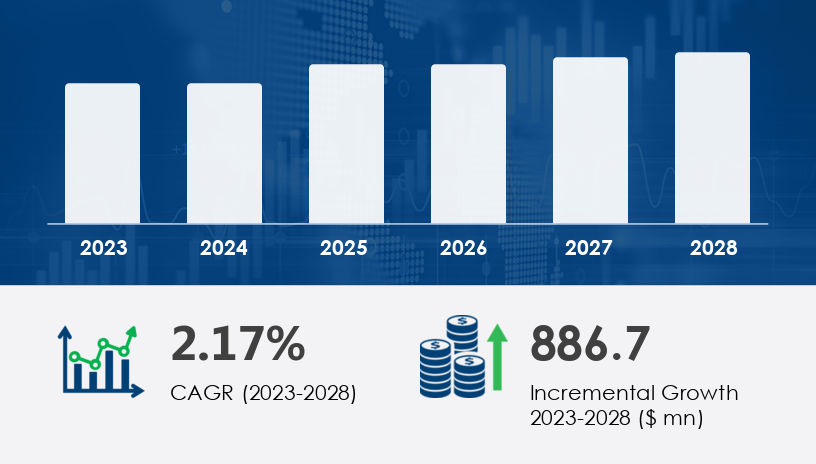

US Snack Bars Market Size 2024-2028

The US snack bars market size is forecast to increase by USD 886.7 million at a CAGR of 2.17% between 2023 and 2028.

In the US market, snack bars continue to gain popularity due to their convenience as on-the-go breakfast options. The global retailing segment, including supermarkets and hypermarkets, dominates the snack bar sales. However, the online retail channel is experiencing significant growth due to increasing internet penetration and smartphone usage. Grocery delivery chains further boost online sales. Grocery delivery chains and convenience stores are other significant distribution channels for snack bars in the US. New product launches remain a key market growth factor, with companies introducing low-sugar and organic options to cater to health-conscious consumers. Product recalls, however, pose a challenge to market players, highlighting the importance of maintaining high product quality and safety standards. To stay competitive, companies must focus on innovation and catering to evolving consumer preferences.

For more details about the industry, get the PDF sample report for free

Market Segmentation:

The market is segmented based on product type, distribution channel, and geography, with detailed data forecasts and estimates from 2024 to 2028.

By Product:

- Energy and nutrition bars

- Granola bars

- Breakfast bars

- Other snack bars

By Distribution Channel:

- Offline distribution

- Online distribution

By Geography:

By Product Insights

The energy and nutrition bars segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing preference for convenient and nutritious food options. Energy bars, made from cereals and various ingredients, are gaining popularity among consumers seeking a quick energy boost. The rise in fitness consciousness and the increasing number of gym memberships in the country are key factors driving the growth of this segment. Additionally, the global retailing segment, including supermarkets and hypermarkets, is a major distribution channel for snack bars. Online retail channels, such as grocery delivery chains, are also gaining traction due to increasing internet penetration and smartphone usage in the US.

The energy and nutrition bars segment was valued at USD 3.9 billion in 2018 and is showing a gradual increase through the forecast period.

Get more details by ordering the complete report

Market Dynamics

Drivers:

- New Product Launches: The market is experiencing growth due to the rising preference for convenient and nutritious food options. New product introductions are a significant driver of this market's expansion. For instance, in February 2023, Natural Balance Foods unveiled Nakd Fruit and Fibre bars, featuring Apple and Cinnamon, and Strawberry and Raspberry flavors. Additionally, in October 2022, Quaker Oats, a subsidiary of PepsiCo Inc., launched Quaker Chewy Granola bars. Consumers' increasing interest in healthier food alternatives, particularly as meal replacements, is another factor fueling the market's growth. Snack bars cater to this demand by offering a variety of flavors and ingredients, such as honey syrup, nuts, beet, spirulina, red berry, orange, brownie, and peanut butter.

Trends:

- Rising Demand for On-the-Go Breakfast Options: The demand for convenient and nutritious breakfast options is an upcoming trend in the market. With urbanization and the increasing number of individuals leading busy lifestyles, the preference for targeted consumer products, such as snack bars, is on the rise. Additionally, the dietary preferences of consumers, including vegan and other specialized diets, are driving the demand for snack bars with innovative and health-conscious ingredients. These factors are expected to fuel the market's expansion during the forecast period. The convenience and nutritional benefits offered by snack bars make them an ideal choice for time-pressed consumers seeking a quick and nourishing breakfast option.

Challenges:

- Product Recalls: Product recalls are a key challenge affecting market growth. The market is witnessing significant growth due to increasing health awareness and the prevalence of obesity and lifestyle diseases. Consumers are seeking nutrient-dense snack options, leading to a higher demand for snack bars infused with essential nutrients, bioactive compounds, and dietary fibers. However, product recalls can disrupt market growth. Manufacturers often source raw materials from external suppliers, increasing the risk of contamination or incorrect labeling. A product recall not only disrupts a company's operations and sales but also negatively impacts its brand image. For instance, Built Brands recalled their Banana Cream Pie Puffs protein bar in June 2022 due to potential contamination.

Key Players & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Key companies mentioned in the report:

- Abbott Laboratories

- Caveman Foods

- Clif Bar and Co.

- Element Snacks Inc

- General Mills Inc.

- Kellogg Co.

- Kroger Co.

- Mars Inc.

- McKee Foods

- Natural Balance Foods

- Nestle SA

- NuGo Nutrition

- PepsiCo Inc.

- Post Holdings Inc.

- PROBAR LLC

- Quest Nutrition LLC

- Soylent Nutrition Inc.

- The Hain Celestial Group Inc.

- The Hershey Co.

- Walmart Inc.