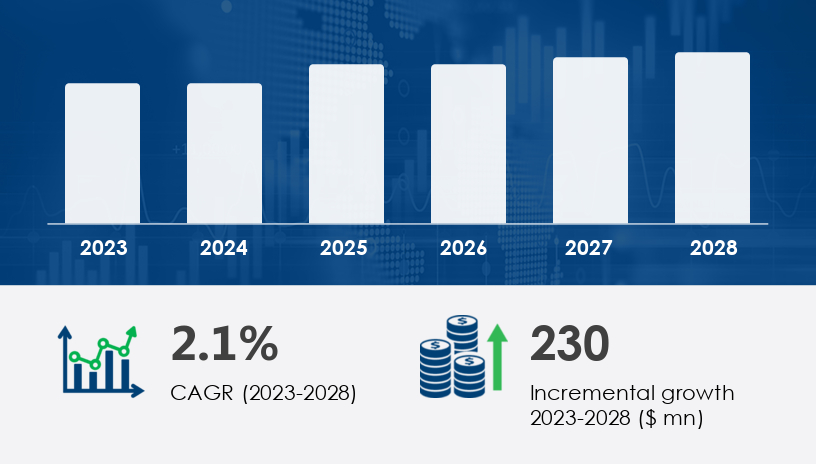

The railway couplers market is poised for substantial growth, with a forecasted increase of USD 230 million at a CAGR of 2.1% from 2023 to 2028. This rise in demand is primarily driven by investments in global railway infrastructure projects and the growing adoption of advanced coupling technologies such as virtual coupling and automated systems. The 2025 outlook suggests that this market will continue to evolve as innovations meet the demands of expanding rail networks and the increasing need for sustainable, efficient transportation.

For more details about the industry, get the PDF sample report for free

Railway couplers are essential components that facilitate the connection and separation of railcars in a railway system. These components ensure that rolling stock—comprising both passenger and freight cars—moves efficiently and safely across vast railway networks. Couplers can be semi-automatic, automatic, or even fully automated, depending on the sophistication of the railway system in use.

In an increasingly competitive transportation market, the ability to quickly and reliably connect and disconnect railcars is crucial, especially as nations expand their rail networks to accommodate rising passenger and freight demand.

The global Railway Couplers Market is experiencing significant growth due to the increasing demand for safe and efficient train coupling systems in both freight and passenger transportation. Key components such as automatic couplers, manual couplers, and freight couplers are essential for seamless train coupling, enhancing the efficiency and safety of rail operations. In addition, buffer couplers, screw couplers, and link couplers are widely used in various railcars, providing robust solutions for different operational needs. Innovations such as knuckle couplers and coupler shanks are further improving coupler alignment and shock absorption, making rail transport safer and more reliable. The integration of advanced anti-creep devices and locking mechanisms ensures the security of railcars, minimizing the risk of uncoupling during transit. As demand for railcar connectors grows, companies are focusing on improving the design and functionality of coupler assemblies, coupler plates, and coupler sleeves, leading to innovations in coupler interface technology.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The railway couplers market is experiencing growth thanks to several key factors:

Countries across the globe, particularly in the Asia-Pacific (APAC) region, are significantly boosting their investments in railway infrastructure. This includes expansions of high-speed rail networks, dedicated freight corridors, and the modernization of existing systems. These initiatives are expected to drive the demand for advanced couplers, which can facilitate more efficient and secure connections between railcars.

For example, India's government has committed USD 120-144 billion to revamp and expand its railway sector over the next five years. This includes the introduction of high-speed bullet trains and freight networks, both of which require cutting-edge coupling technologies to ensure safe and reliable operations.

The market is rapidly evolving with the adoption of automated railway couplers and virtual coupling systems. These technologies allow for more seamless connections without the need for manual intervention. Virtual coupling, for instance, enables trains to operate closer together by using electronic data transmission rather than physical contact, paving the way for greater efficiency in railway logistics.

With global trade on the rise, efficient logistics have become more important than ever. Railway transportation offers a cost-effective and environmentally friendly alternative to road and air transport. As such, the demand for freight railway networks—which rely heavily on robust and reliable railway couplers—continues to grow.

Railway couplers are broadly categorized into semi-automatic and automatic types. Among these, semi-automatic couplers are expected to see significant growth due to their versatility and reliability, particularly in freight operations and high-speed trains.

In semi-automatic systems, the mechanical link is automatically engaged, while the electric and pneumatic links are established manually. These systems are commonly used in high-speed trains and bullet trains, as they offer durability and ensure safe, efficient operations.

The railway couplers market is segmented based on application, and freight trains are the largest consumer of couplers. These trains demand robust and reliable coupling systems to handle the weight of goods being transported across long distances. High-speed trains also require advanced couplers that can withstand high acceleration and deceleration forces.

The Asia-Pacific region, particularly China and India, is expected to contribute 39% to the growth of the global railway couplers market by 2028. China, with its extensive high-speed rail network, is a major player in the global coupler market, while India’s investments in rail infrastructure projects, such as dedicated freight corridors, are expected to drive demand for railway couplers in the coming years.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

The concept of virtual coupling is perhaps the most revolutionary trend shaping the future of the railway couplers market. Virtual coupling allows trains to operate with minimal physical contact, using sophisticated electronic systems to connect and communicate between cars. This technology promises to increase the efficiency of rail networks by reducing the need for mechanical coupling and making it possible for trains to run closer together.

This innovation is particularly useful for high-speed trains and freight operations, where minimizing gaps between trains could result in significant improvements in overall system efficiency.

Automation continues to influence the development of railway couplers. As railway operators move toward automated train systems, there is a growing demand for automated coupling mechanisms that can interact seamlessly with digital and electronic systems. Automated couplers can reduce labor costs, enhance safety by limiting human error, and improve the overall efficiency of operations.

While the outlook for the railway couplers market is generally positive, there are several challenges that stakeholders should be aware of:

One of the primary challenges to the market's growth is the delay in the execution and development of key railway projects. These delays often result from funding issues, regulatory hurdles, and geographical challenges that hinder the timely deployment of railway infrastructure.

For instance, India's ambitious metro and bullet train projects have faced setbacks due to regulatory approvals and funding concerns. Similarly, the completion of rail projects in Europe and the Middle East has been slower than anticipated, affecting the overall demand for couplers.

Get more details by ordering the complete report

Research on the Railway Couplers Market highlights the ongoing development of hybrid systems like hybrid couplers and interlocking couplers, which combine the best of both automatic and manual coupling mechanisms to improve operational flexibility. Coupler adapters, coupler heads, and coupler housings play a crucial role in ensuring the proper function of railcars, optimizing load distribution and preventing excessive wear. The incorporation of tension control mechanisms and coupler springs contributes to the durability and longevity of couplers in extreme conditions. Additionally, innovations in coupler mount and coupler pivot designs have enhanced the dynamic coupling process, leading to smoother train operations. The market is also seeing advancements in emergency release systems, enabling faster uncoupling in case of accidents. As railways focus on sustainability and cost management, efficient coupler assembly systems, including coupler plates and friction drafts, are critical to achieving these goals while maintaining high safety standards.

Railway operators should capitalize on emerging technologies such as automated couplers and virtual coupling systems to optimize their operations and reduce costs. This will be especially critical as countries invest in the modernization of rail systems and expand high-speed and freight rail networks.

With the APAC region leading the way in both passenger and freight rail projects, businesses should focus on expanding their presence in China, India, and other rapidly growing markets. Understanding the specific needs of these regions—particularly in terms of cost-effective and reliable couplers—will be key to tapping into this market.

Railway manufacturers and operators should adapt to technological advancements that enhance coupling efficiency and safety. Integrating automated systems, advanced materials, and digital monitoring tools will not only improve the safety and reliability of railway networks but also ensure a competitive edge in the market.

Safe and Secure SSL Encrypted