US Frozen Pizza Market Size 2024-2028: Key Trends, Segments, and Dynamics

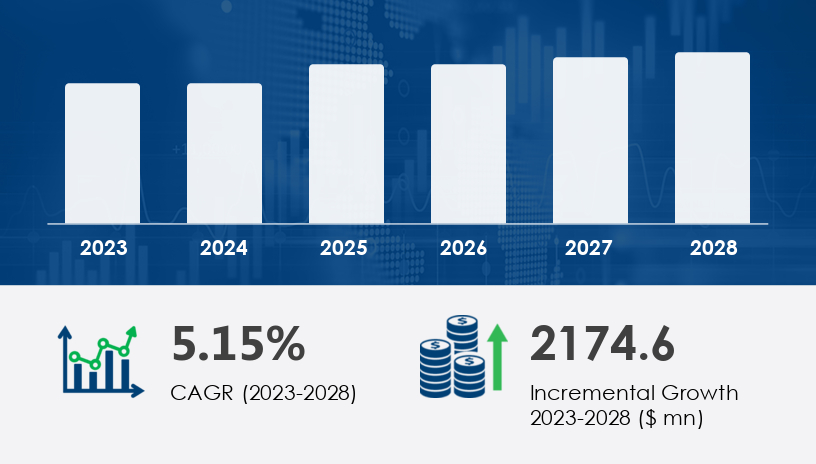

The US frozen pizza market is forecasted to increase by USD 2.17 billion at a CAGR of 5.15% from 2023 to 2028, reflecting significant growth driven by evolving consumer preferences and convenience.

For more details about the industry, get the PDF sample report for free

Market Segmentation

The US frozen pizza market is segmented by type, distribution channel, product, and geography, as outlined below:

By Type:

- Non-vegetarian toppings

- Vegetarian toppings

By Distribution Channel:

By Product:

- Regular frozen pizza

- Premium frozen pizza

- Gourmet frozen pizza

By Geography:

Regional Market Trends

United States

The market in the US continues to thrive due to the increasing preference for Western-style diets and the growing demand for convenient, ready-to-eat meals. Consumers are also focusing on healthier frozen pizza options, including plant-based and vegan alternatives, which align with rising health consciousness.

By Type Insights

- The non-vegetarian toppings segment is expected to witness significant growth during the forecast period. Popular choices such as pepperoni, sausage, and bacon cater to consumers seeking convenient, nutritious, and hearty meals. High-quality ingredients and a variety of crust types like thin, thick, and gluten-free contribute to the growth of this segment.

- Additionally, innovative fusion pizzas, such as BBQ chicken and taco-style, appeal to more adventurous consumers. Vegan and gluten-free options also cater to dietary restrictions like celiac disease and gluten allergies.

Market Dynamics: Drivers, Trends, and Challenges

Drivers:

- Longer Shelf Life of Frozen Pizza Products: One of the key drivers of the market's growth is the extended shelf life of frozen pizzas. This feature makes them convenient for consumers seeking ready-to-eat meals with long-lasting freshness, which aligns with hectic lifestyles and increasing demand for convenience.

Trends:

- Convenience in Transportation of Meal Kits: The convenience of meal kits, which often include frozen pizza, is a growing trend. With the increasing shift to e-commerce and online grocery platforms, consumers are opting for more convenient, contactless shopping experiences. Brands are also focusing on healthier frozen pizzas with clean labels, certifications, and reduced sodium, in response to rising health concerns.

Challenges:

- Rising Health and Nutrition Concerns: A major challenge to market growth is the rising health consciousness surrounding frozen pizza consumption. With growing concerns about high-calorie, high-sodium foods, manufacturers are under pressure to offer healthier alternatives, such as low-calorie and low-sodium pizzas. Innovations in plant-based proteins and vegan cheese, along with improved crust options like cauliflower crust, are addressing these concerns.

Get more details by ordering the complete report

Key Players in the US Frozen Pizza Market

The competitive landscape of the frozen pizza market in the US includes several key players, who have adopted strategies such as strategic partnerships, mergers and acquisitions, and product launches to enhance their market presence. Notable players in the market include:

- Amys Kitchen Inc.

- Bernatellos Foods

- Cappellos

- Caulipower LLC

- Champion Foods LLC

- Charoen Pokphand Foods PCL

- CJ CheilJedang Corp.

- Conagra Brands Inc.

- Dr. August Oetker Nahrungsmittel KG

- Frozen Specialties Inc.

- General Mills Inc.

- K.T.s Kitchens Inc.

- Lucias Pizza

- Miracapo Pizza Co.

- Nestle SA

- Newmans Own Inc.

- Palermo Villa Inc.

- Rich Products Corp.

- Sudzucker AG

- Wegmans Food Markets

Recent Developments

-

February 2024: Several brands have launched new product lines, offering a variety of gluten-free, vegan, and plant-based frozen pizzas. These innovations cater to the growing demand for healthier frozen pizza alternatives, addressing dietary needs and preferences.

-

January 2024: Strategic partnerships between frozen pizza brands and e-commerce platforms have significantly expanded online sales channels. These partnerships aim to meet the demand for contactless grocery shopping and provide consumers with easy access to a wider selection of frozen pizza options.

By understanding these market trends, drivers, and challenges, businesses can better align their strategies to meet evolving consumer demands in the US frozen pizza market.