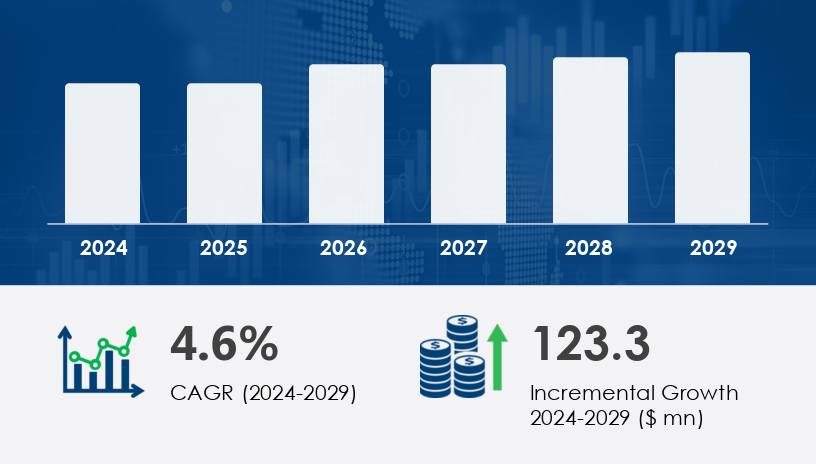

As the global economy accelerates toward a future driven by sustainability and bio-based innovation, few compounds reflect this transformation more acutely than ricinoleic acid. Derived from castor oil, this industrial-grade fatty acid is emerging as a critical enabler across multiple sectors—from lubricants and surfactants to cosmetics and pharmaceuticals. According to recent market projections, the ricinoleic acid market is set to expand by USD 123.3 million between 2024 and 2029, registering a healthy compound annual growth rate (CAGR) of 4.6%. In this thought-leadership deep dive, we explore the opportunities, challenges, and strategic levers shaping the ricinoleic acid market through 2029.

For more details about the industry, get the PDF sample report for free

The growing traction of ricinoleic acid is largely anchored in its versatility. With powerful properties such as high viscosity, antibacterial action, thermal stability, and its ability to act as a natural emulsifier, ricinoleic acid has carved out significant roles in industries as varied as coatings, adhesives, lubricants, cosmetics, and even pharmaceuticals. A strong global pivot toward bio-based chemicals is fueling demand, especially as manufacturers and formulators seek alternatives to petroleum-derived substances. This is particularly evident in the rise of organic personal care products and specialty chemical formulations, which now heavily rely on this fatty acid.

Within the cosmetics and personal care sector, ricinoleic acid is essential for products like moisturizing lotions, anti-acne creams, and shampoos. Its antibacterial properties and soothing nature cater directly to consumer preferences for clean-label and skin-friendly ingredients. Meanwhile, in the industrial domain, it supports the production of hydroxystearic acid, methyl ricinolates, sebacic acid, and synthetic esters—foundational elements for surfactants, lubricants, and coatings.

From a segmentation perspective, the lubricants and grease segment stands out as a key driver of market growth. In 2019, this segment was valued at USD 157 million and has shown consistent upward momentum. Ricinoleic acid is increasingly favored in the formulation of bio-lubricants used in automotive, aerospace, marine, and metalworking industries, where reducing environmental impact is becoming a core operational imperative. These lubricants not only enhance machinery performance but also align with evolving regulations on sustainability and emissions.

The surfactants and cosmetics segments are also expanding rapidly. In surfactant production, ricinoleic acid’s emulsifying and wetting properties improve performance in detergents and printing inks. Meanwhile, the cosmetics industry leverages it for natural skin conditioning and antibacterial effects—addressing rising concerns over synthetic irritants.

Get more details by ordering the complete report

Asia-Pacific (APAC) is projected to account for 50% of the global market’s growth through 2029, making it the dominant region for ricinoleic acid demand. The booming personal care and pharmaceutical sectors in countries like India, China, and South Korea are critical growth engines. Notably, India plays a dual role: as both a major producer of castor seeds and a rapidly growing end-user market. The rising middle class in these countries is fueling demand for high-quality, natural-based products in personal care and healthcare.

North America follows closely, buoyed by robust demand in the specialty chemical and cosmetic industries. Ricinoleic acid’s role in pharmaceutical formulations—particularly as a natural laxative and anti-inflammatory agent—is helping the compound gain traction amid increased healthcare spending and an aging population. In Europe, sustainability mandates are catalyzing adoption in coatings and adhesives, while manufacturers are integrating ricinoleic acid into bio-based industrial products to meet regulatory standards.

What makes the ricinoleic acid market particularly compelling is its alignment with major macroeconomic and environmental trends. The global chemical industry’s pivot to green chemistry creates enormous opportunity for manufacturers able to scale sustainable production. Furthermore, R&D efforts focused on expanding ricinoleic acid applications—especially in biodegradable polymers, pharmaceutical actives, and agrochemicals—could unlock new growth frontiers.

Yet, the market is not without its friction points. Chief among them is the volatility of castor seed prices, the primary raw material for ricinoleic acid. Adverse climatic events such as droughts and floods in key castor-producing regions, particularly Gujarat, India, have strained yields and increased costs. This has introduced risk into the supply chain and hampered cost predictability. For instance, unorganized farming structures and unpredictable weather have disrupted the consistency of castor seed quality and availability.

To mitigate these risks, leading players are exploring alternative sourcing models, investing in synthetic esterification techniques, and engaging directly with seed producers to improve agricultural productivity. Enhancing crop resilience through better seed varieties and weather-adaptive practices could also help stabilize input costs and ensure supply continuity.

For more details about the industry, get the PDF sample report for free

Looking forward, the ricinoleic acid market is poised to become a cornerstone of the global bio-based economy. Capacity expansions are already underway in regions such as APAC and North America, with manufacturers ramping up production to meet escalating demand. Strategic alliances, geographic expansion, and technological innovation are set to become the dominant themes of the industry from 2025 through 2029.

Companies like Acme Synthetic Chemicals and Fisher Scientific are setting the pace through product development and strategic partnerships. These players are also focusing on optimal-grade formulations tailored for niche applications, ensuring superior performance and customer satisfaction across sectors.

The ricinoleic acid market is propelled by its diverse applications across bio-based lubricants, personal care products, and pharmaceutical applications. Extracted primarily through castor oil extraction from castor seeds, ricinoleic acid is valued for its high viscosity, thermal stability, and oxidative stability, making it an optimal grade ingredient for industrial-grade and high-performance lubricants. Its emollient qualities, combined with moisturizing, anti-inflammatory properties, and antimicrobial properties, make it highly sought after in cosmetic formulations such as skin creams, natural lotions, hair conditioners, lip balms, and other skincare products. Additionally, ricinoleic acid’s role in surfactant production, textile finishing, and leather treatment underlines its versatility. The increasing focus on green chemistry and eco-friendly materials drives demand for sustainable chemicals and biodegradable polymers, positioning ricinoleic acid as a key player in the development of bio-based polyurethanes and eco-friendly coatings

Diversify Raw Material Sources: Given the dependency on castor seeds, companies should invest in synthetic production technologies and explore alternative feedstocks to reduce vulnerability to climate-related supply shocks.

Prioritize R&D for Application Expansion: Innovating new applications, particularly in biodegradable plastics, medical devices, and high-performance lubricants, will help companies tap into adjacent high-growth markets.

Strengthen Supply Chain Resilience: Collaborating with castor seed farmers, investing in agricultural R&D, and establishing long-term sourcing contracts can help smoothen supply and reduce cost volatility.

Capitalize on Sustainability Positioning: With increasing regulatory and consumer pressure for environmentally safe products, companies should actively market ricinoleic acid’s bio-based credentials to enhance brand equity.

Target High-Growth Regions: APAC and North America offer robust demand growth, making them priority geographies for capacity expansion, localized production, and market penetration strategies.

For more details about the industry, get the PDF sample report for free

In the industrial domain, ricinoleic acid is pivotal in grease production, lubricant formulations, and metalworking fluids, where corrosion prevention and thermal stability are essential. Its chemical derivatives such as sebacic acid, undecylenic acid, methyl ricinoleate, and hydroxystearic acid expand its utility in chemical derivatives synthesis, estolide synthesis, and bio-based plastics. The compound also acts as an effective drug carrier in pharmaceutical formulations, supporting natural ingredients based therapies. With rising demand for eco-friendly coatings and sustainable chemicals, ricinoleic acid's use in printing inks and other specialized industrial applications is growing steadily. The market's focus on optimal grade and high-performance lubricants further fuels research and innovation, reinforcing ricinoleic acid’s position as an indispensable bio-based raw material in both consumer and industrial sectors.

In a world increasingly defined by environmental stewardship and resource optimization, ricinoleic acid is more than just a niche specialty chemical—it’s a bellwether for the broader green chemistry revolution. With a forecasted growth of USD 123.3 million by 2029, this market offers both compelling commercial opportunities and meaningful contributions to sustainable industrial transformation. For forward-looking companies, now is the time to secure a leadership position in the ricinoleic acid value chain by embracing innovation, fostering resilient supply chains, and delivering eco-conscious solutions that meet the demands of tomorrow’s market.

Safe and Secure SSL Encrypted