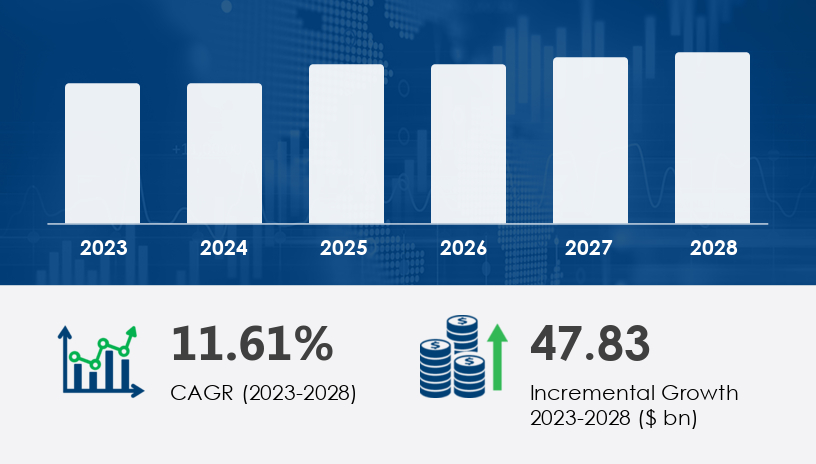

In today’s volatile landscape, surveillance and security equipment have transcended mere deterrents — they are now intelligent, proactive guardians of public and private safety. As we head deeper into 2025, this industry stands at the nexus of technology, policy, and societal need. A compound annual growth rate (CAGR) of 11.61% between 2023 and 2028 reflects both urgency and innovation in this field. This 2025 Outlook and Comprehensive Guide explores market forces, technological advancements, and strategic opportunities for stakeholders navigating this USD 47.83 billion growth trajectory.

For more details about the industry, get the PDF sample report for free

The Surveillance and Security Equipment Market has seen rapid expansion, driven by the increasing global need for CCTV cameras, biometric scanners, and advanced access control systems. These are often integrated with alarm systems and powered by technologies like video analytics and AI surveillance to enhance situational awareness. The shift to cloud-based surveillance has enabled broader scalability and more flexible deployment, particularly with innovations such as drones, IP cameras, and wireless cameras. The adoption of smart cameras equipped with facial recognition and motion detection is becoming standard, while night vision and digital recorders are critical in 24/7 operations. This technology is vital for ensuring public safety and protecting critical infrastructure, with significant implications for fraud prevention, traffic control, and remote monitoring. Devices like high-resolution cameras, smart doorbells, and integrated video management systems support seamless real-time monitoring and object recognition in various settings.

Across commercial, residential, and governmental sectors, the need to preempt threats — from petty crime to cyber-terrorism — is driving massive investment in security infrastructure.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The integration of artificial intelligence in video surveillance is not a trend — it’s a tectonic shift. Traditional CCTV systems are evolving into AI-powered surveillance networks capable of anomaly detection, facial recognition, and behavioral analytics.

AI Benefits Snapshot:

Real-time incident alerts (e.g., unattended baggage, loitering)

Reduced false positives through intelligent motion detection

Enhanced object tracking in crowded environments

24/7 monitoring with minimal human intervention

The commercial segment is the undisputed growth engine of the surveillance and security equipment market.

Mini Case Study: MallGuard Systems — A Retail Security Overhaul

In 2024, MallGuard retrofitted a national chain of shopping malls across the U.S. with AI-enabled cameras and biometric access points. The result? A 28% drop in in-store theft and faster response times to security breaches.

Pros of Commercial Deployment:

Centralized control for multi-location enterprises

Employee and asset protection

Legal compliance in high-risk zones

Cons:

High upfront capital expenditure

Ongoing privacy compliance challenges

Asia-Pacific (APAC) is projected to contribute 48% of global market growth by 2028, driven by smart city development and surveillance mandates in countries like China, India, and Japan.

Strategic Takeaway: Investors and OEMs should prioritize product localization and regulatory alignment to fully capitalize on APAC’s growth potential.

Urbanization is pushing governments to embed surveillance into digital infrastructure. Cities like Singapore and Beijing are deploying IoT-enabled street cameras, drone patrols, and AI surveillance to monitor traffic and public safety.

Biometric access control systems are becoming essential in high-security environments like airports, research labs, and data centers. These systems ensure identity authentication before access is granted.

Privacy: The Double-Edged Sword of Surveillance Expansion

While security is paramount, privacy violations are an undeniable challenge in the expansion of public and private surveillance.

Risks and Challenges:

Overreach in public surveillance may infringe on constitutional rights.

Data misuse from poorly secured surveillance footage can lead to identity theft or stalking.

Public distrust may increase if transparency isn’t prioritized.

Actionable Recommendation: Surveillance providers must implement privacy-first design principles, including encryption, anonymization, and regulatory compliance frameworks like GDPR or CCPA.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Top Market Players Include:

Hangzhou Hikvision Digital Technology

Dahua Technology

Honeywell International

Bosch Security Systems

Johnson Controls

Competitive Strategies Observed:

Partnerships with AI firms

SaaS-based surveillance models

Expansion into emerging markets

Acquisitions to broaden portfolio offerings

Current market analysis highlights a rising emphasis on identifying suspicious activity using advanced technologies such as thermal cameras, enhanced audio equipment, and smart locks. These components are complemented by robust security software that utilizes data encryption and cybersecurity protocols to prevent breaches. Key innovations include license plate recognition, perimeter security, and intrusion detection, which play critical roles in both residential and commercial environments. The deployment of smart sensors for automated alerts and emergency response coordination has also gained traction. Modern surveillance networks now support complex behavior analysis, allowing for predictive monitoring and proactive threat management. The demand for efficient access management, coupled with advanced threat detection capabilities, is driving new trends in security integration, making it a cornerstone for the development of next-generation surveillance ecosystems.

Get more details by ordering the complete report

By 2028, expect:

Fully autonomous surveillance drones in border and traffic monitoring

Edge AI processing to reduce latency and bandwidth usage

Cloud-native VSAAS (Video Surveillance as a Service) gaining mainstream adoption

Ethical surveillance frameworks as a business differentiator

Summary & Strategic Takeaways

The surveillance and security equipment market is entering a hyper-growth phase, driven by AI innovation, urban demand, and global security mandates. However, balancing this growth with privacy, regulatory, and ethical considerations will be key to long-term sustainability.

Invest in AI and edge computing integrations

Prioritize APAC and commercial verticals for expansion

Collaborate with privacy experts for ethical deployment

Monitor regional regulations closely to stay compliant

As surveillance tech becomes smarter, so must our strategy. For businesses, governments, and security providers, the path forward requires not only innovation but responsibility. The next few years will determine whether the industry can meet the demands of a rapidly changing world — safely and ethically.

Safe and Secure SSL Encrypted