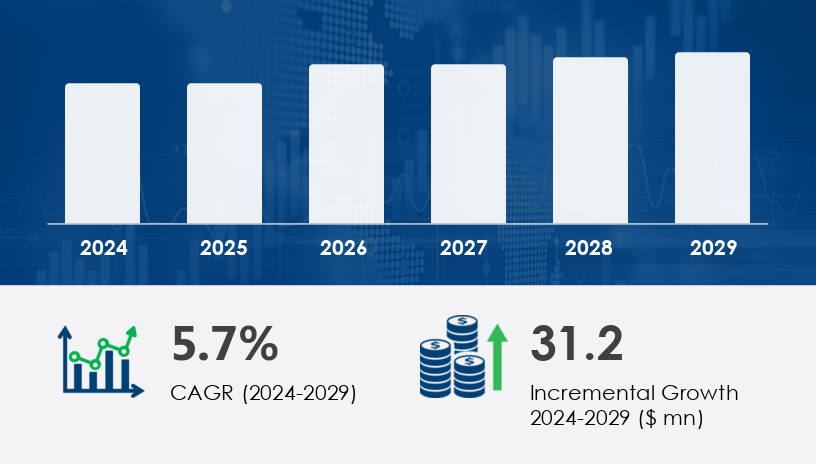

The self-storage software market is projected to grow by USD 31.2 million from 2024 to 2028, at a CAGR of 5.76%. The increasing demand for contactless and technology-driven storage solutions is driving the market forward. Self-storage operators and owners are rapidly adopting digital payment systems, AI-powered chatbots, and IoT integration to enhance operational efficiency and customer convenience. Cloud-based self-storage software is gaining traction, allowing businesses to optimize facility management, automate administrative tasks, and provide real-time monitoring of amenities. However, the industry faces challenges related to cybersecurity and compliance, with financial fraud and data protection being critical concerns. Businesses are addressing these risks by implementing robust cybersecurity measures and adhering to regulatory guidelines. The growing consumer awareness about the benefits of self-storage solutions is fueling market expansion, especially in urban and suburban areas where space optimization is a priority.For more details about the industry, get the PDF sample report for free

By Deployment, the market is segmented into:

Cloud-based

On-premises

The cloud-based segment is expected to witness significant growth during the forecast period. These solutions allow operators to manage multiple sites remotely, access real-time inventory data, process payments, and offer insurance management services. Cloud-based deployments eliminate the need for expensive infrastructure and maintenance, offering scalable services that cater to both small and medium enterprises (SMEs) and large enterprises.

By End-user, the market caters to:

Large enterprises

Small and medium enterprises (SMEs)

By Application, self-storage software is applied in:

Unit management

Tenant management

Access and security monitoring

Billing and invoicing

Reporting and analytics

Cloud software platforms now integrate with digital payments, video streaming services, smart home devices, and AI-powered chatbots, enabling customer support through multiple touchpoints like phone, email, and online chat. The result is a streamlined, secure, and efficient self-storage experience, both for operators and end-users.

US

Canada

North America is forecast to contribute 70% of the market’s total growth between 2025 and 2029. In the US and Canada, automation is a key driver, particularly in access control, facility management, and inventory tracking. The proliferation of e-commerce and growth across various business sectors have amplified the need for dynamic storage solutions. Additionally, cloud computing enables remote work capabilities for facility operators, allowing them to manage customer interactions, monitor security, and conduct analytics from virtually any location. Personalized offerings, smart security features, and integrated IoT devices such as smart locks and cameras ensure both operational efficiency and a positive customer experience.

France

Germany

Italy

UK

Australia

China

India

Japan

While North America dominates the market in terms of revenue and technological maturity, emerging regions like Asia-Pacific and Europe are quickly catching up due to increasing urbanization and business digitization trends.

Get more details by ordering the complete report

The Self-Storage Software Market is evolving rapidly as facility operators increasingly adopt digital solutions to streamline facility management and enhance tenant experiences. Core functionalities such as tenant tracking, payment processing, and online booking are becoming indispensable for efficient unit management and access control. Modern software platforms integrate billing automation, customer portals, and mobile apps to offer seamless, user-friendly interfaces for both operators and customers. Cloud-based solutions provide scalable cloud storage, real-time inventory tracking, and comprehensive lease management, enabling operators to optimize resource utilization. Enhanced security integration and reporting dashboards allow facility managers to monitor operations effectively, while CRM integration helps maintain strong tenant relationships. Features such as gate access controls, reservation systems, and digital contracts are transforming the way self-storage facilities operate, making them more secure and customer-centric.

The primary market driver is the increasing awareness and adoption of self-storage solutions among consumers. As urban populations grow and living spaces shrink, consumers are turning to self-storage to manage their belongings during life transitions. This has led to heightened demand for self-storage software, which streamlines key operations such as reservations, billing, and inventory control. These efficiencies contribute to enhanced customer loyalty and retention.

Additionally, the industry’s transition toward technology-driven operations is accelerating software adoption. From AI chatbots that handle customer queries to platforms that provide real-time analytics, self-storage facilities are becoming increasingly intelligent and automated.

A dominant trend in this market is the integration of IoT and automation within self-storage software platforms. Features like smart locks, security cameras, access control systems, and automated billing significantly enhance operational workflows and security. These technologies reduce manual errors, optimize resource allocation, and improve customer satisfaction through real-time updates and self-service options.

Moreover, the shift to cloud computing is transforming the market landscape. Operators can now offer personalized technology solutions while minimizing infrastructure costs. The use of cloud services also supports remote working, a key need in today’s flexible business environments.

Security remains a critical concern. The digitization of data exposes operators to cybersecurity risks, including unauthorized access and financial fraud. Given the volume of sensitive customer information—from personal identification to payment details—software providers must prioritize data encryption, multi-factor authentication, and continuous monitoring.

Another major challenge is regulatory compliance. Laws such as GDPR in Europe and HIPAA in the US require providers to implement stringent data protection measures. Failure to comply could result in legal penalties and reputational damage. As such, navigating the complex regulatory landscape is essential for any provider aiming to scale in this market.

Get more details by ordering the complete report

Key market trends include the rise of revenue management tools and task automation capabilities that reduce manual workload and increase profitability. Advanced user permissions and data analytics empower operators with actionable insights and improved facility mapping. Automated customer notifications, online payments, and document storage simplify communication and administrative processes. The integration of lead management and rate optimization features supports business growth and competitive pricing strategies. Scalability through multi-location management and API integration allows operators to manage expansive networks efficiently. Additional offerings like tenant insurance, mobile access, and workflow automation cater to evolving customer demands. Real-time visibility via real-time reporting and robust customer support improve operational transparency. Features such as occupancy tracking, storage calculators, and website integration enhance both marketing and operational efficiency. Automated tools including automated invoicing, lock checks, and maintenance tracking ensure smooth facility upkeep. Customization through custom branding, intuitive user dashboards, and timely payment reminders further personalize tenant interactions. Overall, comprehensive facility security, contract management, customer reviews, and streamlined move-in processes with optimized space allocation reinforce the growing adoption of self-storage software solutions.

Several major players are shaping the competitive landscape of the self-storage software market. These companies are pursuing strategic partnerships, product launches, and geographic expansion to gain a competitive edge. The key players include:

6Storage – Offers self-storage software that automates rentals and third-party integrations.

DoorLoop Inc.

Fullsteam Operations LLC

Global ESoftSys

Global Payments Inc.

IDprop

Kinnovis GmbH

OpenTech Alliance Inc.

QuikStor Security and Software

RADical Systems UK Ltd.

Sentinel Systems LLC

Smallenberger Inc.

Stora

Storable Inc.

StoragePug LLC

Storeganise Ltd.

Syrasoft Software LLC

Tenant Inc.

TRACKUM Software

TSS Software Inc.

Yardi Systems Inc.

These companies are categorized using both qualitative (focus areas) and quantitative (market strength) criteria, helping B2B stakeholders evaluate vendor capabilities in areas such as AI integration, customer support, data security, and multi-site scalability.

In recent developments as of June 2024, providers have enhanced their platforms to include insurance management, automated access control, and smart device compatibility, creating a seamless ecosystem for facility operators and tenants alike.

With advanced software solutions addressing both operational needs and customer expectations, the self-storage software market is strategically positioned for sustained growth through 2029.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted