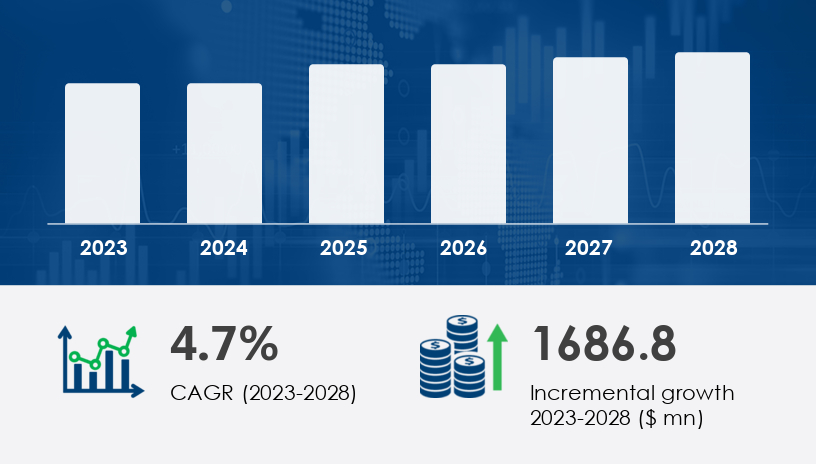

The Take Out Fried Chicken Market is projected to grow by USD 1.69 billion between 2023 and 2028, recording a compound annual growth rate (CAGR) of 4.7%. This robust trajectory is being fueled by two dominant forces: the global expansion of fast-food chains and the rapid adoption of food delivery platforms across key regions. With the offline distribution channel remaining dominant, especially in the U.S., and Asia-Pacific (APAC) contributing 41% to global growth, stakeholders are aligning strategies to meet evolving consumer expectations for convenience, nutrition, and variety.Key players such as Yum Brands Inc., McDonald Corporation, Wingstop Inc., Chick-fil-A Inc., Raising Canes Restaurants LLC, and Shake Shack are investing in innovation to retain competitive edges. From developing grilled or baked alternatives to launching new sandwich offerings like Bojangles' Bo’s Fried Chicken Sandwich (August 2021), brands are diversifying offerings to appeal to health-conscious consumers without compromising flavor.For more details about the industry, get the PDF sample report for free

The industry is segmented by Distribution Channel and Geography:

Distribution Channel

Offline (Dominant Segment): Offline services, especially drive-thru options and takeaway counters, represent the largest market share in the U.S. Fast-food outlets offering crispy, golden, and nutrient-rich chicken—particularly thighs and drumsticks—continue to attract high foot traffic. The convenience and comfort offered by offline ordering have proved vital during pandemic-related lockdowns and continue to be a key growth driver.

Online: While not the largest segment, the online channel is surging due to the rise of food delivery apps and changing consumer behavior, especially post-COVID. Brands have responded by optimizing their digital platforms and delivery logistics.

Geography

North America (U.S., Canada)

APAC (China, Japan)

Europe (UK)

South America

Middle East and Africa

The offline segment was valued at USD 3.99 billion in 2018 and has shown a steady upward trajectory, bolstered by accessible takeaway options and enhanced in-store customer experiences.

The Take Out Fried Chicken Market is witnessing robust growth fueled by evolving consumer preferences for convenience, flavor variety, and indulgent comfort foods. Key offerings such as fried chicken, chicken wings, chicken tenders, chicken nuggets, and crispy chicken continue to dominate menus across the sector. Innovation in taste profiles has expanded the market, with items like spicy chicken, chicken sandwich, chicken strips, breaded chicken, and buttermilk chicken attracting diverse demographics. Variety in cuts—such as chicken drumsticks, chicken thighs, and chicken breast—caters to consumer texture and portion size preferences. Specialty options including hot wings, buffalo wings, BBQ chicken, honey chicken, garlic chicken, lemon chicken, Cajun chicken, Nashville chicken, Korean chicken, and Southern chicken add regional appeal and seasonal interest. Packaging formats like the chicken bucket, family meal, and combo meal are designed for group consumption and upselling. A wide assortment of side dishes, including mashed potatoes, coleslaw, biscuits, macaroni cheese, french fries, and gravy sauce, contribute to higher average order values and enhance overall customer satisfaction.

Get more details by ordering the complete report

The United States and Canada lead North American market growth, driven by a strong cultural preference for savory fried chicken and a dense network of global and local fast-food chains. Meanwhile, APAC is set to account for 41% of global market growth, powered by rising urbanization and fast-food penetration in populous countries like China and Japan. In Europe, particularly the UK, there is also growing demand, although not at the scale of North America or APAC. Other notable regional contributors include South America and the Middle East and Africa, where global chains are expanding aggressively to capture untapped markets.

Global Fast-Food Chain Expansion: Multinational brands are aggressively targeting new geographies, supported by franchise demand and low barriers to entry in developing nations. Customization of flavors to match local tastes has proven an effective strategy for penetrating new markets.

Nutritional Appeal and Consumer Awareness: While fried chicken is often viewed as indulgent, its nutritional profile—particularly dark meat varieties rich in amino acids, protein, vitamin B12, iron, and zinc—offers health benefits like improved bone density, muscle tissue growth, and better heart health when consumed in moderation.

Rise of Food Delivery Apps: Online ordering has seen exponential growth, accelerated by the pandemic. Brands are increasing investments in digital infrastructure to support seamless online experiences. Consumers benefit from the convenience and access to healthier menu modifications, including grilled or baked chicken.

Health-Driven Innovations: With rising consumer awareness around saturated fats and calorie content, brands are reformulating their offerings. Innovations such as healthier batters and alternative cooking methods (e.g., baking or air-frying) are gaining traction.

Health Concerns and Consumer Skepticism: Fast food, including fried chicken, is under scrutiny for its association with chronic conditions like obesity, heart disease, and diabetes. High intake of saturated fats and calories—particularly from darker cuts like thighs and drumsticks—has raised red flags among health experts. According to the American Heart Association, fried food consumption can raise heart disease risk by up to 68%, posing a significant challenge to sustained consumption.

To mitigate these concerns, consumer education and offering grilled or leaner cuts are crucial. Companies are also exploring ways to balance indulgence with nutrition, reinforcing the message of moderation.

For more details about the industry, get the PDF sample report for free

In the competitive landscape of the Take Out Fried Chicken Market, factors such as flavor pairing and service delivery have emerged as key differentiators. Dipping options like dipping sauce, ranch dressing, hot sauce, honey mustard, and BBQ sauce add personalization to meals, boosting consumer loyalty. Operational models revolve around fast food, take-out, and delivery service, with increasing reliance on drive-thru lanes and strategic expansion of chicken chain outlets under the franchise model. Continuous menu innovation, driven by localized tastes and health-conscious trends, reflects the industry's agile response to shifting demand. Key performance indicators now include food quality, customer service, and the digital convenience of online ordering and mobile app platforms. Promotions like the meal deal have proven effective in retaining value-conscious consumers while expanding market reach. As consumers increasingly prioritize speed and quality, players in the sector are investing in technology and logistics to strengthen their competitive edge and deepen brand engagement

The competitive landscape is marked by both legacy fast-food giants and emerging brands, including:

Yum Brands Inc.

McDonald Corporation

Wingstop Inc.

Chick-fil-A Inc.

Raising Canes Restaurants LLC

Shake Shack Inc.

Bojangles Restaurants Inc.

KRISPY KRUNCHY FOODS LLC

Restaurant Brands International Inc.

GENESIS BBQ

Golden Franchising Corp.

Guss Fried Chicken

KyoChon Chicken Rowland Heights

Cajun Operating Co.

Charoen Pokphand Group Co. Ltd.

Pacific Fried Chicken Co.

Honeybee Foods Corp.

ColoradoFried Chicken Co.

Chicken Co.

These players are leveraging strategies like mergers, acquisitions, product launches, and regional expansions to stay ahead. Strategic alliances and geographic diversification continue to shape competitive positioning.

By focusing on innovation, digital transformation, and health-conscious menus, the market is not only evolving to meet modern consumer demands but is also reshaping its image in the fast-food landscape.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted