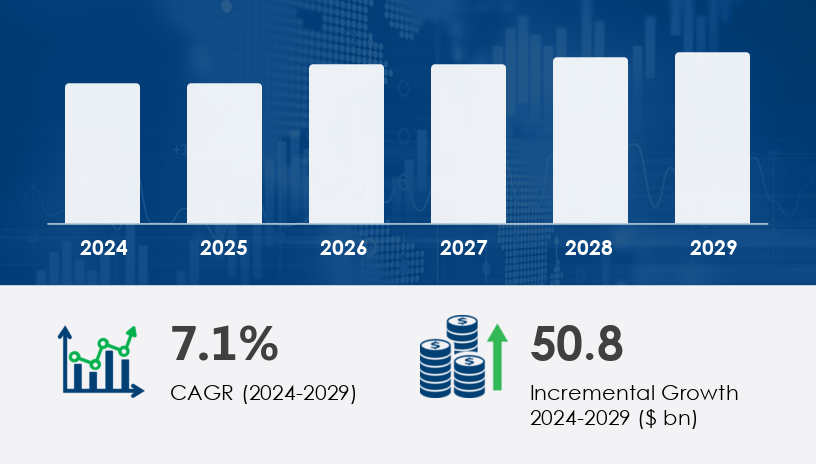

The specialty coffee shops market is entering a new era of expansion, projected to grow by USD 50.8 billion between 2024 and 2029, at a compound annual growth rate (CAGR) of 7.1%. Fueled by increasing consumer demand for high-quality, ethically sourced brews and a surge in artisanal and tech-enabled coffee culture, the sector is transforming how Americans and global consumers engage with their daily caffeine fix.

For more details about the industry, get the PDF sample report for free

At the heart of the market’s momentum is the rising consumption of coffee and coffee pods, particularly in developed nations such as the US, Canada, and Japan, where coffee ranks as the second-most consumed beverage after soft drinks. This consumption is increasingly tied to the experience economy, with consumers prioritizing premium, handcrafted coffee experiences over traditional, mass-produced options.

Another crucial driver is sustainability. Ethical sourcing practices like Fair Trade Coffee and coffee certifications are no longer niche—they are becoming mainstream expectations. The coffee community's commitment to direct trade, transparency, and green roasting techniques is shaping purchasing decisions and brand loyalty.

Emerging coffee trends reflect a growing sophistication among consumers. From cold brew and single-origin coffees to eco-conscious packaging and coffee education workshops, specialty coffee shops are innovating to stay competitive. Advances in espresso machines, pour-over techniques, and coffee shop apps are allowing cafes to elevate both quality and convenience.

Further, coffee shop layouts, barista skills, and third wave coffee philosophies are reshaping how cafes operate—positioning them not just as beverage stops, but cultural hubs for personalized experiences and community engagement.

Despite rapid growth, the industry faces major headwinds—particularly in the form of fluctuating raw coffee bean prices. Climate change, labor costs, and supply chain constraints have made sourcing high-quality beans more expensive and unpredictable. This volatility threatens profit margins, especially for independent specialty shops that rely on premium beans.

To mitigate these impacts, specialty coffee businesses are focusing on supplier relationships, agile pricing models, and diversified offerings such as subscriptions, alternative brews, and coffee shop events that boost customer retention and revenue per visit.

Independent Coffee Shops

This segment is experiencing strong growth, fueled by a preference for unique experiences, coffee shop decor, and local culture. Independent cafes emphasize organic, single-origin, and artisan roasted beans, with an emphasis on customer immersion through coffee education, coffee tasting, and community events. Their adoption of sustainable practices, advanced brewing methods, and direct trade sourcing make them a standout force in the evolving coffee ecosystem.

Chain Coffee Shops

While still significant in scale, chains face growing competition from more nimble independents. However, many are adapting by integrating customization, digital ordering, and localized offerings into their business models.

Offline

The core revenue driver, encompassing brick-and-mortar coffee shops where ambiance, barista interaction, and the physical coffee experience matter most.

Online

A rising distribution channel, bolstered by apps, social media, and delivery platforms. Subscription models, in particular, are redefining how specialty coffee is consumed at home.

18–24 Years

A digitally savvy segment, drawn to personalized brews and Instagram-worthy cafe experiences.

25–39 Years

The dominant consumer group, driving demand for premiumization, sustainability, and tech-enabled convenience.

40–59 Years & Above 60

Gradually increasing participation, particularly for health-focused options like organic coffee and low-acidity brews.

Get more details by ordering the complete report

United States, Canada, Mexico

North America continues to lead specialty coffee innovation. Millennials and Gen Z consumers favor customization and sustainability, while lifestyle factors—such as fast-paced work cultures—further fuel demand. Brands like Starbucks, McDonald's, and Coffee Day are integrating personalization and tech features to stay ahead. Trends such as food bowls, coffee shop delivery, and cold brew innovations are enhancing in-store and off-premise appeal.

France, Germany, The Netherlands, UK

A mature but evolving market where coffee shop layout, design, and organic options play an important role. The European Union's new sustainability regulation (Dec 2025), mandating 50% certified sustainable beans for labeled products, is expected to further drive demand for specialty coffee.

Australia, China, India, Japan, South Korea

Contributing 31% to global growth, APAC’s booming middle class and increasing coffee culture adoption are key factors. Japan and South Korea remain highly receptive to single-origin and artisan brews, while India and China show strong growth in independent cafes and coffee shop education events.

UAE

A niche but rapidly growing market focused on luxury experiences and third wave coffee, with demand for barista training, specialty blends, and sustainable decor on the rise.

Brazil

A coffee-producing powerhouse, Brazil is also seeing growth in local specialty consumption and value-added coffee services.

Includes emerging markets exploring specialty formats via franchise expansions, pop-up shops, and merchandise sales.

The Specialty Coffee Shops Market is thriving, fueled by increasing consumer demand for specialty coffee and premium coffee beans. With a growing preference for organic coffee and single origin selections, customers are prioritizing fair trade practices and ethical sourcing when choosing their coffee. The rise of coffee roasters and an emphasis on artisanal coffee reflect a deeper appreciation for coffee culture, highlighted by elements like latte art and advanced brewing methods. Popular offerings such as espresso drinks, cold brew, and pour over contribute to a diverse coffee menu, supported by high-quality coffee equipment. As consumer expectations evolve, investments in barista training, coffee tasting, and identifying distinct flavor profiles are becoming central. Additionally, coffee certifications and a focus on sustainable coffee practices are shaping purchasing decisions, while events like coffee festivals and coffee competitions are further enriching the overall coffee experience.

For more details about the industry, get the PDF sample report for free

Several companies are shaping the global specialty coffee landscape through innovation, expansion, and acquisitions:

Barista Coffee Co. Ltd.

Blue Bottle Coffee

Brew Berrys Hospitality Pvt Ltd.

Caffe Nero Group Ltd

Caribou Coffee Operating Co. Inc.

Coffee Beanery

Coffee Day Enterprises Ltd.

Costa Ltd.

Doutor Coffee Co. Ltd.

Dunkin' Brands Group Inc.

Ediya Co. Ltd.

Inspire Brands Inc.

Intelligentsia Coffee

La Colombe Torrefaction Inc.

Luckin Coffee Inc.

MTY Food Group Inc.

Peet’s Coffee Inc.

Starbucks Corp.

The Coffee Bean & Tea Leaf

Tim Hortons Inc.

Market research analysis highlights how digital transformation and evolving preferences are reshaping the specialty coffee landscape. The rise of e-commerce coffee platforms and coffee subscriptions is allowing consumers to access specialty drinks beyond traditional cafes. Elements like cafe ambiance, coffee quality, and meticulous bean sourcing contribute to the uniqueness of each shop, as they experiment with rare coffee varieties and offerings like nitro coffee to drive coffee innovation. High standards in barista skills and curated coffee experiences are defining competitive advantage, alongside a refined approach to gourmet coffee and attention to coffee aesthetics. A strong coffee community supported by local roasters and deep coffee expertise is promoting continued growth. Focus on coffee education, curated coffee pairings, unique specialty roasts, and traditional coffee craftsmanship ensures customer engagement and brand loyalty in an increasingly discerning market.

Get more details by ordering the complete report

February 2024: Starbucks unveiled its “Starbucks Reserve” line, focusing on single-origin beans and artisan brewing techniques, emphasizing their commitment to high-end, specialty offerings.

June 2025: Nestle partnered with Blue Bottle Coffee to expand its Nespresso business into the U.S. premium coffee segment, signaling a pivot toward artisanal offerings.

August 2024: JAB Holding Company acquired Peet’s Coffee & Tea for approximately USD 1 billion, significantly expanding its specialty coffee footprint.

December 2025: The EU passed regulations requiring that at least 50% of coffee labeled “sustainable” meet certified conditions—boosting specialty producers already aligned with such standards.

Safe and Secure SSL Encrypted