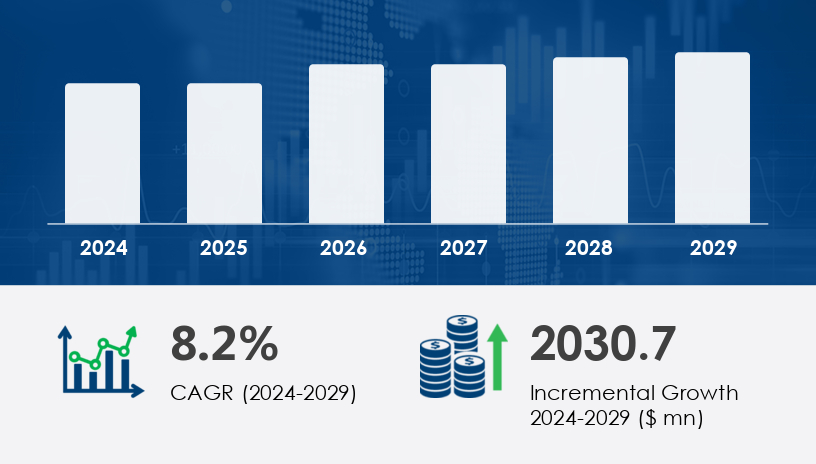

The ortho pediatric devices market is poised to grow by USD 2.3 billion between 2025 and 2029, driven by a robust 8.2% CAGR. This growth is propelled by rising pediatric orthopedic injuries, advancements in medical devices, and expanding healthcare access in emerging markets. The ortho pediatric devices market encompasses a range of medical devices designed to address various orthopedic and cranio-maxillofacial conditions in pediatric patients.

For more details about the industry, get the PDF sample report for free

A pivotal factor propelling the ortho pediatric devices market is the rising incidence of pediatric orthopedic injuries. According to the Centers for Disease Control and Prevention (CDC), unintentional injuries are a leading cause of emergency department visits among American children. Specifically, data from the CDC's Web-based Injury Statistics Query and Reporting System (WISQARS) reveals that males aged 1-19 years consistently exhibit higher nonfatal injury rates compared to females in the same age group. This surge in injuries necessitates the development and adoption of specialized orthopedic devices tailored for pediatric patients, thereby driving market demand.

The ortho pediatric devices market is witnessing several transformative trends:

Technological Integration: Advancements such as 3D printing, smart wearable orthopedic devices, and robot-assisted surgical tools are enhancing the precision and customization of pediatric orthopedic treatments.

Personalized Medicine: There is a growing emphasis on developing bioresorbable implants and bioactive materials that align with the unique anatomical and physiological needs of children.

Home Healthcare and Remote Monitoring: The adoption of telemedicine and remote monitoring solutions is increasing accessibility to orthopedic treatments, especially in underserved areas, facilitating continuous care and rehabilitation.

Minimally Invasive Procedures: The preference for minimally invasive surgeries is on the rise, leading to reduced recovery times and improved patient outcomes.

The Ortho Pediatric Devices Market plays a vital role in addressing musculoskeletal issues in children, including pediatric fractures, clubfoot treatment, and hip dysplasia. Treatment approaches often involve a range of devices such as orthopedic braces, orthopedic casts, pediatric crutches, and pediatric wheelchairs, which support mobility and healing. Structural interventions use bone grafts, titanium implants, bone screws, and orthopedic rods to address complex deformities and ensure proper bone alignment. Devices like casting materials, orthopedic sleeves, pediatric splints, and ankle supports are essential for immobilization and comfort. For spine-related disorders such as scoliosis and kyphosis correction, tools like spinal fusion, spine braces, and external bracing are employed. Specialized solutions including limb lengthening systems, orthopedic pins, and flexible nails allow surgeons to tailor treatment to the child’s growth and development. Additional support tools such as orthopedic wedges, pediatric walkers, pediatric slings, and joint stabilizers aid in rehabilitation and recovery.

The ortho pediatric devices market is segmented based on application, product, and technology:

Hospitals

Clinics

Others

Trauma and deformities

Smart implants

Spine

Sports medicine

3D-printed orthopedic devices

Smart wearable orthopedic devices

Robot-assisted surgical devices

Biodegradable implants

Among the various segments, the Trauma and Deformities category is expected to hold the largest market share during the forecast period. This segment encompasses procedures involving the application of metal plates, screws, and intramedullary nails for bone stabilization. The increasing prevalence of bone deformities among pediatric patients, coupled with technological advancements and new product launches catering to this specific demographic, are key factors fueling market growth. Consequently, the demand for trauma and deformity-related devices, including metal implants, plates, screws, and rods, is anticipated to surge during the forecast period.

The ortho pediatric devices market is analyzed across the following regions:

North America

Europe

Asia-Pacific (APAC)

Rest of World (ROW)

North America is projected to dominate the ortho pediatric devices market during the forecast period. The region's dominance is attributed to several factors:

High Prevalence of Pediatric Orthopedic Conditions: An increasing number of pediatric musculoskeletal disorders and fractures are driving the demand for specialized orthopedic devices.

Advanced Healthcare Infrastructure: The presence of state-of-the-art medical facilities and adoption of cutting-edge technologies enhance treatment outcomes.

Favorable Reimbursement Policies: Availability of favorable reimbursement policies for spinal implants used in pediatric orthopedics is promoting market growth.

Rising Awareness: Growing awareness about early diagnosis and treatment of musculoskeletal conditions contributes to market expansion.

These factors collectively bolster North America's position as a leader in the ortho pediatric devices market.

A significant challenge facing the ortho pediatric devices market is the escalating costs associated with orthopedic devices and surgeries. The overall cost of orthopedic surgery includes the cost of devices, procedure charges, consultation fees, medicines, and consumable costs, which can be substantial. Insurance coverage and regulatory approvals are also essential factors influencing the market's growth. Orthopedic conditions requiring bone grafting, such as clubfoot correction, can further increase the cost burden. Despite these challenges, the potential for improved patient outcomes and quality of life makes ortho pediatric devices a valuable investment for the healthcare industry.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Market research highlights the growing application of advanced technologies in areas like gait analysis, bone stimulators, and joint fusion, enhancing diagnostic accuracy and treatment outcomes. The development of bioresorbable devices and bone anchors reflects innovation in materials that minimize long-term complications. Products used in post-surgical care include orthopedic traction systems, bone plating, and orthopedic spacers, supporting stable healing. Pediatric-specific solutions such as knee braces, prosthetic limbs, and pediatric orthotics are increasingly designed with ergonomic precision and growth adaptability. Demand for solutions in ligament repair, tendon repair, and fracture stabilization is also on the rise, driven by both congenital and trauma-related conditions. The integration of custom-fit devices and smart monitoring tools is transforming the landscape, with providers focusing on safety, comfort, and mobility. These innovations ensure continuity in care and better patient outcomes, positioning pediatric orthopedics as a high-growth segment within the broader medical device industry.

Research analysis of the ortho pediatric devices market reveals a strong emphasis on personalized care, biocompatible materials, and device miniaturization tailored to children’s anatomy. The market is increasingly influenced by regulatory compliance, clinical trial outcomes, and collaborations between hospitals and device manufacturers. As awareness of pediatric musculoskeletal disorders increases, the market is expected to grow steadily, supported by investments in R&D and a shift toward minimally invasive procedures.

Key players in the ortho pediatric devices market are focusing on innovation and strategic initiatives to strengthen their market position:

OrthoPediatrics Corp.: In December 2023, OrthoPediatrics Corp. launched the OrthoPediatrics Specialty Bracing Division (OPSB), a non-surgical intervention for pediatric orthopedics. This move underscores the company's commitment to expanding its product portfolio and addressing the diverse needs of pediatric patients.

Medtronic and Boston Children's Hospital: In July 2024, Medtronic and Boston Children's Hospital entered into a strategic collaboration to develop pediatric orthopedic devices using 3D printing technology. This partnership aims to improve patient outcomes and reduce the time and cost associated with traditional manufacturing methods.

Smith & Nephew: In October 2024, Smith & Nephew completed the acquisition of Osiris Therapeutics, a leader in regenerative medicine for orthopedic applications. This acquisition enhances Smith & Nephew's portfolio by adding cellular and tissue-based products for pediatric orthopedic procedures.

These strategic initiatives highlight the industry's focus on innovation and collaboration to meet the evolving needs of pediatric orthopedic care.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.1 Hospitals

6.1.2 Clinics

6.1.3 Others

6.2 Product

6.2.1 Trauma and deformities

6.2.2 Smart implants

6.2.3 Spine

6.2.4 Sports medicine

6.3 Technology

6.3.1 3D-printed orthopedic devices

6.3.2 Smart wearable orthopedic devices

6.3.3 Robot-assisted surgical devices

6.3.4 Biodegradable implants

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 ROW

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted