In a bold transformation, the motorcycle suspension systems market is not just adapting—it’s redefining itself. From a functional necessity to a core performance differentiator, suspension systems are now central to how motorcycles ride, feel, and compete. “We’re entering an era where suspension is no longer passive—it’s intelligent,” said an industry analyst at the 2023 Milan Motorcycle Show. This marks the beginning of a Next-Gen Outlook that is reshaping how OEMs, aftermarket players, and riders think about vehicle handling, comfort, and customization.

For more details about the industry, get the PDF sample report for free

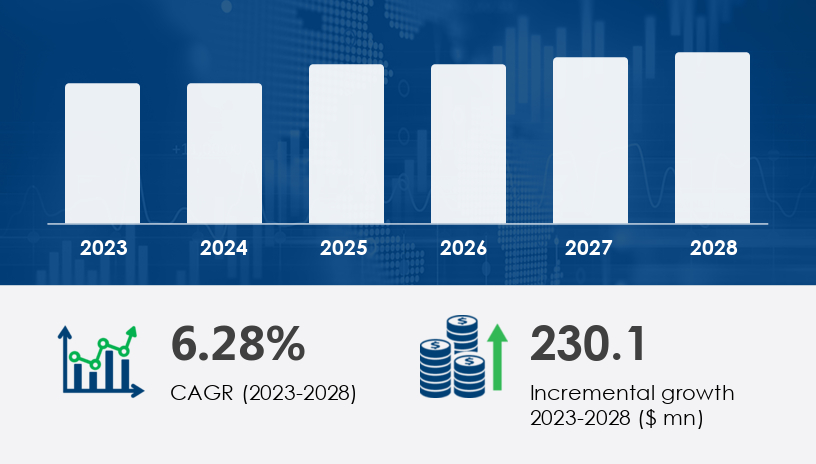

Once driven solely by basic utility and affordability, motorcycle suspension systems are now being influenced by electrification trends, stringent ICE regulations, and the rising demand for real-time adaptable systems. From 2019’s mechanical dominance to the 2023 pivot toward electronic integration, the outlook for 2024–2028 promises adaptive systems, OEM expansion, and explosive regional growth.

Legacy Disruption: OEMs traditionally focused on mechanical reliability and cost-efficiency.

New Strategy Emerging: OEMs are now integrating advanced technologies like dual bending valve front forks and semi-active suspensions to meet rising customer expectations.

Analyst Insight: OEMs are using suspension innovation to differentiate products and comply with global emissions standards.

Case Example: Hero MotoCorp launched a new touring line in India featuring mono-shock rear suspensions with built-in adaptive dampers.

OEM market led with USD 380.7 billion in 2018

It’s expected to dominate due to rising long-distance travel and commuter bike demand.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Legacy Disruption: Historically served budget-conscious riders and older bikes with minimal tech.

New Strategy Emerging: A rise in customization culture has shifted focus to premium suspension upgrades tailored to off-road and performance enthusiasts.

Analyst Insight: The aftermarket is becoming a playground for personalization and comfort-driven upgrades.

Case Example: Fox Factory Holding Corp. reported a surge in U.S. demand for dual-shock custom kits for older Harleys and Royal Enfields.

Suspension replacement is increasing in both traditional and modern scooters.

Riders seek enhanced comfort and braking via upgraded shocks and disc brake-integrated systems.

Legacy Disruption: Front and rear systems were often developed in silos, with basic spring-damper tech.

New Strategy Emerging: Manufacturers now pursue synergy between electronically controlled front forks and rear mono shocks for real-time responsiveness.

Analyst Insight: The dual bending valve technology from Showa is gaining ground for its weight savings and near-cartridge performance.

Case Example: BMW Motorrad showcased a 2024 electric bike concept with full adaptive front-rear suspension integration.

The front suspension market now includes lightweight forks with electronic sensors.

Rear systems improve braking and stability through mono-shock configurations.

As electric motorcycles gain market share, suspension systems must evolve to handle new weight distributions and battery positioning. Semi-active systems are becoming the standard, with real-time adjustments based on rider input and terrain feedback.

"Electric bikes demand smarter suspension—and the race is on to make them seamless," noted a senior engineer.

OEMs like BMW, Hero MotoCorp, and KYB are blurring traditional lines by offering customizable options at the point of sale—putting pressure on aftermarket brands to innovate or collaborate.

With APAC contributing 88% of global growth, regulatory shifts in India and China are accelerating product lifecycle innovation, especially in electric and low-emission motorcycles.

The Motorcycle Suspension Systems Market is witnessing significant growth due to increasing demand for enhanced ride comfort, handling stability, and rider safety across both commuter and premium motorcycles. Core components such as front suspension, rear suspension, shock absorbers, fork tubes, and springs play a critical role in ensuring a smoother riding experience. Traditional systems like telescopic fork, mono shocks, and dual shocks are being complemented by advanced technologies such as electronic suspension, offering greater suspension adjustability and improved suspension durability. With rising interest in off-road suspension for adventure biking and the influence of motorcycle electrification, there’s growing use of lightweight materials and innovative suspension design to achieve weight reduction. The increasing production of electric motorcycles and demand for OEM components and aftermarket parts are further propelling the market forward.

AI-Tuned Suspension Systems: Expect predictive damping using AI to auto-adjust for road conditions and rider profiles.

Electric-Optimized Frames: Lightweight suspension built around battery-heavy frames to ensure balance and traction.

Modular Retrofit Kits: Universal adaptive kits for older motorcycles enabling semi-active performance at aftermarket prices.

Innovation in Action: Arnott LLC is pioneering hybrid suspensions combining Duolever and Telelever technology—blending old-school mechanics with modern sensors for a responsive yet stable ride.

Big Question: With riding experiences becoming digitized, are we ready for motorcycles that tune themselves before we hit the ignition?

Get more details by ordering the complete report

Invest in Smart Suspension Systems

Adopt AI-driven inventory optimization for the OEM segment to match dynamic demand in real time.

Expand APAC-Specific Offerings

Leverage India and China’s booming motorcycle sales with localized product development and lightweight suspension kits.

Strengthen OEM–Aftermarket Partnerships

Collaborate with key aftermarket players to co-develop hybrid solutions for budget-conscious and customization-driven riders.

Focus on Electrification Compatibility

Design front and rear suspension systems tailored for electric motorcycles, addressing new structural and weight challenges.

Personalization as a Core Value Proposition

Use customer data to offer modular, adjustable, and rider-specific suspension options at point of sale.

Accelerate R&D in Lightweight Materials

Innovate using carbon fiber, aluminum, and titanium for performance-enhancing and sustainable designs.

Research in the Motorcycle Suspension Systems Market focuses on cutting-edge suspension technology and improving overall motorcycle dynamics through systems like adaptive suspension, active suspension, and semi-active system configurations. Advancements in suspension sensors, control units, and real-time adjustments are central to modern suspension innovation, especially in high-performance suspension setups. Engineers are optimizing compression damping, fork performance, and shock absorption using advanced dampers and specialized designs like dual bending valve and cartridge forks. As demand rises for tailored solutions, suspension durability and motorcycle comfort are being enhanced through precision engineering. Integration of hydraulic suspension systems and focus on suspension adjustability are helping riders achieve better control across varying terrains. The convergence of these innovations is shaping the future of motorcycle suspension as a key differentiator in both performance and safety.

The motorcycle suspension systems market is undergoing a transformation from mechanical utility to adaptive intelligence, driven by electrification, customization, and regulatory change. With APAC leading the charge and OEMs embracing innovation, this market is no longer about keeping wheels on the ground—it’s about redefining the ride.

Are we thinking big enough about what a motorcycle suspension system can be?

Safe and Secure SSL Encrypted