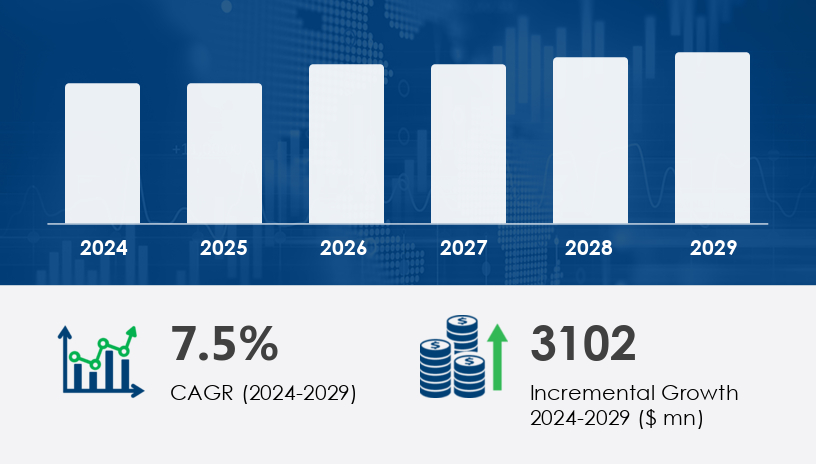

The global water and wastewater management market is set to grow by USD 3.1 billion from 2024 to 2029, accelerating at a robust CAGR of 7.5%, driven by sustainable mining practices, digital transformation, and mounting water scarcity challenges.As we move into the 2025 Outlook, environmental stewardship and data-driven technologies are reshaping industrial landscapes. Water and wastewater management — a critical operational pillar across mining, manufacturing, and municipal systems — is experiencing a profound transformation. From AI-powered monitoring in cobalt extraction to IoT-enabled filtration in semiconductor facilities, this market is evolving from necessity to strategic imperative.In this comprehensive guide, we’ll explore key trends, regional dynamics, and actionable strategies that businesses must adopt to capitalize on this market’s high-growth trajectory.For more details about the industry, get the PDF sample report for free

The increasing industrial burden on water resources, coupled with the depletion of freshwater reserves, has spotlighted water management as an economic and environmental priority. A 2024 Technavio analysis projects a USD 3.1 billion increase in global market size, fueled primarily by the mining sector’s transition to sustainable practices and the adoption of AI and IoT in treatment systems.

“Mining has evolved from a purely extractive industry to one under constant environmental scrutiny,” says Dr. Helen Frosch, Environmental Engineering Lead at EcoGeo. “Modern water management is no longer optional—it’s fundamental.”

Mining operations consume enormous volumes of water, and their discharge is often contaminated with toxic heavy metals (nickel, lithium, cobalt), coal particles, alkaline and acidic chemicals, and surfactants. The demand for mineral-based products in EVs and batteries is only accelerating this pressure.

Water Treatment: Dominates the market, driven by demand from mining and construction. Technologies like ion exchange, membrane filtration, and reverse osmosis are in high demand.

Wastewater Treatment: Gaining traction in industrial sectors but still secondary to freshwater resource management.

Type

Application

Primary, secondary, and tertiary treatments are all vital, but tertiary systems — involving advanced filtration and disinfection — are becoming essential for industries discharging into ecologically sensitive zones

Membrane separation and sludge treatment are cornerstones of modern systems, particularly in high-contamination zones such as metal extraction. Membrane-based processes allow for precision-level separation of microscopic pollutants, while AI-driven sludge treatment optimizes waste volume reduction.

Industrial: Mining, manufacturing, and energy sectors are the largest consumers and polluters of water resources.

Municipal: Urban population growth and outdated infrastructure create steady demand for municipal treatment systems.

Get more details by ordering the complete report

China, India, Japan, and South Korea are at the epicenter of industrial expansion. Water resource stress is a mounting concern, prompting governments and private sectors to invest in digitized water management.

The U.S. and Canada lead in regulatory enforcement and the integration of AI-powered leak detection and predictive maintenance. With a strong presence of nickel, cobalt, and lithium mining, sustainability is top of mind.

Sustainability regulations in Germany, France, and the UK push adoption of eco-compliant technologies and smart sensors in both municipal and industrial applications

South America

Middle East and Africa

The Water and Wastewater Management Market is undergoing rapid transformation due to growing concerns over water scarcity, water pollution, and the need for sustainable practices across industries. Advanced technologies such as reverse osmosis, membrane filtration, ultrafiltration, and ion exchange are increasingly adopted for efficient contaminant removal and water processing. These technologies play a crucial role in addressing pollutants like heavy metals, toxic chemicals, oil grease, soaps detergents, and fine particles in both industrial and municipal water sources. Environmental stress from acidic wastewater, alkaline chemicals, and coal particles also necessitates specialized treatment methods to ensure water quality and maintain ecological balance. With increasing emphasis on desalination, pre-water treatment, and eco-friendly alternatives, governments and organizations are aligning strategies with environmental regulations to strengthen water security.

For more details about the industry, get the PDF sample report for free

Technological innovation is accelerating ROI

Strong regulatory push ensures consistent demand

Diverse end-use applications from mining to construction

High capital expenditure for advanced systems

Complexity in managing multistage treatment across sites

Limited skilled workforce for AI and IoT integration

Managing wastewater from mining operations involves treating tailings dams, effluent streams, and contaminated runoff, each with unique chemical profiles. According to industry experts, implementation is hindered by:

Varying water quality parameters

Limited integration of digital infrastructure

Rising cost of eco-friendly treatment chemicals

The integration of sensors, machine learning, and AI is not a futuristic concept — it’s already redefining maintenance, energy usage, and compliance.

By 2029, more than 65% of water management systems in the mining industry will be fully automated or semi-automated, according to a study by Senior Technavio Expert.

Get more details by ordering the complete report

Adopt Circular Water Systems: Recycle and reuse to minimize dependence on freshwater.

Invest in Digital Twins: Simulate treatment scenarios before real-world implementation.

Prioritize Modular Systems: Allow for flexible upgrades without full infrastructure overhauls.

Engage Regulators Early: Design systems aligned with evolving compliance frameworks.

Train Workforce in IoT and AI: Future-ready teams will dictate operational success.

Strategic analysis of the market reveals that robust water management strategies are anchored in multi-stage processes including primary treatment, secondary treatment, and tertiary treatment to process and recycle wastewater efficiently. Efforts such as wastewater reuse and treated water recovery have become vital, especially in sectors like mining, where mining chemicals, slurry transport, and mineral extraction generate complex wastewater streams. Additional use cases, such as dust suppression and deep-sea mining, further underline the significance of water management. The integration of chemical methods and physical methods helps manage solid particles, while ensuring regulatory compliance with local and global mandates. Advanced water treatment equipment facilitates the mitigation of ecological impacts, helping reduce the overall ecological footprint. Factors like regulatory compliance, management of water discharge, and application of surfactants continue to shape the future of the wastewater management landscape.

Get more details by ordering the complete report

The water and wastewater management market is no longer about environmental responsibility alone — it’s about operational efficiency, compliance, and long-term economic viability. With regulations tightening and resource scarcity worsening, companies that innovate in water stewardship will lead not just in compliance, but in profitability and public trust.

Safe and Secure SSL Encrypted