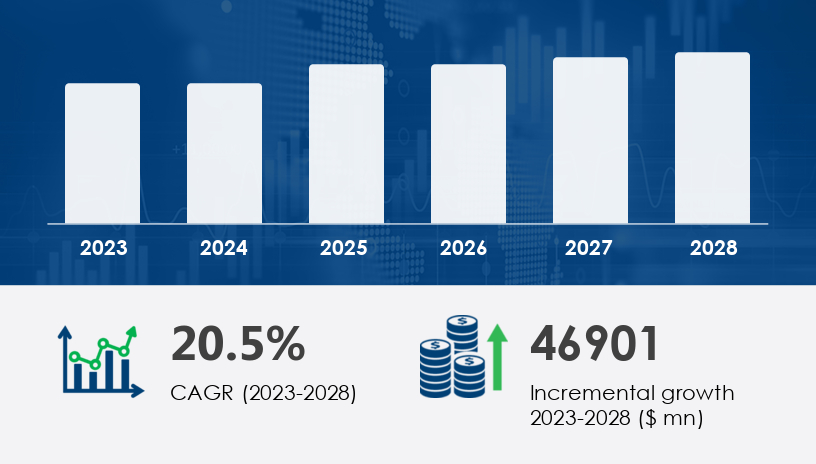

The Poland E-Commerce Market is poised for substantial growth, driven by increasing internet penetration, mobile commerce, and advanced digital infrastructure. In 2023, the market stood at a strong base and is projected to increase by USD 46.9 billion by 2028, growing at a compound annual growth rate (CAGR) of 20.5%. As e-commerce adoption spreads across sectors and demographics, Poland continues to emerge as a critical player in the European digital retail landscape.

For more details about the industry, get the PDF sample report for free

One of the most influential drivers of the Poland E-Commerce Market is the availability of diverse online payment options. Consumers in Poland have access to a variety of payment methods, including credit and debit cards, bank transfers, online wallets, and cash on delivery. This wide selection enhances the convenience of digital transactions, encouraging broader participation in e-commerce activities. The accessibility and flexibility of these payment systems reduce friction at checkout and have been instrumental in expanding the user base, contributing significantly to the overall market growth. With over 21 million Polish internet users, this payment ecosystem supports and accelerates digital commerce adoption.

Omnichannel retailing is shaping the future of the Poland E-Commerce Market, as brands increasingly integrate online and offline channels to enhance customer engagement. Fashion retailers, in particular, are adopting this approach by merging in-store experiences with online platforms. Platforms like Miinto and Showroom exemplify this trend, offering seamless transitions between physical and digital shopping environments. Additionally, the rise of mobile commerce is noteworthy, with over 50% of e-commerce transactions in Poland conducted via mobile devices. As consumers continue to rely on smartphones, tablets, and laptops for product research and purchasing, this convergence of mobile, in-store, and online channels is redefining retail strategies across Poland.

The Poland e-commerce market is rapidly expanding, fueled by the growth of robust e-commerce platforms and optimized digital storefronts that cater to tech-savvy consumers. The surge in mobile commerce and the increasing influence of social commerce have driven demand for reliable payment gateways, smooth secure checkout, and diversified digital payment options, including the rising use of mobile payment systems. Efficient shopping journeys are supported by user-friendly shopping carts and extensive product catalogs, while back-end systems like inventory management and streamlined order fulfillment ensure smooth operations. Polish retailers are investing in customer engagement tools, leveraging AI personalization and machine learning to deliver tailored experiences. Meanwhile, immersive technologies such as augmented reality help visualize products, enhancing product recommendations and reducing cart abandonment. Overall, businesses are prioritizing user experience to capture and retain a growing online customer base.

The Poland E-Commerce Market is segmented by:

Type:

B2B

B2C

Application:

Home Appliances

Fashion Products

Groceries

Books

Others

The B2B segment is emerging as the fastest-growing component of the Poland E-Commerce Market. Valued at USD 9.22 billion in 2018, the segment has shown consistent growth and is expected to continue its upward trajectory through 2028. This expansion is largely due to the ability of B2B platforms to extend market reach cost-effectively, particularly in categories such as electronics, furniture, care products, and groceries. Analysts highlight that logistics innovations and the support of cross-border frameworks like the ECDB (Electronic Data Interchange for Administration, Commerce and Transport in Europe) are facilitating this growth. With B2B platforms now playing a pivotal role in the Polish economy, their continued digital transformation is a key contributor to the market's evolution.

With more than 21 million internet users and a rapidly growing number of registered e-commerce stores, Poland is among the fastest-growing e-commerce markets in the region. The retail sector is projected to reach €22.5 billion by 2026, reinforcing Poland's strategic importance in the European e-commerce value chain. According to analyst insights, this growth is bolstered by a robust digital infrastructure, supportive government regulations, and increasing mobile commerce adoption, which together form a favorable environment for market expansion.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

A key challenge facing the Poland E-Commerce Market is the increasing presence of counterfeit products, particularly in the fashion and cosmetics segments. As Polish consumers seek affordable online prices, they are sometimes exposed to unauthenticated products, especially from lesser-known or international platforms. This has the potential to erode consumer trust and impact overall market integrity. Despite strong digital infrastructure and effective payment systems, the prevalence of counterfeit goods remains a persistent concern. To maintain credibility and customer loyalty, e-commerce businesses must invest in transparency, product verification tools, and strong vendor screening mechanisms.

Recent market research highlights how social media platforms are influencing consumer decisions, particularly through shoppable posts, interactive buy buttons, and integrated in-app purchase features. Smooth order processing and the ability to analyze customer insights using real-time analytics and predictive analytics enable brands to adapt strategies swiftly. The shift toward omnichannel retail and multichannel selling models ensures consistency across touchpoints. Flexible delivery options, including same-day delivery, next-day delivery, and access to convenient parcel lockers, are key differentiators in the Polish market. Reliable returns processing, visible product reviews, and trusted customer ratings help build consumer trust. Security and convenience are enhanced through advanced payment security, intuitive mobile apps, and strong user authentication. Digital strategies involving social sharing, marketing automation, and expanding cross-border trade are becoming essential, especially with the rise of quick commerce, which emphasizes speed and availability in urban markets.

Poland’s e-commerce landscape is evolving with a clear focus on innovation, user-centric design, and operational agility. As competition intensifies, retailers that harness data-driven personalization, seamless multichannel integration, and smart logistics will lead the market. The intersection of fast delivery, secure payments, and immersive digital experiences is defining success in one of Central Europe's most dynamic online retail environments.

Leading companies in the Poland E-Commerce Market are adopting innovative strategies to strengthen their competitive positions. For instance:

Allegro.pl, one of Poland’s most dominant platforms, continues to invest in expanding its product offerings and enhancing delivery logistics.

Amazon and eBay have deepened their presence in the Polish market by localizing platforms and streamlining fulfillment processes.

Miinto and Showroom have pioneered omnichannel strategies in fashion, integrating digital storefronts with physical experiences.

Companies like Shopify and Media Expert Group are investing in AI and machine learning to improve personalization and customer service.

These strategies reflect a shift toward enhancing the consumer journey through faster shipping, mobile-friendly interfaces, and AI-powered recommendations. Moreover, Polish retailers are increasingly leveraging partnerships and mergers to scale operations and broaden product categories, from consumer electronics to pharmaceutical products.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Type

6.1.1 B2B

6.1.2 B2C

6.2 Application

6.2.1 Home appliances

6.2.2 Fashion products

6.2.3 Groceries

6.2.4 Books

6.2.5 Others

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted