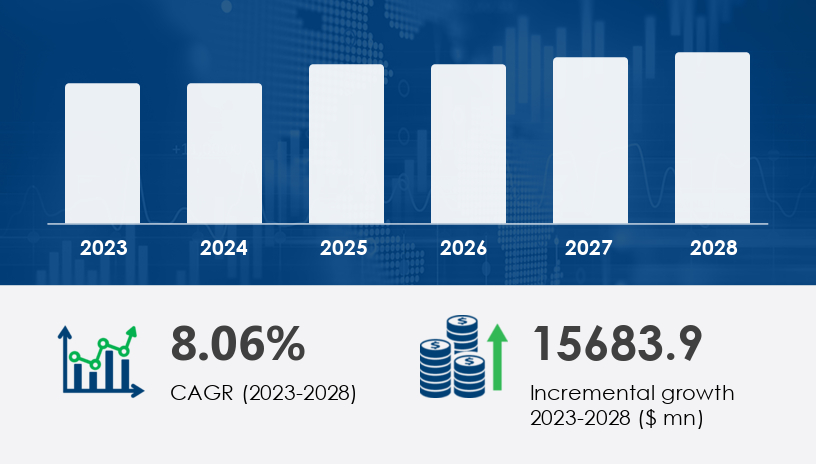

The US blister packaging market is projected to surge by USD 15.68 billion between 2023 and 2028, clocking an impressive CAGR of 8.06%. This growth trajectory is underpinned by a confluence of factors—rising demand for unit-dose pharmaceutical packaging, cost-saving supply chain benefits, and integration of smart technologies. In this 2025 Outlook and Strategic Insights report, we dive deep into what’s driving blister packaging adoption across industries like healthcare, food, cosmetics, electronics, and industrial goods.

For more details about the industry, get the PDF sample report for free

Get more details by ordering the complete report

Thermoforming remains the dominant technology, largely due to its cost-efficiency, compact footprint, and flexible production line integration. The thermoforming segment was valued at USD 21.99 billion in 2018 and has shown steady upward momentum.

This technique involves molding PVC, polyethylene, or PET films into precise cavities for pills, lozenges, or electronics. One machine can often complete the process, improving speed and reducing spatial requirements—a crucial consideration in high-throughput pharmaceutical environments.

Blister packaging can slash overall pharmaceutical packaging costs by up to 11%, significantly impacting the bottom line—especially for OTC drug manufacturers, where packaging can outstrip active ingredient costs.

From reduced packaging line complexity to smaller shipping volumes and lower warehousing demands, blister packaging drives operational efficiency while also supporting eco-conscious goals due to reduced material waste.

Blister packaging is gaining ground in snacks and confectionery, thanks to its tamper-evident features and ability to maintain freshness and extend shelf life. Materials such as polyvinyl chloride (PVC) and polyethylene terephthalate (PET) are widely used for their barrier properties and visual clarity.

Thermoforming: Leading segment driven by cost and scalability.

Cold Forming: Utilized for sensitive pharmaceuticals requiring extended protection from moisture, light, and oxygen.

Forming Film: Includes materials like PVC, PET, and COC.

Lidding Material: Aluminum foils and specialty films used for sealing and product integrity.

United States (US): Entire market scope pertains to the US geography, with robust demand from pharmaceuticals, personal care, and electronics sectors.

Smart blister packs incorporating RFID tags, temperature sensors, and tracking chips are redefining traceability in the pharma and electronics sectors. They offer:

Real-time inventory updates

Improved patient compliance tracking

Enhanced regulatory adherence (e.g., DSCSA, FDA serialization)

Driven by FDA-compliance demands and the Drug Quality and Security Act of 2013, many pharmaceutical firms are outsourcing to contract packagers. These specialists provide:

GMP-certified facilities

Integrated barcode systems

Smart pack capabilities

Contract packaging is especially crucial for nutraceuticals, vitamins, and OTC medications, enabling small to mid-sized manufacturers to meet stringent safety standards without heavy upfront investment.

The market faces serious headwinds from fluctuations in crude oil and natural gas prices, impacting costs of key materials like:

PVC

Aclar

Aluminum

As these are derived from hydrocarbons, geopolitical tensions or supply constraints can severely disrupt production economics.

While paperboard-backed carded blister packs offer an eco-friendly edge, they sometimes compromise on barrier effectiveness. Manufacturers must strike a delicate balance between biodegradability and protection performance.

The blister packaging market is experiencing significant expansion due to rising demand across multiple sectors including pharmaceutical blister, consumer goods, electronics packaging, and medical devices. Common packaging types such as blister packs, face seal, trapped blister, and clamshell packaging are widely utilized for their visibility and product protection benefits. Thermoformed blister packaging remains dominant for its versatility, while cold form packaging offers enhanced barrier protection, especially when combined with materials like aluminum foil, PVC film, PET plastic, and PP sheet. Advanced barrier solutions such as Aclar film and barrier film are employed to ensure product integrity. To further enhance protection, foil lidding and heat seal processes are commonly applied in carded blister, slide blister, and skin packaging formats. These innovations are also finding growing applications in food blister and cosmetic packaging, while retail blister continues to dominate shelf displays due to its tamper resistance. Enhanced features like tamper-evident and child-resistant mechanisms support safety and compliance, especially for unit dose and multi-dose formats.

Thermoforming will continue to dominate, especially for pharmaceuticals and food applications due to its efficiency and scalability.

Smart packaging and RFID integration will become standard for high-value, regulated products.

Sustainability pressures will nudge manufacturers toward paper-based solutions, creating a secondary wave of innovation in barrier technology.

As the US blister packaging market matures, expect a surge in cross-sector innovation. From child-resistant formats in consumer goods to smart diagnostics in healthcare packs, blister packaging is poised to become a hybrid product-protection and data-delivery system.

In-depth analysis of the blister packaging market highlights rapid advancements in production technologies and material sustainability. The use of blister machines and thermoforming equipment, alongside precise sealing technology, die cutting, and blister tooling, ensures high-volume output with consistent quality. Material choice is increasingly guided by performance and environmental considerations, with a notable shift toward rigid film and flexible film that balance durability and sustainability. Emerging trends like anti-counterfeit features are critical in sectors such as pharmaceuticals and high-value electronics packaging, driving innovation in design and traceability. The market is also witnessing growing interest in sustainable blister solutions, such as biodegradable film and recyclable blister alternatives, in response to global environmental concerns. Advanced substrates like high-density polyethylene and polycarbonate sheet are being explored for their strength and recyclability, while blister trays are increasingly adopted for secure handling and transport. These dynamics collectively underscore the blister packaging market's shift toward efficiency, safety, and eco-conscious solutions across a wide array of applications

Invest in automation-friendly thermoforming equipment to scale with demand while minimizing costs.

Form strategic alliances with contract packaging firms for GMP-compliant, tech-enabled packaging solutions.

Diversify material sourcing to mitigate raw material volatility—especially with aluminum and PVC derivatives.

Adopt RFID-enabled packs for high-value goods to enhance traceability and consumer trust.

Safe and Secure SSL Encrypted