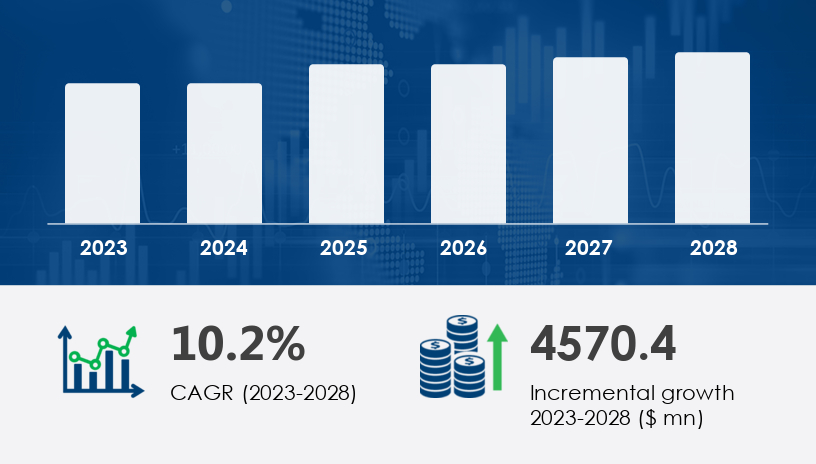

The organic energy drinks market is set to experience remarkable growth from 2024 through 2028, with an anticipated increase of USD 4.57 billion at a robust CAGR of 10.2%. This surge is fueled by a powerful consumer shift towards healthier beverage options and a demand for natural ingredients that deliver mental alertness and physical performance without the drawbacks associated with traditional energy drinks. The market's dynamic evolution highlights both opportunities and challenges for companies aiming to capture a growing base of health-conscious consumers.In recent years, the energy drinks segment has transformed significantly. Consumers, particularly teens, young adults, fitness enthusiasts, and the geriatric population, increasingly seek products that combine efficacy with clean-label transparency. Unlike conventional energy drinks laden with sugar, artificial additives, and high caffeine content, organic energy drinks appeal to those who prioritize wellness and sustainability. Key ingredients like vitamin B complexes, amino acids, herbal extracts, taurine, and natural sugars define this new wave of beverages. Additionally, sugar-free and low-calorie variants have gained traction, responding to the rising demand for beverages that boost energy without compromising health. This evolution is underscored by major product launches—such as Guru Organic Energy Corp.’s zero-sugar Wild Berry flavor introduced in 2023—supported by aggressive marketing campaigns leveraging social media, influencer partnerships, and in-store promotions.For more details about the industry, get the PDF sample report for free

Segmentation by packaging reveals a clear consumer preference for cans, a segment that was valued at USD 4.84 billion in 2018 and continues to see significant growth. Cans offer unparalleled convenience, portability, and extended shelf life, making them the ideal packaging format for on-the-go consumers. They are also highly recyclable, aligning well with sustainability trends that increasingly influence purchasing decisions. Beyond packaging, the distribution channels have expanded with both offline and online sales playing crucial roles. Direct selling and e-commerce are rapidly gaining momentum, enabling brands to connect with niche audiences such as gamers and athletes.

Geographically, the Asia-Pacific (APAC) region is projected to contribute roughly 33% of global market growth, driven by rising health awareness and expanding consumer bases in countries like China and India. North America remains a dominant market, propelled by the US and Canada, where health-conscious lifestyles and a robust organic product ecosystem create fertile ground for market expansion. European markets, led by Germany, the UK, and France, are also witnessing growth, supported by consumer preferences for natural and sustainable beverage options.

The primary driver of this market expansion is the launch of innovative organic energy drink products catering to a broad demographic spectrum. These products emphasize natural ingredients and cleaner labels while providing the desired energy boost. Increasing innovation is a defining trend, as companies introduce sugar-free options, ready-to-drink teas, beverage concentrates, and juices made from fruits and vegetables, broadening appeal beyond traditional carbonated drinks. Marketing strategies emphasize brand differentiation through sustainability and health benefits, which resonate with consumers increasingly wary of artificial additives and excessive caffeine.

However, the market does face notable challenges. Recalls due to contamination or quality control failures—such as the January 2024 recall of Monster Energy’s Green Energy Drink caused by can coating delamination—can undermine consumer trust and impact brand reputation. Furthermore, health risks linked to excessive caffeine consumption and shifting lifestyle choices towards healthier alternatives remain a hurdle for market penetration. Companies must therefore invest in rigorous quality assurance protocols and transparent communication to safeguard consumer confidence.

Get more details by ordering the complete report

The competitive landscape is vibrant, with players ranging from pure organic beverage companies like Ardor Organic, Inc., Babe Brewing LLC, and Guru Organic Energy Corp. to diversified conglomerates like PepsiCo Inc. These companies pursue growth through strategic alliances, mergers and acquisitions, geographical expansion, and continuous product innovation. Categorizing firms by focus and strength reveals a mix of dominant, leading, and emerging players working to capture niche consumer segments.

Research analysts highlight that organic energy drinks are particularly favored among fitness enthusiasts, athletes, gamers, and students who seek sustained energy and mental clarity from natural sources. Brands that can deliver superior product efficacy while maintaining sustainability and clean-label credentials stand to gain competitive advantages. The inclusion of natural functional ingredients such as herbal extracts and amino acids supports positioning as wellness beverages rather than mere stimulants.

The Organic Energy Drinks Market is gaining rapid traction, driven by growing consumer demand for clean label drinks that offer a natural energy boost without synthetic additives. Core innovations in the space include organic energy drinks, natural energy drinks, and plant-based energy beverages that appeal to health-conscious individuals. These low-calorie energy and sugar-free energy options are reshaping functional beverages with ingredients like natural caffeine, guarana extract, yerba mate, and green tea extract. Infusions of ginseng, ashwagandha, lion’s mane, and cordyceps are expanding the adaptogen beverages category, while organic guarana and natural sweeteners such as stevia enhance product appeal. Many brands now highlight vitamin-infused drinks and antioxidant beverages to support wellness-focused lifestyles. Eco-friendly packaging and sustainable sourcing have become essential, with products leveraging organic fruit juices and clean energy shots to deliver on both performance and environmental responsibility.

Get more details by ordering the complete report

As consumers seek more transparency, the market has responded with non-GMO drinks, vegan energy drinks, and gluten-free energy solutions. Herbal energy drinks and B12 energy shots are emerging as popular formats, especially for those embracing holistic health. Zero-calorie drinks and natural flavor drinks are gaining momentum alongside products boasting organic certification and innovative energy drink cans that support on-the-go consumption. Key growth areas include plant-based caffeine sources such as organic matcha drinks and turmeric energy shots, complemented by ginger root drinks and raw green coffee for enhanced functionality. The emphasis on organic raw ingredients continues to drive development in health-focused beverages, positioning them as viable alternatives to synthetic energy solutions. With increased attention to clean, plant-powered performance, organic sports drinks are expected to solidify their place in the mainstream energy drink category.

From 2024 to 2028, the organic energy drinks market is forecast to maintain strong growth momentum, driven by innovation, health-conscious consumer demand, and expanding distribution channels. The market’s evolution toward natural, sugar-free, and sustainably packaged options mirrors wider consumer trends emphasizing wellness and environmental responsibility. Companies that effectively balance product innovation with stringent quality control and authentic brand messaging will not only meet rising consumer expectations but also solidify long-term market leadership in this vibrant and fast-growing industry segment.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted