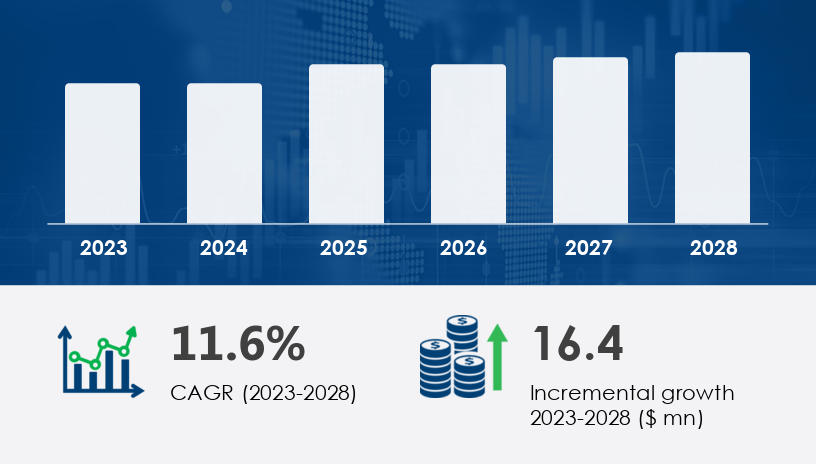

The Japan Pilates Equipment Market is poised for robust expansion, forecasted to increase by USD 16.4 million at a CAGR of 11.6% between 2023 and 2028, as per latest market insights. This rapid growth trajectory underscores a strategic shift in consumer behavior toward low-impact, holistic fitness methods. The 2025 Outlook reveals an evolving landscape shaped by demographic trends, tech integration, and wellness-focused lifestyles.In this comprehensive guide, we unpack the driving forces, challenges, and strategic pathways shaping Japan’s Pilates equipment market, blending data-backed analysis with expert commentary to help businesses and stakeholders navigate the next growth phase.

For more details about the industry, get the PDF sample report for free

With over 30% of Japan’s population expected to be aged 65+ by 2030, the demand for low-impact fitness systems like Pilates is accelerating. The appeal lies in Pilates’ emphasis on controlled movements, core strength, posture alignment, and breath regulation — making it an ideal regimen for elderly individuals seeking to maintain mobility and avoid joint strain.

Commercial Segment: Gyms, health clubs, fitness centers, and boutique Pilates studios are the primary drivers here. As urban dwellers increasingly turn to structured group workouts, these venues invest in premium equipment—especially reformers and Cadillacs—for both fitness and therapeutic programs.

Residential Segment: With the proliferation of virtual workouts, smart wearables, and home gyms, residential adoption is surging. E-commerce platforms and specialty retailers have capitalized on this by offering compact, affordable Pilates gear tailored for home use.

Pilates Machines: This segment continues to dominate. Valued at USD 9.80 million in 2018, it has steadily grown due to rising applications in rehab and physical therapy. Equipment like chairs, towers, and barrels are increasingly found in clinical settings.

Mats, Balls, and Rings: These essentials are popular in both home and group studio settings. Their affordability and versatility make them ideal for beginners and advanced practitioners alike.

“As consumer expectations grow, reformer designs are evolving too—with eco-friendly materials and modularity becoming top buying criteria,” notes Senior Technavio Expert.

Offline: Traditional retail, including sports stores and specialized fitness outlets, remains significant—especially for commercial purchases and high-ticket machines.

Online: Growth is explosive here. E-commerce is the go-to for residential consumers, driven by ease of delivery, wider selections, and competitive pricing. Brands like Decathlon SA and URBNFit have expanded their online presence to meet this demand.

Get more details by ordering the complete report

Health Consciousness and Lifestyle Diseases: Rising obesity, hypertension, and sedentary behaviors have made functional fitness programs like Pilates more relevant.

Clinical Pilates Adoption: A fast-growing trend in rehab centers and physiotherapy clinics. It’s especially popular post-surgery or after musculoskeletal injuries.

Integration of Wearables: Linked home solutions and wearables that track form, breathing, and posture are enhancing user experience and adherence.

Popularity of Other Fitness Formats: High-intensity training and dance-based workouts like Zumba continue to attract a younger demographic, potentially limiting Pilates’ broader appeal.

Initial Equipment Costs: High setup costs for commercial machines can deter smaller studios and home users without adequate space or budget.

Pros:

Low-impact, suitable for all ages

Enhances posture, flexibility, and joint mobility

Ideal for rehab and chronic pain management

Complements other fitness formats

Cons:

Initial investment for machines can be high

Requires trained instructors for proper guidance

Slower results compared to cardio-based formats

For more details about the industry, get the PDF sample report for free

The Pilates Equipment Market in Japan has witnessed notable growth, fueled by a rising interest in wellness and low-impact fitness regimens. Among the most popular equipment are the Pilates Reformer, Pilates Cadillac, and Pilates Chair, widely used across premium studios and home fitness spaces. Other essentials include the Pilates Barrel, Pilates Arc, and Pilates Tower, which support spinal alignment and flexibility. Mat-based workouts continue to gain traction with the use of the Pilates Mat, Resistance Bands, and Pilates Ring for enhancing body control and endurance. Complementary gear like the Pilates Ball, Spine Corrector, and Wunda Chair are increasingly favored for rehabilitation-focused routines. The market also sees strong adoption of multifunctional units such as the Combo Chair and Ladder Barrel, while the inclusion of the Pilates Trapeze and Reformer Bed reflect a demand for comprehensive, studio-grade equipment across Japan’s urban wellness centers.

The market is defined by both global brands and domestic players. Key companies include:

Merrithew International Inc.

Balanced Body Inc.

Mad Dogg Athletics Inc.

Gratz Industries LLC

Decathlon SA

Oak Mountain Products LLC

Stamina Products Inc.

Japan Conditioning Academy

SALT and HONEY

Strategic efforts include mergers, geographic expansion, product innovation, and virtual training platforms. For instance, Balanced Body Inc. has introduced eco-friendly materials and foldable reformers to cater to the home-user segment.

Get more details by ordering the complete report

Eco-friendliness will be a differentiator in product design.

Residential fitness is here to stay, especially for Japan’s busy urban population.

Pilates machines remain the largest revenue-generating segment, but growth in portable equipment (rings, mats, balls) signals new revenue streams.

Online and hybrid models (studio + app) offer the best growth prospects for Pilates-focused businesses.

Looking ahead to 2028, the Japan Pilates Equipment Market will become a model for aging-nation fitness strategies, potentially influencing markets in South Korea, Germany, and Italy—countries facing similar demographic challenges.

For Manufacturers: Focus R&D on foldable, space-efficient, eco-friendly machines tailored for home users.

For Studios: Invest in hybrid delivery (in-person + app) to expand reach and flexibility.

For Retailers: Offer bundle deals of home kits (mat, ring, ball) with access to virtual classes.

For Startups: Explore opportunities in AI-enabled Pilates apps that integrate with wearables.

For more details about the industry, get the PDF sample report for free

In analyzing the Japanese market, specialized accessories and enhancements play a crucial role in Pilates routines. Equipment like Pilates Springs, Foot Corrector, and Magic Circle are commonly integrated into training modules. Innovations such as Pilates Straps, Reformer Carriage, and Pilates Bench are tailored for progressive resistance and alignment precision. Devices like the Arm Chair, Pilates Roller, and Stability Ball are also popular for balance and core-focused workouts. The market offers a wide range of supportive tools including Pilates Blocks, Reformer Handles, and Pilates Props to accommodate users of all skill levels. Additionally, accessories such as the Wall Unit, Pilates Pedal, Reformer Footbar, and Pilates Cushion enable modular configurations for different exercise goals. Functional aids like the Balance Board, Pilates Weights, Reformer Box, and Pilates Gliders are complemented by innovative equipment such as Core Align, Pilates Stool, and Reformer Pulley. Finally, versatile tools including Pilates Sliders, Aerial Hammock, Pilates Bolster, and Reformer Ropes signify the growing preference for diverse and adaptable Pilates setups across Japan’s fitness landscape.

The Japan Pilates Equipment Market is more than a fitness trend—it’s a response to national health needs, a lifestyle shift, and a business opportunity. Whether you're an equipment maker, fitness professional, investor, or wellness advocate, the time to align with this growing movement is now.

Safe and Secure SSL Encrypted