled diagnostics are increasingly standard in North American food testing. As per analyst commentary, the stringent implementation of food safety regulations and the high incidence of foodborne illness outbreaks have accelerated the adoption of advanced food safety solutions, solidifying the region's leadership in the global market.

Get more details by ordering the complete report

Despite rapid growth, the Food Safety Testing Market faces significant challenges—particularly in developing economies. Infrastructure gaps, including a lack of accredited labs, outdated testing facilities, and limited automation, hinder market penetration. Moreover, regulatory hurdles such as lengthy approval processes and inconsistent enforcement across regions restrict broader implementation. These issues contribute to the underutilization of resources and delay the deployment of innovative testing technologies. In such environments, food manufacturers may struggle to achieve certifications like FSSC 22000, which are often essential for international trade and supply chain partnerships.

Advanced laboratory techniques such as chromatography analysis, mass spectrometry, and biosensor technology are becoming standard in toxin analysis and adulteration testing. These tools also support food authenticity verification and shelf-life testing, reinforcing food integrity and traceability. Field applications such as hygiene monitoring, swab testing, and surface testing help identify contamination risks during food handling. With growing demand for transparency, tests now routinely screen for antibiotic residues, veterinary drugs, food additives, and preservative testing. Emerging risks like aflatoxin detection, ochratoxin testing, fumonisin analysis, and Campylobacter testing are also gaining attention, along with viral threats like Norovirus detection and Hepatitis A.

The expanding scope of parasite testing, Vibrio testing, Staphylococcus detection, and Clostridium testing indicates a broader effort toward comprehensive microbial surveillance. The integration of immunoassay technology, DNA sequencing, and other precision tools enhances test reliability and detection sensitivity. These innovations support stringent regulatory compliance while advancing food quality and nutritional analysis. As food production scales globally, ensuring food safety through consistent, validated testing methodologies becomes a competitive differentiator and a public health imperative. The market is evolving rapidly with increased investment in automated systems and digitized reporting to streamline testing operations across supply chains.

To address these challenges and tap into high-growth markets, companies are focusing on several key strategies:

Investing in R&D for next-gen diagnostic technologies, including PCR systems, molecular diagnostics, and AI-driven data analysis.

Pursuing global certifications like FSSC 22000, which validate food safety protocols and build consumer trust.

Collaborating with regulatory authorities to streamline approval processes and align with global compliance standards.

Expanding into emerging markets, where demand is rising due to increased consumer awareness and stricter local regulations.

These strategies allow firms to not only maintain regulatory compliance but also to differentiate themselves through technological excellence, supply chain traceability, and faster turnaround times. By enhancing their safety management systems and integrating automation, companies can effectively meet growing market demand while maintaining operational efficiency and brand credibility.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Type

6.1.1 Meat and Poultry

6.1.2 Fruits and Vegetables

6.1.3 Processed Foods

6.1.4 Dairy

6.1.5 Others

6.2 Technology

6.2.1 Rapid

6.2.2 Traditional

6.3 Product Type

6.3.1 Pathogen

6.3.2 Genetically Modified Organism

6.3.3 Allergen

6.3.4 Chemical and Pesticides

6.3.5 Others

6.4 Geography

6.4.1 North America

6.4.2 Europe

6.4.3 APAC

6.4.4 South America

6.4.5 Middle East and Africa

6.4.6 Rest of World (ROW)

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted