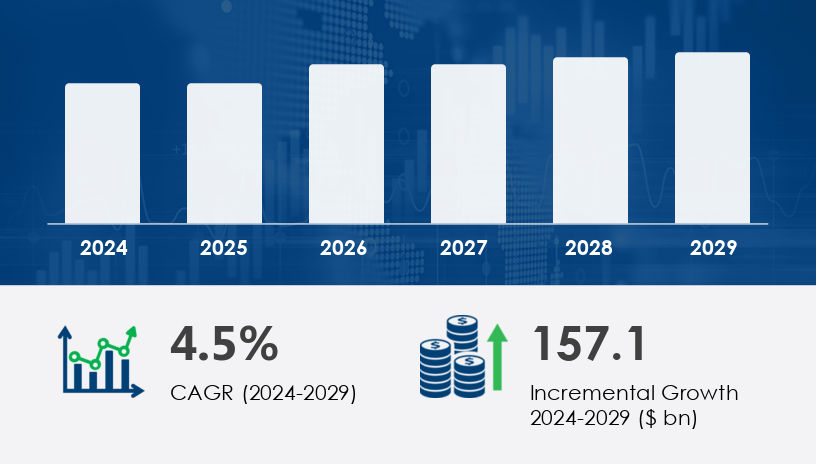

The global semiconductor market is projected to grow by USD 157.1 billion between 2024 and 2029, reaching new heights at a CAGR of 4.5%. This explosive growth, powered by the rise of IoT, green manufacturing initiatives, and expanding demand across verticals like automotive, healthcare, and industrial automation, marks a critical juncture for the industry.

For more details about the industry, get the PDF sample report for free

One of the primary drivers fueling the expansion of the semiconductor market is the accelerated adoption of Internet of Things (IoT) devices. These devices depend heavily on semiconductor components for connectivity, processing, and power efficiency. As IoT integration deepens across industries like consumer electronics, healthcare, and industrial automation, demand for semiconductors that offer low power consumption and high performance continues to surge. This trend has especially impacted analog and digital circuits, magnetic sensors, and integrated systems. The market's expansion in this area reflects the analyst view that IoT proliferation is the “primary catalyst for market growth.” Foundry services are also scaling up to meet the design complexity and production requirements of IoT-enabled systems.

A notable trend shaping the semiconductor market is the shift toward sustainable manufacturing practices. As semiconductor fabrication is energy- and water-intensive—consuming around 1 Terawatt-hour (TWh) of energy and 2–4 million gallons of ultra-pure water daily per plant—companies like TSMC and Intel are implementing eco-friendly strategies. These include water recycling, pollution reduction, and improved process control. This sustainability push aligns with both regulatory pressure and consumer expectations, encouraging innovation in thin film deposition, etching equipment, and defect inspection. The growing environmental consciousness within the industry underscores a larger transformation toward resource-efficient semiconductor production.

The semiconductor market serves as the backbone of the global electronics ecosystem, with core components like the microchip, integrated circuit, transistor, and diode driving performance in countless applications. Passive components such as the resistor and capacitor remain fundamental to circuit design, supporting signal filtering and energy storage. The rise of high-performance processing is powered by the microprocessor, memory chip, and subtypes like DRAM, NAND flash, and SRAM, which cater to both consumer electronics and enterprise systems. Additionally, demand for logic chip and analog chip solutions continues to grow across mobile, automotive, and industrial applications. The increasing electrification of devices is also fueling the adoption of power semiconductors, particularly MOSFET, IGBT, and thyristor technologies.

The semiconductor market is segmented by:

Application: Networking and Communication (N&C), Data Processing, Industrial, Consumer Electronics, Others

Product: Integrated Circuits (ICs), Optoelectronics, Discrete Semiconductors, Sensors

Semiconductor Materials: Fabrication, Packaging

End-User: OEMs, Aftermarket, Distributors

Within the application segment, Networking and Communication (N&C) emerges as the top-performing category. In 2019, the N&C segment was valued at USD 189.50 billion, and it has shown a steady upward trajectory. This growth is propelled by increasing data usage, the expansion of 5G networks, and IoT connectivity. The segment benefits from high demand for analog and digital circuits, as well as foundry services optimized for high-yield, low-power chip production. Analysts highlight that N&C semiconductors are pivotal in addressing “the surge in data demand from consumer electronics and IoT devices”, cementing this segment's dominance through the forecast period.

Covered Regions:

North America

Europe

APAC

Rest of World (ROW)

Asia-Pacific (APAC) is set to contribute 82% of the total market growth from 2025 to 2029, making it the undisputed leader in the semiconductor industry. The region's expansion is driven by robust demand in countries like China, India, South Korea, and Taiwan, which are hubs for industrial automation, electronics manufacturing, and advanced chip production. China’s strong demand in automotive and aerospace, coupled with India’s increasing investment in electronic infrastructure, reinforces the region’s strategic importance. Analysts note that APAC’s leadership is underpinned by a “high level of industrial automation and disposable income fueling electronics demand.” Additionally, the presence of key foundries and investments in advanced node technologies like CMOS and gallium arsenide bolster APAC’s production capabilities.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite positive growth indicators, the semiconductor market faces a pressing supply-demand imbalance. Demand, particularly from consumer electronics and data-driven sectors, has outpaced production capabilities. This mismatch leads to price volatility, production delays, and increased operational risk. The shortage is further complicated by the long lead times required to establish or scale up fabrication facilities. Analysts emphasize that “the semiconductor shortage has led to longer lead times and delayed deliveries,” putting pressure on manufacturers to innovate and diversify supply chain strategies. This bottleneck challenges even major players and may ultimately affect end-user pricing and availability.

Market research highlights strong growth in optoelectronic devices, including the LED chip, photodiode, and laser diode, which are essential for lighting, sensing, and optical communication systems. Imaging advancements rely on components like the image sensor, CMOS sensor, and MEMS sensor, all of which are widely used in smartphones, surveillance systems, and autonomous vehicles. Specialized applications are driving demand for pressure sensor, temperature sensor, accelerometer, and gyroscope, supporting wearables and advanced automotive systems. Wireless communication components like the RF chip, amplifier, and oscillator are also seeing increased integration. Furthermore, complex designs such as system-on-chip, ASIC, and FPGA architectures are enabling more compact, power-efficient, and multifunctional devices across sectors.

The semiconductor industry is witnessing a wave of strategic alliances, investments, and technological innovations aimed at strengthening market positions and mitigating supply constraints:

In March 2025, GlobalFoundries secured a USD 4.2 billion investment to expand its 300mm fab in Abu Dhabi, enabling advanced semiconductor production.

Samsung Electronics and AMD, in May 2024, deepened their partnership for next-generation CPU and GPU manufacturing using Samsung’s 3nm process technology.

The European Chips Act, unveiled in July 2025, represents a €43 billion initiative to strengthen Europe’s semiconductor ecosystem, promoting research, skill development, and localized manufacturing.

Intel, in February 2023, launched Intel Foundry Services to meet rising demand through contract manufacturing, marking its strategic entry into third-party chip production.

Leading firms such as Analog Devices, Intel, NVIDIA, TSMC, and Samsung are also accelerating R&D, adopting gate-all-around transistors, silicon carbide, and advanced packaging technologies to stay ahead of the innovation curve. These developments reflect analysts' views that “silicon photonics and 3D integration will redefine semiconductor capabilities” in the near future.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.1 N and C

6.1.2 Data processing

6.1.3 Industrial

6.1.4 Consumer electronics

6.1.5 Others

6.2 Product

6.2.1 ICs

6.2.2 Optoelectronics

6.2.3 Discrete semiconductors

6.2.4 Sensors

6.3 Semiconductor Materials

6.3.1 Fabrication

6.3.2 Pacakging

6.4 End-User

6.4.1 OEMs

6.4.2 Aftermarket

6.4.3 Distributors

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted