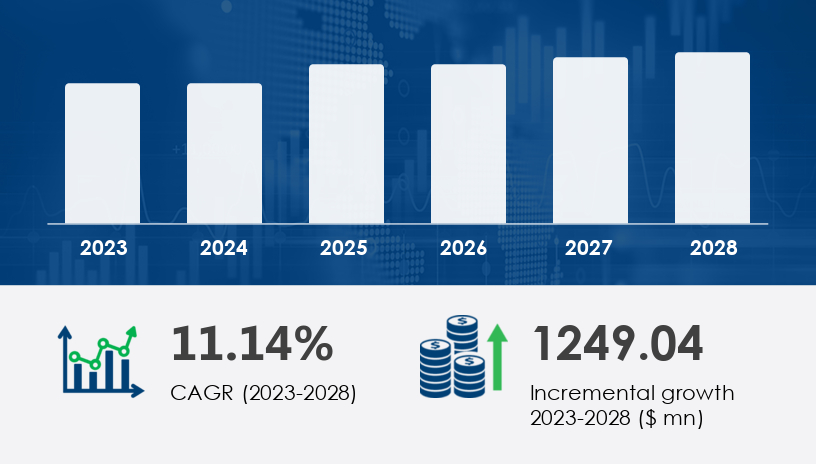

The Virgin Coconut Oil Market is poised for robust expansion through 2029, driven by rising consumer demand for natural and health-promoting products. Virgin coconut oil, derived from fresh coconut meat, is increasingly popular for its multifaceted applications in food, cosmetics, and pharmaceuticals. As of 2024, the Virgin Coconut Oil Market is forecast to grow by USD 1.25 billion from 2023 to 2028, at a CAGR of 11.14%, according to Technavio.

For more details about the industry, get the PDF sample report for free

A major force propelling the Virgin Coconut Oil Market is the growing awareness of its numerous health benefits. Rich in medium-chain triglycerides such as lauric acid and caprylic acid, virgin coconut oil is known for supporting heart health, reducing cholesterol levels, and aiding gut health. Research underscores its antioxidant and antimicrobial properties, enhancing its appeal across food and personal care sectors. As health consciousness rises globally, more consumers are switching to virgin coconut oil as a versatile, stable, and functional alternative to traditional cooking oils. Analyst commentary highlights how this trend has translated into surging demand across both culinary and cosmetic industries, significantly boosting market expansion.

A notable trend in the Virgin Coconut Oil Market is the surge in value-added product development. Producers are increasingly offering items such as virgin coconut oil capsules, driven by demand for portable, natural wellness products. The Philippines dominates the value-addition landscape with 60–70% of global activity, followed by emerging technologies in India. Innovations like cold-pressed extraction methods are also gaining traction, preserving nutrients and enhancing oil purity. This trend is reshaping market dynamics and offering new revenue streams to both producers and retailers, aligning with evolving consumer preferences for high-quality, functional products.

The Virgin Coconut Oil Market is rapidly expanding, driven by rising consumer demand for organic coconut oil, conventional coconut oil, and especially virgin coconut oil due to their recognized health benefits. Produced using methods such as cold-pressed oil and expeller-pressed oil extraction, these oils retain vital compounds like lauric acid and caprylic acid, known for their cholesterol reduction, heart disease prevention, and Candida control properties. Moreover, virgin coconut oil is gaining popularity in anti-cancer therapy, Alzheimer’s management, and diabetes management applications, reinforcing its appeal in both B2C demand and B2B demand segments. Sustainable production practices such as natural processing, wet milling, and fermentation process using non-GMO coconuts and synthetic-free oil contribute to the market's eco-conscious direction

By Application:

Organic

Conventional

By Distribution Channel:

Offline

Online

By Packaging:

Plastic Bottles

Glass Jars

Pouches

Metal Cans

The organic segment is the market's standout performer, reflecting consumers’ growing preference for natural and chemical-free products. Virgin coconut oil in this segment is produced using non-GMO farming practices, excluding synthetic chemicals. According to the report, the organic segment was valued at USD 793.16 million in 2018 and has shown consistent growth since. Analysts point out that this growth is tied to increased demand for antioxidant-rich skincare and wellness products, particularly in developed markets. The oil’s high smoke point, unique flavor, and medium-chain triglycerides like lauric acid make it ideal for culinary use, weight management, and personal care—further enhancing its market share.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Regions Covered:

North America (US, Canada)

Europe (France, Germany, Italy, UK)

APAC (China, India, Japan, Philippines)

Latin America (Argentina, Brazil)

Middle East & Africa (Egypt, KSA, Oman, UAE)

Rest of World (ROW)

The APAC region dominates the Virgin Coconut Oil Market, contributing 36% to global growth. Countries like the Philippines and Indonesia are pivotal in global supply, thanks to favorable climates and established coconut farming industries. Unrefined coconut oil from these regions is in high demand for both culinary and cosmetic applications. The oil's high saturated fat content ensures product stability, while its antioxidant and antimicrobial properties enhance its desirability in health-conscious markets. Analysts emphasize that growing consumer awareness and strong export capabilities from APAC underpin its market leadership, despite periodic price volatility.

A key obstacle in the Virgin Coconut Oil Market is the complex sourcing of tender coconuts. While countries like Brazil were initial suppliers, rising demand has shifted focus to Asia, including the Philippines, India, and Indonesia. However, these regions face limitations due to aging trees—many planted in the 1950s—and long maturity cycles of 10 to 30 years. This sourcing intricacy drives up production costs and complicates consistent supply. To address this, companies are investing in sustainable sourcing and forging strong supplier partnerships to ensure raw material quality, a strategy analysts highlight as crucial for maintaining competitiveness.

As a recognized nutraceutical ingredient, virgin coconut oil is increasingly included in functional food and personal care applications. Consumers value its natural aroma, coconut flavor, and antioxidant benefits, including high levels of Vitamin E and healthy fatty acids, which support brain health, immune support, and holistic wellness. The oil is also widely used in skincare products and haircare products, particularly those under natural cosmetics categories. The market is being shaped by preferences for pure coconut oil, unrefined oil, and offerings sourced from quality coconut meat. This trend is bolstered by a growing emphasis on sustainable packaging and eco-conscious products, as well as rising demand from premium organic and health-conscious consumers.

Distribution channels for virgin coconut oil are divided between offline distribution and online distribution, with increased presence in grocery stores and convenience stores enhancing accessibility. The growth of B2C demand is further supported by e-commerce platforms, while B2B demand remains robust across the natural cosmetics, functional food, and nutraceutical industries. Enhanced transparency in coconut farming and a strong push for sustainable packaging are reshaping supply chains. Brands prioritizing eco-conscious products with a focus on synthetic-free oil and natural processing are gaining competitive advantage. As the market matures, innovation in product development, including the integration of natural aroma, vitamin-rich profiles, and novel packaging formats, will be key to capturing consumer loyalty.

Innovations and Developments:

Companies are adopting strategies such as cold-pressed extraction, R&D investments, and strategic partnerships to capture market share.

March 2024: Edible Oils Corporation launched a new line of organic, cold-pressed Virgin Coconut Oil to meet rising consumer demand.

August 2024: NutriFusion partnered with a top Philippine coconut oil producer to ensure a steady supply of premium oil.

January 2025: Coconut Matter received a USD 15 million investment to boost production and R&D capabilities.

May 2025: The Indian government introduced standardized labeling regulations to enhance consumer trust and market transparency.

Adret Retail Pvt. Ltd.

Apex and Coco and Solar Energy Ltd

Archer Daniels Midland Co.

Barleans Organic Oils LLC

Greenville Agro Corp.

Marico Ltd.

Nutiva Inc.

The Hain Celestial Group Inc.

Tata Consumer Products Ltd.

Coconut Matter

These companies are leveraging geographic expansion, mergers and acquisitions, and product innovation to stay competitive. Analysts categorize market players across dimensions like pure play, category-focused, and dominant, offering a nuanced view of strategic positioning

The Virgin Coconut Oil Market is undergoing rapid growth, bolstered by its health benefits, versatile applications, and consumer inclination toward organic living. APAC leads the charge in both production and consumption, while the organic segment stands out in terms of demand. Nevertheless, the industry must tackle sourcing and sustainability challenges to maintain momentum. With continued innovation, investment, and regulatory support, the market is poised for a strong upward trajectory through 2029.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Application

6.1.1 Organic

6.1.2 Conventional

6.2 Distribution Channel

6.2.1 Offline

6.2.2 Online

6.3 Packaging

6.3.1 Plastic Bottles

6.3.2 Glass Jars

6.3.3 Pouches

6.3.4 Metal Cans

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

6.4.6 Rest of World

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted