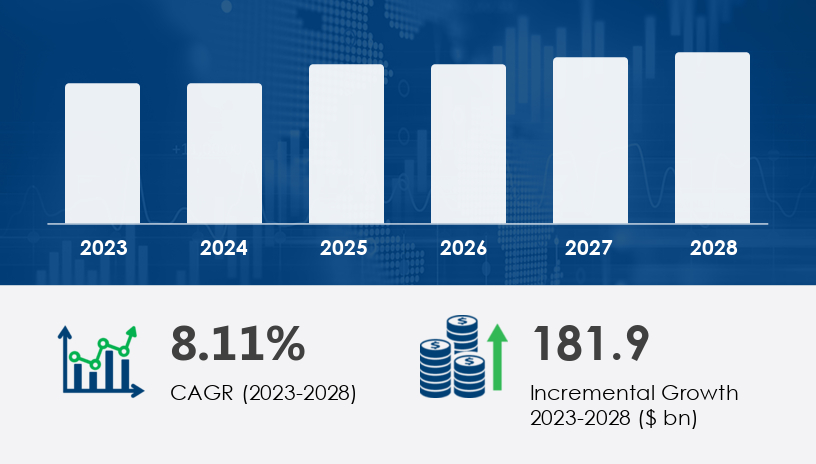

"Renewables are no longer the alternative—they are the foundation of global energy strategy." That’s how one industry panelist framed the pivot during a recent energy transition roundtable. And the numbers back this up: the renewable energy investment market is forecast to grow by USD 181.9 billion between 2024 and 2028, powered by a steady CAGR of 8.11%. As decarbonization targets tighten and fossil fuel volatility lingers, the renewable energy sector is no longer reacting to change—it is leading it. What was once a niche of environmental idealism is now a battleground for infrastructure supremacy, fueled by smart policies, technological breakthroughs, and evolving capital flows.

For more details about the industry, get the PDF sample report for free

2019–2023: Foothold in Uncertainty

From 2019 to 2023, renewable energy investments matured from early government-backed incentives to more commercial-scale funding. Utility-scale solar and wind technologies began outperforming expectations in both efficiency and return on capital. Asset finance grew steadily, valued at USD 230.30 billion in 2018, and laid the groundwork for long-term scaling.

2024–2028: Acceleration Phase

Between now and 2028, the market will enter an acceleration phase marked by regulatory breakthroughs, cross-border funding alliances, and the mainstreaming of distributed systems. With APAC contributing 67% of total market growth, especially in China and Japan, and regions like the US and EU pushing offshore wind and grid resilience, we’re seeing a coordinated global effort—rooted in economics, not just ethics.

Legacy Disruption: High upfront costs and uncertain returns once limited growth in asset finance.

New Strategy Emerging: Modern financing tools, like tax-credit transfer markets and green bonds, are easing liquidity constraints.

“Businesses seek energy affordability amid crisis-era economics, and financing models are finally catching up,” notes a senior energy analyst.

Case in Action: Clean Energy Finance Corporation has enabled decentralized commercial and farm-level projects through innovative financing schemes, unlocking growth in hard-to-penetrate segments.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Legacy Disruption: Residential and small-scale setups suffered from fragmented policy support and limited grid access.

New Strategy Emerging: Smart grid integration and local clean energy mandates are building momentum.

Expert Insight: Analysts suggest distributed systems will thrive where regional energy security overlaps with community-driven carbon reduction efforts.

Case in Action: In Germany, small-scale solar installations surged post-2022 as local tax breaks and energy resilience mandates kicked in, driving up deployment by over 30% in affected regions.

Legacy Disruption: Investment was lopsided, driven primarily by North America and Europe.

New Strategy Emerging: APAC’s rise, with China and Japan leading, signals a shift toward more diversified geographic investment.

Expert Insight: With 67% of global growth sourced from APAC, the region’s role has evolved from cost-competitive manufacturing to innovation-led deployment.

Case in Action: China’s rollout of smart grid systems to integrate offshore wind is a hallmark of the shift from volume to value-driven growth.

Tax incentives like Canada’s Investment Tax Credit (ITC) and the U.S.’s renewable portfolio standards are increasingly shaping the playing field.

Innovators like AZORA CAPITAL SL are combining analytics, AI, and decentralized storage to redefine investment criteria—making operational efficiency a primary differentiator.

Energy volatility and intermittency are no longer tolerated risks. Firms leading in energy storage integration and grid resiliency—such as Nebras Power—are positioning themselves as indispensable players.

The Renewable Energy Investment Market is witnessing robust growth, driven by the global commitment to clean energy and decarbonization. Key areas of investment include solar PV, wind turbines, and biofuel production, supported by financial mechanisms like tax credits, green bonds, and renewable subsidies that de-risk projects and incentivize growth. Increasing deployment of utility-scale solar, offshore wind, and advanced solar inverters is backed by expanding battery storage capabilities to enhance grid resilience. Investors are also leveraging carbon credits and carbon offsets as part of sustainability strategies. The development of efficient wind blades, comprehensive energy storage solutions, and deployment of smart grids further strengthen the market. Technologies such as solar panels, power optimizers, and solar farms contribute significantly to energy efficiency and carbon reduction efforts, accelerating the shift toward renewable energy and environmentally responsible portfolios.

AI-Driven Optimization for Microgrids: As generative AI enters energy planning, predictive models could cut downtime and optimize output per kilowatt.

Biofuel Resurgence for Transport Sectors: With rising EV infrastructure costs, biofuels may stage a comeback—particularly for aviation and shipping.

Hydrogen Deployment at Scale: Policy and capital are converging to make hydrogen a feasible alternative by 2028, particularly in industrial zones.

Innovator in Action: Mitsubishi UFJ Financial Group is backing integrated hydrogen pilot projects, combining finance and infrastructure execution.

If hydrogen, AI, and storage redefine what’s possible—who controls tomorrow’s grid?

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Accelerate Distributed Strategy: Tap into demand for small-scale clean energy projects through co-financing and community models.

Own the Grid Conversation: Lead investments in grid resilience planning and distributed smart infrastructure.

Leverage Clean Policy Capital: Build internal capacity to navigate tax-credit transfer markets and unlock capital pools.

Integrate Storage and AI: Use AI-powered grid optimization and scalable battery tech to tackle intermittency challenges.

Reskill Workforce Proactively: Create training programs for solar PV installation and offshore wind maintenance to avoid labor bottlenecks.

Track Carbon Metrics in Real Time: Use platforms for AI-driven carbon tracking in commercial projects to meet both compliance and investor standards.

In-depth analysis of renewable energy investments highlights evolving strategies centered on grid modernization, energy arbitrage, and large-scale deployment of infrastructure such as wind farms and solar trackers. Support for the energy transition and global drive toward net-zero emissions have also intensified focus on next-generation clean sources like hydrogen fuel, geothermal energy, and tidal energy, alongside more established options like biomass boilers. Decision-making is increasingly data-driven, with tools like energy analytics, smart meters, and charge controllers informing efficient operations and investment planning. Technologies such as solar batteries, wind generators, and clean technologies are being adopted to reinforce energy financing strategies and reduce dependency on fossil fuels. Models like power purchase agreements and smart grid integration improve the scalability and bankability of projects. Ultimately, emphasis on energy resilience, carbon reduction, and energy optimization is shaping a future-proof investment environment focused on long-term sustainability.

The renewable energy investment market is not just growing—it’s transforming. It’s moving from subsidy-driven momentum to commercially viable, scalable infrastructure. Policy has aligned with profitability. Technology has closed the efficiency gap. And global crises have made energy affordability non-negotiable.

Still, the question remains: Are we framing this as just energy evolution—or are we architecting a new economy?

Access our Full 2024–2028 Playbook to lead your market transformation.

Safe and Secure SSL Encrypted