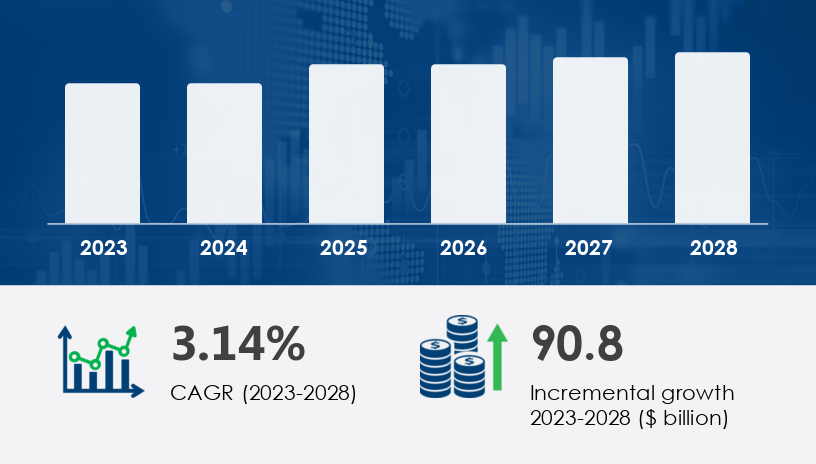

US Pharmacy Market 2024-2028, Poised for Growth Amid Aging Population and Digital Transformation

The US pharmacy market is projected to expand by USD 90.8 billion at a CAGR of 3.14% from 2024 to 2028, driven by an aging population, increasing demand for prescription and over-the-counter (OTC) medications, and digital advancements in healthcare. Industry players are adopting telepharmacy services, electronic health records (EHRs), and automation to enhance patient care.

For more details about the industry, get the PDF sample report for free

Market Segmentation Analysis

By Product Type

- Prescription Drugs: The dominant segment, benefiting from rising demand for chronic disease treatments.

- Over-the-Counter (OTC) Medications: Growing sales due to consumer preference for self-medication and preventive healthcare products.

By Ownership Structure

- Pharmacy Chains: Leading distribution networks, offering wider access to prescription and OTC medications.

- Independent Pharmacies: Catering to localized patient needs with personalized healthcare services.

By Type

- Retail Pharmacies: Driving sales through storefront and e-commerce platforms.

- Hospital Pharmacies: Essential for inpatient and outpatient medication management.

- Others: Specialty and long-term care pharmacies, addressing specific medical conditions.

By Region

- Northeast (New York, Massachusetts, Pennsylvania): High concentration of retail and hospital pharmacies due to urbanization.

- Midwest (Illinois, Ohio, Michigan): Growth in telepharmacy adoption to serve rural communities.

- South (Texas, Florida, Georgia): Expanding elderly population fueling demand for chronic disease medications.

- West (California, Washington, Colorado): Strong presence of digital pharmacies and biotech firms driving innovation.

Key Market Dynamics

Market Drivers

- Aging Population & Chronic Disease Prevalence: With the baby boomer generation aging, demand for prescription drugs, OTC medications, and health supplements is rising. Pharmacists are expanding services to include medication synchronization, immunizations, and treatment management to cater to chronic diseases like diabetes, hypertension, and arthritis.

- Digitalization & Technology Integration: The increasing penetration of EHRs, online pharmacies, and automation is enhancing efficiency. Pharmaceutical manufacturers are leveraging digital tools for improved production and distribution.

- Growing Pharmaceutical Exports: The US pharmaceutical sector benefits from exports of biologics, biosimilars, antiretroviral drugs, and vaccines, driving revenue growth.

Emerging Market Trends

- Rise of Telepharmacy Services: Telepharmacy is revolutionizing medication access, patient consultations, and adherence management, especially in underserved areas.

- EHR Adoption & Data Analytics: Hospitals and retail pharmacies are adopting EHRs for seamless prescription tracking, patient monitoring, and compliance with healthcare regulations.

- Growth in OTC & Generic Drug Sales: Retail pharmacies are witnessing higher sales of OTC drugs and generic medicines, influenced by GDP performance and seasonal demand.

Challenges Impacting Market Growth

- Escalating Drug Prices & Reimbursement Pressures: Rising pharmaceutical costs and reimbursement restrictions pose financial burdens on patients, healthcare systems, and insurance providers.

- Regulatory Compliance & Licensing: Strict quality control and licensing standards require pharmacies to comply with evolving industry regulations.

Get more details by ordering the complete report

Key Companies in the Pharmacy Market

Some of the key companies of the Pharmacy Market are as follows:

- Albertsons Companies Inc.

- Cardinal Health Inc.

- CVS Health Corp.

- Humana Inc.

- McKesson Corp.

- Rite Aid Corp.

- The Cigna Group

- The Kroger Co.

- United Health Group Inc.

- Walgreens Boots Alliance Inc.

- Walmart Inc.

Recent Developments in the US Pharmacy Market

- CVS Health Corp. launched a new digital prescription service in December 2023, enhancing remote access to medications.

- Walgreens Boots Alliance Inc. partnered with a leading AI firm in November 2023 to streamline pharmacy automation.

- McKesson Corp. announced a strategic acquisition of a specialty pharmacy in October 2023, strengthening its market position.

- Humana Inc. introduced AI-powered telepharmacy services in September 2023, improving virtual patient consultations.

- Walmart Inc. expanded its e-pharmacy network in August 2023, focusing on nationwide prescription delivery.