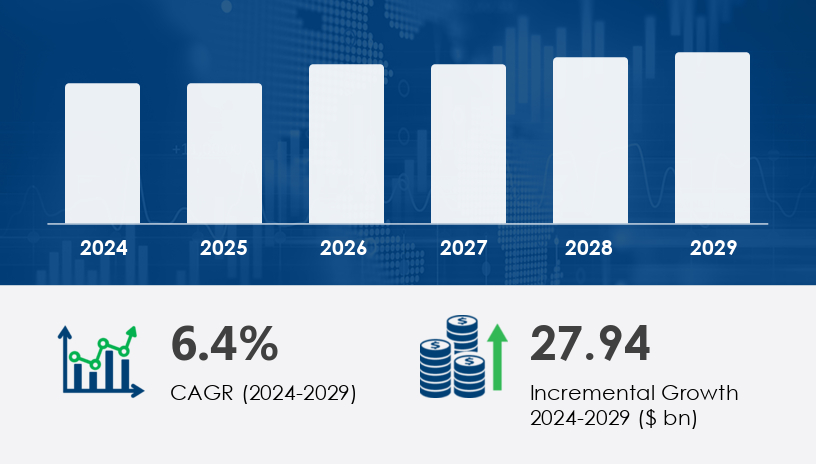

The packaged dehydrated food market is poised for a dramatic expansion, with forecasts projecting a robust USD 27.94 billion growth between 2024 and 2029 at a steady CAGR of 6.4%. As we enter 2025, strategic insights into this dynamic market reveal a convergence of convenience, nutrition, and long shelf-life preferences that are reshaping the food industry.

For more details about the industry, get the PDF sample report for free

A significant driver of this market's growth is the rising consumer preference for healthy, portable snacks that offer extended shelf life. Dehydrated foods, such as freeze-dried fruits and protein-rich meals, cater to health-conscious individuals seeking convenient options without compromising nutritional value. This trend is particularly evident among Millennials and Gen Z consumers, who prioritize wellness and convenience in their dietary choices.

An emerging trend in the packaged dehydrated food market is the integration of advanced dehydration technologies, such as freeze-drying and spray-drying, to enhance product quality. These methods preserve the nutritional content, flavor, and texture of foods, appealing to consumers seeking high-quality, ready-to-eat meals. Additionally, the rise of e-commerce platforms has facilitated greater accessibility to a diverse range of dehydrated food products, further driving market growth.

The Packaged Dehydrated Food Market is witnessing robust growth as consumers increasingly seek lightweight, long-lasting, and nutritious food options. Popular items such as dried fruit mixes, backpacking meals, and trail mix ingredients cater to outdoor enthusiasts and health-conscious individuals. Innovations in natural snack alternatives are evident in offerings like fruit leather, fruit chips, and organic dried fruit, providing clean-label appeal. Convenience-driven options such as freeze-dried meals, dehydrated snacks, and spray-dried powders are becoming staples for emergency kits and on-the-go nutrition. Traditional methods still hold relevance with sun-dried vegetables, dried banana chips, and dehydrated pineapple maintaining consumer interest due to their minimal processing and long shelf life.

The packaged dehydrated food market is segmented based on technology, distribution channel, and geography.

Spray Drying

Freeze Drying

Sun Drying

Others

Offline

Online

Among the various technologies, the spray drying segment holds a significant share in the market. Valued at USD 26.07 billion in 2019, spray drying continues to grow steadily due to its cost-effectiveness and efficiency in producing powdered foods. This method is widely used for dairy products, flavorings, and instant mixes, making it a preferred choice for manufacturers aiming to meet the increasing demand for convenient dehydrated foods.

North America, particularly the United States, is experiencing notable growth in the packaged dehydrated food market. This growth is driven by a large consumer base, well-established providers, and strong infrastructure. The increasing preference for convenient, nutritious, and long-lasting food solutions among consumers further fuels market expansion.

Europe is estimated to contribute 34% to the global market growth during the forecast period. The region's demand is driven by a preference for clean-label products, sustainability-conscious shopping, and higher adoption of outdoor recreational foods. Countries like Germany and the UK are leading consumers of dehydrated foods, with products like dried tropical fruits gaining popularity among health-conscious shoppers.

