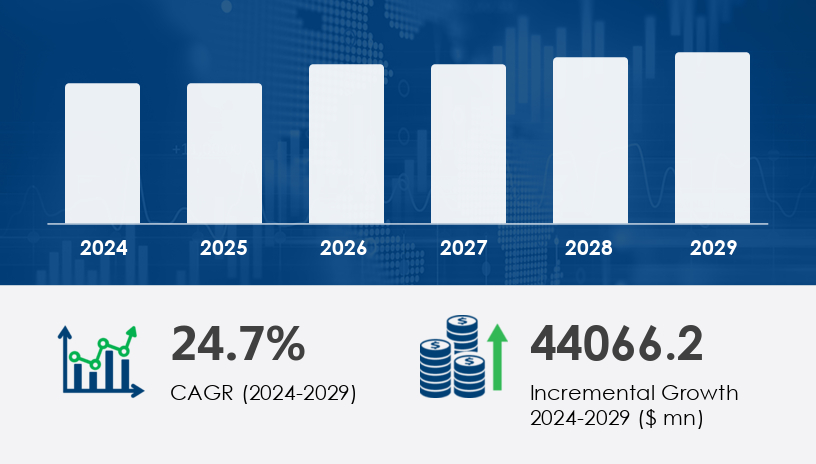

The Network As A Service (NaaS) market is poised for rapid expansion, with its market size expected to increase by USD 44.07 billion from 2024 to 2029. This growth represents a compound annual growth rate (CAGR) of 24.7%, underscoring the sector’s momentum as enterprises continue their digital transformation efforts. In 2024, the market already demonstrated strong performance, driven by increasing reliance on cloud infrastructure and the demand for agile, cost-effective networking solutions.

For more details about the industry, get the PDF sample report for free

A primary driver fueling the growth of the Network As A Service (NaaS) market is the accelerated adoption of cloud services by enterprises. Organizations across industries are migrating from traditional, on-premises IT infrastructures to cloud-based environments to enhance scalability and cost-efficiency. According to industry data, over 60% of corporate data was stored in the cloud as of 2023, and this trend is set to continue as businesses increasingly value flexibility, security, and access to real-time data. NaaS supports this shift by offering elastic bandwidth allocation, cloud orchestration, and latency optimization, enabling businesses to outsource complex network operations and focus on core competencies.

One of the most prominent trends in the NaaS market is the adoption of software-defined networking (SDN) and network virtualization. As companies strive for greater IT agility, these technologies allow businesses to convert physical network elements into shareable virtual resources, facilitating dynamic capacity adjustments and policy-based networking. Moreover, the shift toward zero-touch network setup and subscription-based models reflects a broader move toward operational efficiency and reduced capital expenditures. This evolution is particularly important for supporting hybrid cloud deployments, IoT applications, and 5G integration, all of which demand secure, scalable, and responsive network infrastructures.

The Network as a Service (NaaS) Market is reshaping how organizations build and manage their network environments by offering flexible, on-demand connectivity through cloud-based platforms. Core to this evolution is the growing reliance on cloud networking and virtual networks, supported by network virtualization technologies that enable seamless infrastructure scalability. Key components like the SDN controller and network orchestration tools allow service providers to dynamically manage traffic and optimize resource allocation. With the rapid expansion of cloud infrastructure, businesses are prioritizing network security and bandwidth management to ensure secure, high-performance connectivity. Technologies like network automation, hybrid cloud, and multi-cloud strategies further enable agile deployment across diverse environments. Enhancing network scalability and API integration capabilities is essential for adapting to dynamic enterprise demands, while robust network monitoring and service chaining support more efficient and secure service delivery.

The Network As A Service (NaaS) Market is segmented by:

End-user: IT and telecom, BFSI, manufacturing, healthcare, others

Type: WAN-as-a-service, LAN-as-a-service

Sector: Large enterprises, SMEs

Application: Cloud and SaaS connectivity, UCaaS and video conferencing, virtual private network, others

The IT and telecom segment is projected to dominate the NaaS market in terms of both growth and revenue share during the forecast period. This segment was valued at USD 2.33 billion in 2019 and has continued its upward trajectory. This growth is attributed to the increased demand for cloud services and IT infrastructure in the telecommunications industry. As network infrastructure becomes more critical in enabling business continuity and supporting 5G rollouts, IT and telecom companies are embracing NaaS solutions to deliver high-speed internet access and meet bandwidth demands efficiently. According to analysts, the convergence of cloud orchestration, virtual firewalls, and zero-touch setup is reshaping IT operations, enhancing service agility and compliance while reducing deployment complexity.

Covered Regions:

North America

Europe

APAC

Rest of World (ROW)

North America is expected to lead the global Network As A Service (NaaS) market, contributing approximately 39% to overall market growth during the forecast period. The United States, in particular, is a major growth engine due to the strong emphasis on cyber resilience, cloud adoption, and hybrid network models. Enterprises in the U.S. are rapidly adopting network security virtualization and zero trust frameworks, in addition to technologies such as edge computing, AI analytics, and blockchain-based security. These innovations are driven by the need for low-latency, high-availability network services that can scale with dynamic business needs. Analysts highlight that strategic investments in network infrastructure, virtual network functions, and cloud service integration are setting the stage for continued market expansion in this region.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite its rapid growth, the Network As A Service (NaaS) market faces significant challenges, particularly the increasing complexity of modern networks. As networks grow in scale and diversity, managing massive volumes of traffic, performance metrics, and device configurations becomes increasingly difficult. This complexity is further intensified by the rise of IoT, which introduces a vast array of endpoints requiring continuous monitoring and secure data flows. Organizations must invest in advanced network management tools and skilled professionals to maintain real-time network visibility and operational stability. The lack of standardization across NaaS solutions also complicates deployment and interoperability, making it difficult for businesses to seamlessly integrate new services into existing infrastructures.

Recent market research shows increasing adoption of advanced network technologies such as network slicing and edge computing to support emerging use cases and improve performance at the network edge. With the proliferation of connected devices, IoT connectivity has become a critical driver for scalable and secure NaaS solutions. Providers are leveraging network analytics and implementing zero-trust security frameworks to ensure secure access and continuous monitoring. Features like cloud firewalls, reduced network latency, and modernized data center architectures are improving network performance and resilience. Services such as network provisioning, VPN service, and MPLS networks are being redefined through automation and cloud integration. WAN optimization and network resilience are now crucial in delivering consistent user experiences, while cloud connectivity and network agility help enterprises transition from traditional infrastructures to more adaptive, cloud-native models.

Deeper research analysis highlights how intelligent networking capabilities like traffic management, load balancing, and network encryption are enhancing the performance and security of NaaS offerings. Tools such as the virtual router and programmable network fabric play key roles in enabling flexible configurations and dynamic traffic routing. The integration of cloud gateways, real-time network telemetry, and granular microsegmentation is advancing both operational visibility and security posture. To ensure smooth interoperability, vendors are investing in network interoperability features and overlay networks, which allow for the abstraction of underlying physical infrastructure. The emergence of programmable network endpoints, along with seamless cloud orchestration and strategic network peering, is empowering service providers to deliver customizable, scalable solutions across global enterprise networks.

Innovations or Recent Developments

Key players in the Network As A Service (NaaS) market are investing heavily in technological innovation, strategic alliances, and platform expansion to maintain competitive advantage:

In February 2025, IBM expanded its Cloud Pak for Networking portfolio, adding features to automate network operations and improve security, a move aimed at simplifying management of complex enterprise networks.

In December 2024, Juniper Networks partnered with Microsoft to integrate Juniper’s Contrail Service Orchestration into Microsoft Azure, streamlining access to NaaS for Azure customers.

Cisco Systems completed its acquisition of Acacia Communications in August 2024, boosting its NaaS capabilities by enabling high-capacity, low-latency services.

In March 2024, Nokia introduced its Network Services Platform (NSP) to support 5G and IoT deployments, offering enhanced scalability and service flexibility.

These developments reflect a market where network automation, AI-driven analytics, and cloud-native architectures are critical differentiators. Analysts point out that these innovations are not just enhancing performance but also reducing operational costs and accelerating time-to-value for enterprise clients.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 End-user

6.1.1 IT and telecom

6.1.2 BFSI

6.1.3 Manufacturing

6.1.4 Healthcare

6.1.5 Others

6.2 Type

6.2.1 WAN-as-a-service

6.2.2 LAN-as-a-service

6.3 Sector

6.3.1 Large enterprises

6.3.2 SMEs

6.4 Application

6.4.1 Cloud and SaaS connectivity

6.4.2 UCaaS and video conferencing

6.4.3 Virtual private network

6.4.4 Others

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted