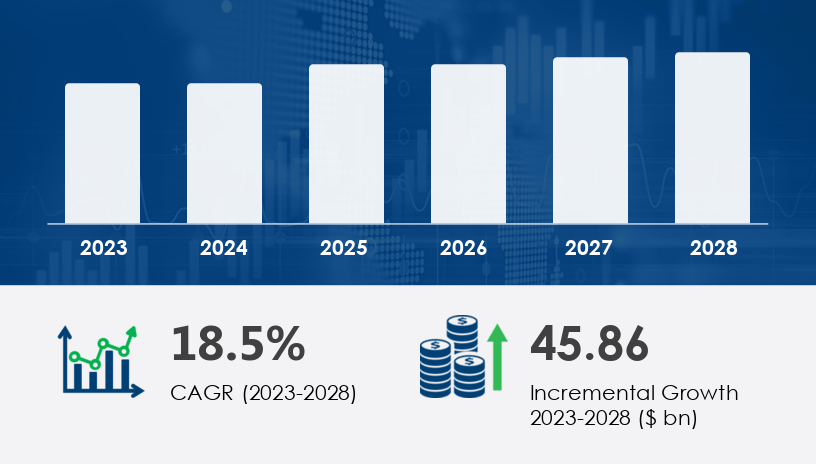

The retail colocation market is projected to expand by USD 45.86 billion at a CAGR of 18.5% between 2023 and 2028, driven by the growing demand for cost-effective, scalable, and secure data center solutions. This comprehensive guide delves into the key market segments—by end-user, industry application, and geography—providing strategic insights to help stakeholders navigate this dynamic landscape.

For more details about the industry, get the PDF sample report for free

Retail colocation services enable businesses to lease computing resources in third-party data centers, sharing facilities with other tenants while maintaining control over their IT infrastructure. This model offers several advantages over building and maintaining in-house data centers, including reduced capital expenditures, enhanced security, and improved connectivity. The increasing adoption of cloud services, the proliferation of the Internet of Things (IoT), and the growing demand for energy-efficient, high-density processing and green data center solutions are key trends shaping the market.

Growth Drivers & Challenges

SMEs are increasingly adopting retail colocation to reduce capital expenditures and gain access to advanced technologies such as cloud services and IoT. However, challenges include limited IT expertise and budget constraints.

Expert Quote

“Retail colocation offers SMEs a cost-effective way to scale their IT infrastructure without the need for significant upfront investment.” – Analyst at Technavio

Mini Case Study

A Canadian e-commerce startup leveraged retail colocation to host its IT infrastructure, enabling rapid scalability during peak shopping seasons without compromising on performance or security.

Key Facts

The SMEs segment was valued at USD 9.44 billion in 2018 and is expected to show significant growth during the forecast period.

North America is estimated to contribute 32% to the growth of the global market during the forecast period.

For key industry insights and forecasts, get the PDF sample report for free

Growth Drivers & Challenges

Large enterprises seek retail colocation for enhanced security, compliance with industry regulations, and global interconnection capabilities. Challenges include integration complexity and potential vendor lock-in.

Expert Quote

“For large enterprises, retail colocation provides a flexible and secure environment that supports global operations and compliance requirements.” – senior Technavio analyst

Mini Case Study

A U.S.-based financial institution adopted retail colocation to meet stringent data security regulations while expanding its global presence.

Growth Drivers & Challenges

The IT and telecom sector's high data processing needs and the rapid adoption of cloud services drive the demand for retail colocation. Data privacy concerns and regulatory hurdles pose challenges.

Expert Quote

“Retail colocation is essential for IT and telecom companies to manage the increasing volume of data and ensure compliance with data protection regulations.” – Analyst at Technavio

Mini Case Study

A leading telecommunications provider utilized retail colocation to enhance its network infrastructure, improving service delivery and customer satisfaction.

Key Facts

Retail colocation services offer global interconnection and advanced cooling solutions, ensuring optimal performance and reliability for business applications and IT infrastructure.

The adoption of cloud technologies, 5G technology, and high-capacity networks is driving the growth of colocation data centers.

Unlock detailed market trends by ordering the complete report

Growth Drivers & Challenges

The healthcare industry's need for secure data storage and compliance with health regulations fuels the demand for retail colocation. Challenges include legacy systems and high operational costs.

Expert Quote

“Retail colocation enables healthcare providers to securely store patient data and comply with stringent regulations while focusing on core healthcare services.” – senior Technavio analyst

Mini Case Study

A Canadian hospital network adopted retail colocation to host its electronic health records system, ensuring data security and compliance with health regulations.

Key Facts

Retail colocation data centers offer reliable technologies, including redundant power supplies, cooling solutions, and intelligent power management.

Security, uptime service-level agreements (SLAs), and global interconnection are essential considerations for businesses when choosing a colocation provider.

The Retail Colocation Market is witnessing robust growth fueled by increasing demand for colocation facilities that offer enhanced managed hosting and software-defined data centers. These facilities provide scalable colocation cabinets and colocation cages tailored to the needs of SME data centers, ensuring efficient resource utilization and IT infrastructure management. With the rise of cloud-based resources and hybrid cloud solutions, connectivity solutions such as high-speed connectivity and connectivity networks have become critical to support seamless data migration and data storage. Operators are investing in energy efficiency and redundant configurations to enhance data center reliability, while robust security measures are implemented to safeguard against evolving threats. The integration of legacy applications with modern cloud services further underscores the market’s emphasis on maintaining data center operations that prioritize data center flexibility and scalability.

Dive deeper into the industry outlook, get the PDF sample report for free

Opportunities

Emerging Markets: Expanding into regions with growing digital infrastructure needs, such as South America and parts of Asia-Pacific.

Technological Advancements: Leveraging advancements in edge computing and 5G technology to offer enhanced services.

Sustainability Initiatives: Implementing energy-efficient solutions to meet environmental goals and reduce operational costs.

Risks/Challenges

Intense Competition: The presence of numerous global and regional players intensifies competition.

Regulatory Compliance: Navigating complex data protection laws and regulations across different regions.

Technological Obsolescence: The rapid pace of technological advancements requires continuous investment in infrastructure upgrades.

Detailed analysis reveals that retail colocation providers are focusing on advanced network equipment and computing servers to improve data center productivity and overall infrastructure upgrades. Emphasis on operational services and infrastructure costs optimization is crucial for maintaining wholesale colocation and hosting services competitiveness. The market also benefits from increased network reliability and data center connectivity, crucial for online presence and e-trade platforms that demand uninterrupted service. Collaboration with system integrators enhances IT operations and supports seamless integration with cloud infrastructure. Additionally, features such as data center security and data center redundancy reinforce the resilience and reliability of these facilities, making retail colocation a strategic solution for businesses seeking robust and scalable data center solutions.

Safe and Secure SSL Encrypted