The Asia-Pacific region is expected to be the fastest-growing market for packaged dehydrated foods. Factors such as increasing health consciousness, rising disposable incomes, and rapid urbanization in countries like China, India, and Japan contribute to this growth. The demand for convenient and nutritious food options is propelling the adoption of dehydrated foods in the region.

In South America, rising income levels contribute to higher purchasing power among consumers, spurring consumption and creating opportunities for market expansion. Continued urbanization and rising income levels are expected to sustainably drive consumption growth in the medium to long term.

Robust demand from Middle Eastern countries, including Saudi Arabia, the UAE, and Qatar, supports the overall market potential in the Middle East and Africa. Increasing consumption expenditure and a growing population are driving the demand for packaged dehydrated foods in this region.

Europe stands out as the top region in the packaged dehydrated food market, contributing 34% to global market growth. The region's preference for clean-label products, sustainability-conscious shopping, and higher adoption of outdoor recreational foods are key drivers of this growth. Countries like Germany and the UK are leading consumers of dehydrated foods, with products like dried tropical fruits gaining popularity among health-conscious shoppers.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A significant challenge facing the packaged dehydrated food market is the increasing adoption of home dehydration techniques. As more consumers turn to homemade alternatives, companies in the market must differentiate themselves by offering unique value propositions, such as convenience, consistency, or added health benefits. This trend may impact the sales of commercially packaged dehydrated foods, requiring manufacturers to innovate and adapt to changing consumer preferences.

Current market research indicates a rising demand for specialty and premium products, especially those focusing on flavor variety and health benefits. For instance, freeze-dried berries, dried mango slices, and nutritious trail mix remain top performers in the fruit snack segment. Demand for adventure-ready products like dehydrated camping food, shelf-stable snacks, and dried apple rings reflects a broader trend toward convenience and outdoor lifestyle. Innovations in vegetables and meats are also evident with the rise of freeze-dried vegetables, dehydrated meal kits, and organic fruit snacks. The market is also seeing growing interest in protein and savory options such as dried apricot halves, freeze-dried meat, and dehydrated soup mixes, offering variety beyond traditional sweet-based dehydrated foods.

Deeper research analysis shows the market is diversifying through product innovation and functional enhancements. Items such as dried coconut flakes, freeze-dried yogurt, and dehydrated herbs are expanding culinary uses in both retail and foodservice segments. Pantry staples like dried tomato powder, freeze-dried fruits, and dehydrated pasta meals support meal prep convenience and extended storage. Health-forward and niche products are gaining traction, including dried berry blends, freeze-dried smoothies, and dehydrated protein bars. Meanwhile, snack categories continue to grow with dried vegetable chips, freeze-dried cheese, and dehydrated rice dishes leading innovation. Rounding out the market are unique formats like dried fruit powders, freeze-dried desserts, dried kale chips, freeze-dried pet food, dehydrated fruit bars, and dried mushroom slices, underscoring the category's versatility and broad appeal.

Companies in the packaged dehydrated food market are focusing on innovations to enhance product quality and meet consumer demands. For instance, Nestlé introduced a new product line of organic and plant-based dehydrated meals under its Garden Gourmet brand in February 2024, catering to the growing demand for healthier and sustainable food options. Additionally, Tetra Pak launched an innovative dehydrated food packaging technology, Tetra Rex, in September 2024, extending the shelf life of dehydrated food products while maintaining their quality.

Strategic partnerships are also shaping the competitive landscape. In July 2025, Danone and Nestlé announced a strategic partnership to combine their complementary portfolios in the dehydrated food market, aiming to strengthen their positions and enhance innovation. This collaboration is expected to create a leading entity in the market, leveraging each company's strengths to meet the evolving needs of consumers.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Technology

6.1.1 Spray drying

6.1.2 Freeze drying

6.1.3 Sun drying

6.1.4 Others

6.2 Distribution Channel

6.2.1 Offline

6.2.2 Online

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted