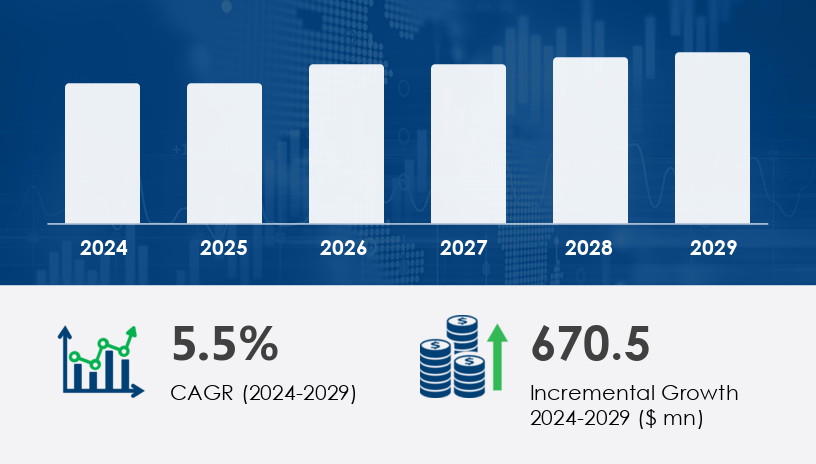

As we move into the second half of the decade, the global phacoemulsification devices market is on track to expand by USD 670.5 million, driven by a CAGR of 5.5% from 2024 to 2029. This sustained momentum reflects a convergence of factors: the rising burden of cataracts, technological innovation, evolving surgical practices, and global demographic shifts. Yet, the path forward is neither linear nor without obstacles. Cost barriers, regulatory complexity, and supply chain pressures continue to test stakeholders across regions. Nevertheless, as the ophthalmic landscape transforms, phacoemulsification stands at the forefront of that evolution, shaping the future of vision care.

For more details about the industry, get the PDF sample report for free

Cataracts remain the leading cause of blindness globally, affecting tens of millions each year. Phacoemulsification—a minimally invasive surgical method that uses ultrasonic energy to break and remove the cloudy lens—has become the gold standard for cataract extraction, with over 28 million procedures performed annually. This technique not only ensures high precision and improved recovery times but is also increasingly being leveraged for refractive lens exchange and combined glaucoma surgeries, underscoring its expanding utility.

The growing demand is not limited to procedural volume. The market is also being reshaped by surgical innovations such as AI-assisted diagnostics, robotic surgery, and next-generation phaco tips. Companies are racing to integrate intelligent software and customizable settings into their devices, enabling more tailored and efficient surgeries. Moreover, as microincision cataract surgery (MICS) gains favor for its faster recovery and reduced trauma, phacoemulsification systems and consumables are adapting to meet these surgical nuances.

Among all segments, phacoemulsification consumables—including handpieces, tips, foot pedals, and phaco packs—are projected to experience notable growth. These components are critical for maintaining surgical precision and optimizing outcomes. For instance, companies like Medical Technical Products are enhancing their offerings with innovations like the F-Sonic phaco tip sets, which deliver improved geometry and holding capacity, aiding in efficient lens fragmentation.

The rising adoption of ambulatory surgery centers (ASCs) and ophthalmic clinics is further driving demand for cost-effective and high-performance consumables. Unlike capital-intensive systems, consumables offer recurring revenue potential for manufacturers while enabling providers to maintain high throughput. With surgical volumes increasing in low- and middle-income countries, affordability and quality in consumables are becoming key differentiators.

Get more details by ordering the complete report

North America is forecast to account for 40% of global market growth, powered by high healthcare expenditure, a strong reimbursement framework, and robust infrastructure. The U.S. alone spent over USD 14,570 per capita on healthcare in 2023, fueling the demand for advanced ophthalmic technologies. Leading manufacturers in the region are leveraging these conditions to roll out increasingly sophisticated systems that integrate digital diagnostics and user-friendly interfaces.

Meanwhile, Asia-Pacific and Latin America are witnessing a surge in demand due to growing aging populations, rising awareness about cataract treatment, and increasing medical tourism. Countries like India and Brazil are positioning themselves as affordable cataract surgery hubs, attracting patients globally. For device makers, this presents a twofold opportunity: expand footprint in high-volume markets and innovate with cost-effective models tailored for resource-constrained environments.

The biggest tailwinds pushing market expansion include:

Rising Cataract Prevalence: With global life expectancy increasing, the cataract burden is growing proportionately. Millions of elderly patients will require safe, effective surgical options in the coming years.

Integration with Glaucoma Surgery: The practice of combining phacoemulsification with glaucoma interventions in a single procedure is gaining popularity, offering comprehensive eye care solutions and better patient convenience.

Technological Advancements: The introduction of surgical robotics, adjustable phaco power settings, and real-time monitoring systems is transforming the surgical landscape, making procedures more efficient and outcomes more predictable.

In addition, phacoemulsification protocols and standards continue to evolve, ensuring safety and reproducibility. Certification programs for cataract surgeons, along with continual upgrades in phacoemulsification systems, further elevate clinical benchmarks.

For more details about the industry, get the PDF sample report for free

Despite its advantages, the market faces several persistent challenges. The high cost of phacoemulsification systems, particularly in underfunded healthcare systems, restricts adoption. Hospitals and clinics in developing regions often rely on refurbished equipment, which can limit access to the latest innovations.

Regulatory complexity is another hurdle. Device manufacturers must navigate stringent approval processes across multiple geographies, balancing time-to-market with safety and efficacy. Moreover, supply chain inconsistencies—exacerbated by raw material shortages and logistical delays—pose risks to inventory management and service delivery.

Additionally, clinical complications and limitations in specific patient populations (e.g., those with dense cataracts or co-existing ocular conditions) necessitate continuous R&D investment to develop safer and more adaptable devices.

The phacoemulsification devices market is experiencing rapid growth due to the increasing demand for minimally invasive cataract surgery, with innovations in both phacoemulsification systems and phacoemulsification consumables. These systems rely on core components such as the ultrasound handpiece, phaco handpiece, phaco tips, and foot pedals, which work together with the control console to deliver ultrasonic vibrations that enable lens emulsification. Key consumables include phacoemulsification packs, viscoelastic agents, capsular tension rings, intraocular lens (IOL) implants, and balanced salt solution to maintain ocular integrity during procedures. Supporting technologies like irrigation systems and aspiration systems ensure efficient removal of lens fragments while protecting the corneal endothelium and lens capsule. Devices such as the phaco probe and advanced systems featuring WHITESTAR technology, elliptical tips, and F-Sonic tips contribute to higher surgical efficiency. These tools are now standard across various ophthalmic surgery settings, especially with the use of small incisions that help preserve the posterior chamber and anterior chamber during cataract removal procedures

Looking ahead to 2029, the phacoemulsification devices market will be defined by three strategic imperatives: innovation, accessibility, and integration. The focus will increasingly shift from mere technological advancement to value-based care—enhancing outcomes while reducing costs.

We anticipate stronger industry movement toward:

Affordable Innovation: Developing cost-effective devices without compromising performance, especially for deployment in emerging markets.

Digital Integration: Incorporating AI-powered diagnostics and teleophthalmology to enhance preoperative planning and postoperative monitoring.

Sustainability and Longevity: Leveraging UV protection and extended-use consumables to minimize waste and lower lifecycle costs.

In parallel, investment in training programs and certification will be critical. As surgical automation advances, ensuring surgeon competency and adaptability to new tools will determine the success of technology adoption.

For more details about the industry, get the PDF sample report for free

For manufacturers and stakeholders seeking to lead this market, the following strategies are essential:

Diversify Product Portfolio: Offer both premium systems for developed markets and low-cost, durable systems for high-volume emerging regions.

Invest in AI and Robotics: Stay ahead of surgical automation trends by integrating decision-support tools and smart operating features.

Strengthen Regulatory Strategy: Proactively engage with regulators to streamline approvals and demonstrate safety through robust clinical trials.

Enhance Global Supply Chains: Build flexible, region-specific logistics networks to reduce disruption risks and improve service reliability.

Focus on Outcomes: Partner with healthcare providers to collect data on clinical success and use it to refine products and enhance value propositions.

Ongoing research and development in the phacoemulsification devices market emphasize innovations that improve visual rehabilitation outcomes and optimize surgical instruments for complex ophthalmic diagnostics. Enhanced phaco machines, integrated with smart ultrasound capabilities, enable surgeons to operate more precisely with tools like the phacoemulsifier. Fluidics technologies using both peristaltic pumps and Venturi pumps are refined for better control during surgery. Complementary instruments such as the eye speculum, microsurgical instruments, and povidone-iodine for preoperative disinfection, alongside local anesthetics and topical anesthesia, streamline procedural flow. The market also benefits from rising adoption of premium IOLs, tailored for personalized visual rehabilitation, while protecting delicate intraocular structures. With advances in surgical efficiency and a focus on reducing recovery time, phacoemulsification continues to be the cornerstone of modern eye care and ophthalmic surgery, delivering superior outcomes with fewer complications.

Get more details by ordering the complete report

The phacoemulsification devices market is poised for a significant leap forward by 2029. Amid an aging global population and increasing demand for efficient cataract treatment, this sector represents one of the most dynamic frontiers in medical technology. The challenge—and the opportunity—lies in balancing high-end innovation with scalable, cost-effective solutions. As companies navigate this path, those who prioritize patient-centric design, regulatory foresight, and global accessibility will shape not just the market, but the very future of sight.

Safe and Secure SSL Encrypted