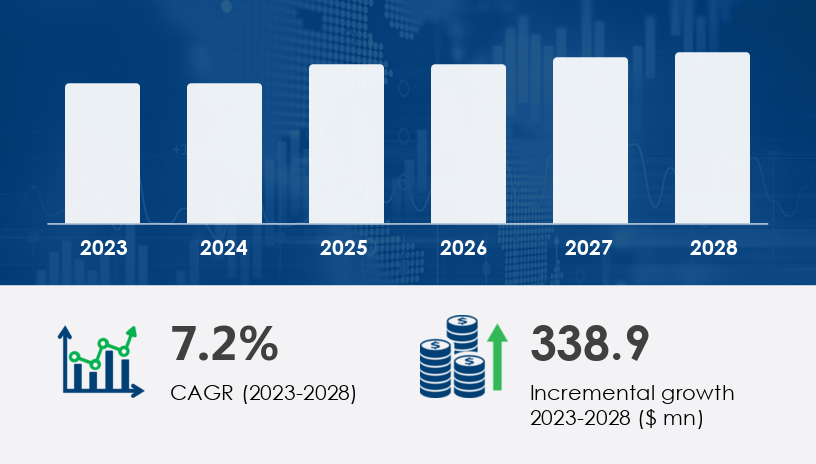

The organic coconut water market is experiencing significant growth, projected to increase by USD 338.9 million at a CAGR of 7.2% between 2023 and 2028. This surge is driven by rising health consciousness, a shift towards plant-based beverages, and the expanding e-commerce landscape. For businesses in the beverage, retail, and wellness sectors, understanding these dynamics is crucial for strategic planning and market positioning.

For more details about the industry, get the PDF sample report for free

Organic coconut water is gaining popularity due to its rich nutritional profile, including vitamins, minerals, amino acids, antioxidants, and heart-healthy electrolytes. It serves as a natural diuretic and digestive aid, appealing to health-conscious consumers seeking functional beverages. The increasing awareness of these health benefits is propelling the demand for organic coconut water, particularly among millennials and fitness enthusiasts.

The ready-to-drink (RTD) format, available in convenient packaging like tetra packs and cans, enhances accessibility and aligns with the on-the-go lifestyles of modern consumers. This trend is further supported by the growing preference for clean-label products, free from artificial additives and preservatives.

The market is segmented into online and offline distribution channels. The online segment is witnessing significant growth, driven by the convenience and accessibility of e-commerce platforms. Major e-retailers and traditional retailers expanding their online presence are making organic coconut water readily available to consumers. This shift is expected to continue, offering businesses opportunities to reach a broader audience and increase sales.

Asia Pacific (APAC): Dominating the market with a 37% contribution to global growth, APAC's demand is fueled by countries like China, India, and Thailand. The region's extensive coconut production and cultural affinity for coconut-based beverages ensure a steady supply and growing consumer base.

North America: The U.S. leads in market share, driven by a strong consumer preference for healthy, natural beverages. The well-established retail infrastructure and widespread availability of coconut water in supermarkets, convenience stores, and online platforms enhance product accessibility.

Europe: Germany is a key player in the European market, where the demand for natural drinks offering hydration without added sugars or artificial ingredients is on the rise. The trend towards plant-based diets and low-calorie options contributes to this growth.

South America: Countries like Brazil and Ecuador are major producers, with the market benefiting from the regional emphasis on natural health beverages.

Middle East and Africa: Rising disposable incomes and increased health awareness among consumers are contributing to the market's growth in this region.

Health Benefits: The rich nutrient content of organic coconut water, including electrolytes and antioxidants, positions it as a desirable choice for health-conscious consumers.

Clean-Label Products: The growing demand for products free from artificial additives and preservatives is driving the market for organic coconut water.

E-commerce Growth: The proliferation of e-commerce platforms has enabled companies to expand their reach, making organic coconut water more accessible to a broader audience.

Functional Beverages: The incorporation of added vitamins, minerals, and adaptogens into coconut water products is creating unique offerings that appeal to health enthusiasts.

Sustainable Packaging: Eco-friendly, sustainable packaging solutions are playing a key role in the market's growth, appealing to environmentally conscious consumers.

Flavor Innovations: The introduction of flavored coconut water and blends with other health-focused ingredients is attracting a broader audience.

Substitute Availability: The market faces competition from alternatives like energy drinks, fruit extract juices, and plant-based milks, which offer diverse choices to consumers.

Adulteration Risks: Ensuring the authenticity of natural ingredients is crucial, as the market's growth may be hindered by the presence of counterfeit or low-quality products.

Supply Chain Issues: The perishable nature of coconut water requires effective supply chain management to maintain freshness, posing challenges for manufacturers.

The Organic Coconut Water Market is experiencing significant growth, driven by rising consumer demand for clean-label, natural hydration drinks. Consumers are increasingly opting for pure coconut water, which is recognized for its natural electrolytes, coconut water vitamins, and coconut water minerals that support effective electrolyte balance and coconut water nutrition. Popular variants include unsweetened coconut, flavored coconut, and unflavored coconut options, all promoting organic hydration and positioned as low-calorie hydration alternatives. Health-focused buyers appreciate the plant-based drink status of coconut water, with added benefits such as being a vegan beverage, gluten-free drink, and non-GMO coconut source. Further differentiation in the market is seen in premium formats like cold-pressed coconut, raw coconut water, and organic coconut nectar, highlighting coconut water purity and appealing to the clean-eating segment. The incorporation of natural coconut flavor and natural sweetener options continues to attract health-conscious consumers looking for authentic taste with coconut water refreshment.

Leading companies in the organic coconut water market are implementing various strategies to enhance their presence. These companies include:

These companies are focusing on product innovation, sustainable practices, and expanding their distribution networks to maintain a competitive edge in the market.

Research within the Organic Coconut Water Market focuses on the functional aspects of the drink, especially its role in coconut water recovery, coconut water detox, and coconut water wellness. Rich in potassium, bioactive compounds, and coconut water antioxidants, the beverage supports coconut water health and is widely recognized in the fitness and wellness space for its use as a coconut water sports drink. Studies are also evaluating the energy-boosting properties of coconut water energy in comparison to synthetic alternatives. Innovations include the use of organic coconut extract and sourcing strategies like fair trade coconut, which align with sustainable and ethical production values. With a focus on enhancing hydrating electrolytes, coconut water rehydration, and cancer-fighting antioxidants, analysts also note the growing potential of organic coconut drink formulations that offer both health benefits and functional performance. Continuous improvements in coconut water source quality and transparency are helping position coconut water as a trusted solution for overall wellness and lifestyle hydration.

The organic coconut water market is poised for substantial growth, driven by health trends, consumer preferences for natural beverages, and advancements in distribution channels. Businesses in the beverage, retail, and wellness sectors should leverage these insights to align their strategies with market dynamics, ensuring a strong position in the evolving landscape of functional beverages.

Safe and Secure SSL Encrypted