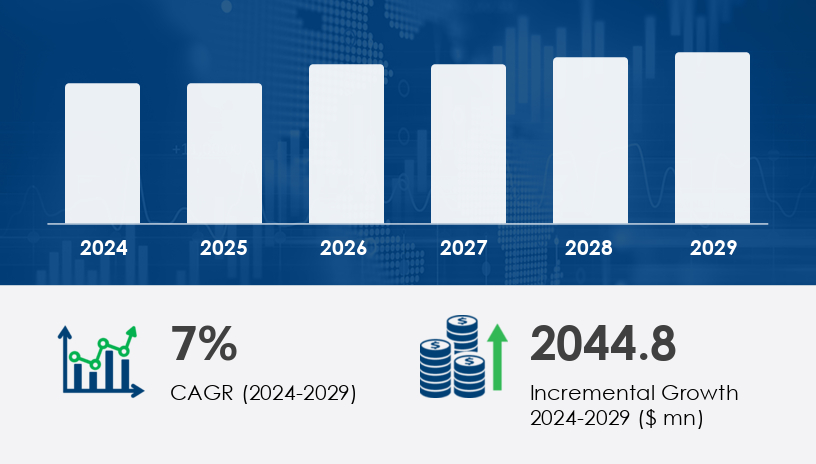

The Vietnam semiconductors market is poised to grow by USD 2.04 billion between 2025 and 2029, expanding at a CAGR of 7%, cementing Vietnam’s emergence as Southeast Asia’s next semiconductor powerhouse. This 2025 outlook offers a comprehensive guide for stakeholders eyeing opportunities in this dynamic, high-growth ecosystem.

Amid escalating geopolitical shifts and supply chain realignments, Vietnam has surfaced as a viable and strategic alternative to traditional semiconductor hubs. The country's favorable policy environment, competitive labor costs, and increasing domestic demand for consumer electronics have set the stage for exponential industry growth.

For more details about the industry, get the PDF sample report for free

The Vietnam semiconductors market is witnessing strong growth, driven by increasing global demand for semiconductor chips, particularly in sectors like 5G networks, IoT devices, and wearable electronics. The country is enhancing its production capabilities across segments such as integrated circuits, microprocessors, memory chips, analog semiconductors, and logic circuits, all of which are fundamental to modern microelectronics. Demand for applications like automotive chips, AI processors, and cloud computing infrastructure is pushing innovation in power management and chip design. Vietnam is also investing in advanced wafer processing and 3D packaging technologies to meet the evolving needs of data centers, quantum computing, and flexible electronics, placing itself as a strategic player in the regional and global semiconductor supply chain.

Vietnam’s semiconductor industry is transitioning from manufacturing to innovation.

Emerging technologies such as AI, IoT, and smart consumer devices are key catalysts.

Foreign direct investment (FDI) and regional partnerships will define market leadership.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Vietnam’s government has strategically positioned semiconductors as a national priority. Incentives include tax holidays, land use benefits, and R&D subsidies aimed at attracting global giants like Intel, Samsung, and MediaTek.

The consumer electronics segment, valued at USD 2.56 billion in 2019, is expected to grow significantly as Vietnam becomes a central hub for smart device production — from wearables to gaming circuits.

Although talent remains a bottleneck, Vietnam is investing in STEM education and research partnerships to bridge this gap. High-tech zones in Ho Chi Minh City and Hanoi are home to R&D facilities where engineers focus on next-gen semiconductor solutions.

| Pros | Cons |

|---|---|

| Cost-effective labor and infrastructure | Skills shortage in advanced semiconductor design |

| Strong government support and foreign investment incentives | IP protection concerns remain a hurdle |

| Expanding domestic and regional demand for IoT/AI technologies | Volatile inventory cycles impacting pricing and profitability |

| Strategic location for APAC distribution | Infrastructure requires further upgrades for cutting-edge production |

The semiconductors market in Vietnam is segmented according to application, end-user, device, and material.

Consumer Electronics: Dominates due to Vietnam's growing middle class and booming smart device demand.

Communications: Fueled by the rise of low-cost mobile devices and widespread 4G/5G adoption.

Automotive and Medical Devices: Emerging as high-potential verticals.

Power Management ICs (PMICs)

Microchips for smart wearables and factory automation

RFID technologies for logistics and inventory control

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Vietnam is among the fastest-growing markets for smartphones, with over 61.3 million users. This growing user base is driving innovation in energy-efficient processors, eco-friendly components, and secure connectivity modules.

With the adoption of 3D packaging and application-specific integrated circuits (ASICs), Vietnam is aligning with global manufacturing trends to support smart homes, digital health monitors, and cloud-sync processors.

Inventory overflows in DRAM and NAND markets have led to reduced pricing power. In Q2 2022, inventory cycles rose to 121 days, signaling a need for smarter demand forecasting.

While Vietnam is improving its legal framework, concerns over IP security persist, especially for firms engaged in proprietary chip design.

Analytical insights reveal Vietnam’s increasing focus on building capabilities in chip manufacturing through state-of-the-art fabrication equipment, including photolithography, etching systems, and deposition equipment. The availability and development of high-quality semiconductor materials like silicon wafers, gallium arsenide, and compound semiconductors are also enhancing production efficiency. With the rise of OLED displays, sensor chips, and RF components, local companies are scaling up chip testing, assembly services, and custom packaging solutions. To ensure long-term reliability, advanced thermal management systems and precision circuit boards are being integrated. Support for nanotechnology and the development of semiconductor lasers further reflect Vietnam’s ambition to expand its footprint in the global semiconductor ecosystem.

Get more details by ordering the complete report

Invest in Local Partnerships: Collaborating with Vietnamese firms can ease regulatory navigation and improve cultural alignment.

Adopt Agile Inventory Management: AI-driven supply chain platforms can minimize losses from demand fluctuations.

Focus on Differentiation: Develop specialized chips for verticals like smart health and digital payments.

Engage in Government Dialogues: Be part of industry groups shaping Vietnam’s IP and trade policies.

As the global semiconductor demand diversifies and decouples from traditional suppliers, Vietnam offers a strategic alternative rooted in scalability, affordability, and innovation. If current trends continue, Vietnam may secure its place as Asia Pacific’s leading chip packaging and smart IC innovation hub.

Vietnam's semiconductor industry stands at a pivotal juncture. The country offers an appealing mix of policy support, market demand, and cost advantages. However, players must navigate regulatory nuances, IP issues, and workforce constraints to fully unlock value.

Safe and Secure SSL Encrypted