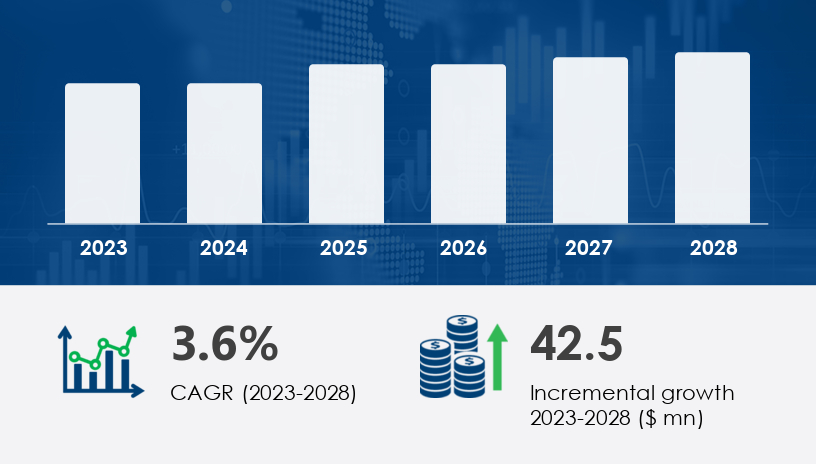

The global synoptophore market is set to experience a steady upward trajectory from 2025 through 2029, with an anticipated increase of USD 42.5 million at a compound annual growth rate (CAGR) of 3.6% between 2023 and 2028. This expansion is driven by a rising tide of visual acuity disorders—particularly in the pediatric population—requiring precise diagnosis and non-invasive treatment solutions. The growing prevalence of amblyopia, strabismus, and ocular motility disorders underscores the critical role synoptophores play in modern ophthalmology.At the heart of this growth is the evolution from traditional, manual synoptophores to advanced, automated models. These next-generation devices offer heightened diagnostic accuracy, enhanced user efficiency, and broader application in non-surgical therapy. Despite high device costs acting as a market restraint, the clear demand for tools that aid in early detection and treatment is reshaping the landscape. This trend is particularly pronounced in North America, which is projected to contribute 35% of global market growth by 2028, thanks to robust investments in ophthalmic research and the prioritization of visual health.For more details about the industry, get the PDF sample report for free

Segment Analysis

By application, the diagnostic segment holds the lion’s share of the market and is expected to remain dominant through 2029. Synoptophores are vital in assessing ocular muscular imbalances via tests for sensory fusion, simultaneous perception, and stereopsis. The non-invasive nature of these diagnostic procedures is especially beneficial in pediatric care, where early intervention can prevent lifelong vision impairment. However, the segment does face competitive pressure from alternative diagnostic tools like photo screeners and prism cover tests, which are often more affordable and user-friendly.

The therapeutic segment, though smaller, is gaining traction as awareness of non-surgical treatments increases. Automated synoptophores are being used to treat conditions such as aniseikonia, cyclophoria, and convergence insufficiency, offering a viable alternative to surgical intervention. This trend is supported by growing interest in holistic and patient-centric ophthalmic care.

Geographically, while North America leads in market share, regions like Asia (notably India, China, and Japan) and Europe (Germany, the UK, and France) are emerging as critical growth zones. Increasing access to eye care services and awareness of early diagnosis are key enablers in these regions. Countries like India are witnessing a surge in pediatric eye disorder diagnoses, creating a ripe environment for market expansion, especially in therapeutic applications.

Opportunities & Risks

The synoptophore market's forward momentum is buoyed by several high-impact opportunities. First, the increased global incidence of traumatic brain injuries and strokes—which often result in visual impairments—has expanded the market's relevance beyond pediatric care to neurology and rehabilitation. This opens avenues for synoptophores in multi-disciplinary clinical settings.

Second, the rise of automated synoptophores brings digital transformation to the ophthalmology space. These devices not only improve diagnostic precision but also streamline workflows for optometrists and ophthalmologists. As we move toward an era of personalized medicine, the role of synoptophores in tracking patient progress post-surgery or during orthoptic therapy is becoming indispensable.

On the flip side, the high cost and limited portability of traditional devices pose significant barriers to widespread adoption, particularly in low- and middle-income countries. Manual synoptophores also suffer from complexity in usage and limited diagnostic versatility, reducing their appeal in fast-paced clinical environments. Addressing these challenges through cost-effective innovation and modular device development could unlock new demand in underserved markets.

Get more details by ordering the complete report

Forecast & Future Trends

Looking ahead, the global synoptophore market is poised for transformational change, driven by three defining trends. First is the increased adoption of AI-integrated diagnostic tools. We anticipate that AI-enabled synoptophores, capable of real-time image analysis and adaptive testing protocols, will become the gold standard for clinical and research applications.

Second, early screening for amblyopia and strabismus is set to gain greater emphasis, especially in school-based vision health programs. The integration of synoptophores into public health initiatives could dramatically improve early detection rates and reduce long-term societal costs associated with visual disabilities.

Third, patient expectations are evolving. The demand for non-invasive, painless, and quick eye assessments is fueling a shift toward user-centric designs and multifunctional devices. As healthcare becomes more outpatient-focused, portable and cloud-connected synoptophores could dominate, supporting tele-optometry models and remote consultations.

We also expect industry leaders to pursue strategic partnerships with educational institutions and research hospitals to refine device usability and demonstrate clinical efficacy. These collaborations will be instrumental in solidifying the position of synoptophores in next-gen ophthalmic care.

Actionable Insights for Stakeholders

For device manufacturers, the key to capturing growth lies in innovation and affordability. Developing low-cost, automated synoptophores with user-friendly interfaces can open access to emerging markets. A tiered pricing strategy, paired with bundled training and support services, can drive adoption in both urban and rural clinics.

For healthcare providers, integrating synoptophore evaluations into routine eye check-ups—especially for pediatric and geriatric populations—can differentiate services and improve patient outcomes. Collaborating with insurers to include synoptophore-based assessments in reimbursement plans could also reduce out-of-pocket costs for patients.

For investors and policymakers, channeling funds toward R&D and subsidized distribution of diagnostic tools in low-resource settings can foster inclusive eye care ecosystems. Supporting awareness campaigns around early visual disorder diagnosis and non-surgical therapy options can stimulate demand and broaden the market base.

For more details about the industry, get the PDF sample report for free

Market Research Overview

The Synoptophore device plays a crucial role in modern strabismus treatment and amblyopia therapy, making it a core component in orthoptic assessment and vision therapy. Designed to evaluate and improve eye alignment and binocular vision, the device is frequently used to perform stereopsis tests and analyze ocular motility. Healthcare professionals rely on fusion exercises and diplopia management techniques facilitated by the Synoptophore to strengthen the eye muscle and improve visual acuity. As an essential ophthalmic device, it is especially useful in Synoptophore training and strabismus diagnosis, particularly during amblyopia screening. Widely considered an advanced orthoptic device, it supports the evaluation of eye coordination, sensory fusion, and motor fusion, contributing to effective therapeutic interventions. The global market demand for the Synoptophore machine is also driven by the rise in strabismus correction cases, particularly in the domain of pediatric ophthalmology, as it accurately identifies eye deviation and strengthens visual perception.

Research Analysis Overview

Research into the Synoptophore Market indicates a growing prevalence of binocular dysfunction, leading to increased reliance on orthoptic training and enhanced accuracy through the Synoptophore test. Technological advancements in tracking eye movement and delivering targeted amblyopia treatment make these devices essential tools in pre- and post-strabismus surgery evaluations. They are increasingly utilized in comprehensive vision assessment programs, helping to establish proper ocular alignment and enabling precise Synoptophore therapy protocols. Innovations in eye tracking and diagnostics are expanding their role in evaluating the visual field, while binocular training is integrated into routine orthoptic exercises for effective strabismus management. Major market players such as Haag-Streit, Appasamy Associates, Inami Synoptophore, and Clement Clarke are investing in high-performance systems for ophthalmic diagnostics, reflecting a competitive landscape focused on precision, usability, and pediatric care.

For more details about the industry, get the PDF sample report for free

Conclusion

As we look toward 2029, the synoptophore market is not merely expanding—it is evolving. Fueled by rising visual acuity disorders, especially among children and neurological patients, and bolstered by technological advancements, synoptophores are becoming essential tools in both diagnostic and therapeutic ophthalmology. While cost remains a hurdle, the push toward automation, early detection, and patient-centered care models will redefine how vision health is delivered across the globe.

Whether you're a clinician aiming to enhance diagnostic precision, a manufacturer looking to disrupt the status quo, or a policymaker focused on equitable healthcare, the message is clear: the future of eye care is converging around innovation—and the synoptophore is at the center of this vision.

Safe and Secure SSL Encrypted