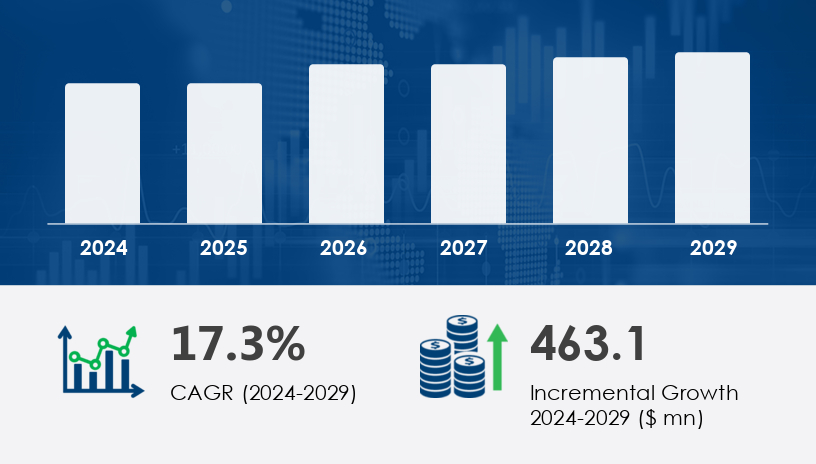

The motorcycle rental market size is projected to grow by USD 463.1 million between 2024 and 2029, at a remarkable CAGR of 17.3%. This surge is powered by booming road-trip tourism, the rise of flexible commuting needs, and the digital transformation of mobility services. The motorcycle rental market has moved beyond its niche appeal and is now a major player in the global transportation ecosystem. With more travelers and commuters prioritizing cost-effectiveness, convenience, and sustainability, motorcycle rentals are gaining traction—especially in urban centers and tourist hotspots. By 2025, the market is not just about transportation—it's about experience, flexibility, and smart mobility solutions that meet the evolving lifestyle of modern consumers.

For more details about the industry, get the PDF sample report for free

The motorcycle rental market is accelerating due to a shift toward flexible, on-demand mobility. Increasing road-trip tourism, eco-conscious commuting, and the affordability of rentals over ownership are fueling demand. Companies are leveraging AI, machine learning, and digital platforms to simplify user experience and expand their reach.

Growth Drivers & Challenges: Urban congestion and the need for affordable daily transport fuel the commuter motorcycle segment. Particularly in developing economies, lightweight, fuel-efficient bikes (under 300cc) dominate. However, inconsistent product quality and price volatility are ongoing concerns.

Expert Comment: “Commuter rentals are the bridge between affordability and flexibility. They are essential in high-density urban areas where vehicle ownership is impractical,” notes Senior Technavio Expert

Case Study: Wickedride Adventure Services partnered with Bangalore Metro Rail Corporation to offer integrated commuter bike rentals at metro stations. The result: a 22% increase in last-mile ridership and a 40% surge in weekly rentals within three months.

Notable Stats: Commuter motorcycles were valued at USD 193.6 million in 2019, and demand continues rising, particularly in Asia and Europe.

Growth Drivers & Challenges: The luxury motorcycle segment is powered by tourism and experience-based travel. Tourists, especially in North America and Europe, seek high-end bikes for scenic rides. But high capital costs and a niche customer base constrain aggressive expansion.

Expert Comment: “Luxury rentals aren’t just about transport—they’re about identity, experience, and brand storytelling,” says Senior Technavio Expert.

Case Study: EagleRider in the U.S. built a Harley-Davidson-exclusive rental network that aligns with long-haul travel trends. The service saw repeat customer rates of 45% for multi-day luxury bike tours across Route 66 and the Pacific Coast Highway.

Notable Stats: North America accounts for 33% of global market share, dominated by luxury cruiser rentals.

Growth Drivers & Challenges: Subscription-based models are redefining customer expectations by offering unlimited riding with monthly fees. These models reduce upfront costs for users and offer revenue stability for operators. The challenge? Fleet maintenance and churn rates.

Expert Comment: “Subscription models cater to the new-age consumer who values experience over ownership. They blend affordability with accessibility,” says Senior Technavio Expert.

Case Study: Rydr Club, a startup in Germany, introduced tiered subscriptions with AI-based ride analytics. The program achieved a 30% lower attrition rate than traditional rental models and a 20% increase in customer lifetime value (CLV) within the first year.

Notable Stats: Subscription services are growing at a CAGR of 19.8%, outpacing traditional short-term rentals.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Opportunities:

Digital Expansion: AI-powered platforms and mobile booking apps enhance UX and streamline operations.

E-bike Integration: Rising fuel prices and sustainability awareness are driving electric motorcycle rentals.

Tourism Recovery: Post-COVID travel rebound offers huge potential, especially in APAC and Europe.

Partnership Ecosystems: Collaborations with hotels, tourism boards, and public transit systems boost visibility.

Risks:

On-demand Taxi Competition: Flexible ride-hailing services are a major alternative, especially in urban centers.

Regulatory Complexities: Varying licensing, insurance, and safety laws across geographies hinder scalability.

Operational Costs: Fleet maintenance and insurance costs remain high, especially for luxury models.

Customer Retention: High churn rates, especially in subscription models, affect profitability.

From 2025 to 2029, the motorcycle rental market is expected to grow at a CAGR of 17.3%, reaching USD 463.1 million. Commuter bikes will remain dominant in developing markets, while luxury rentals will expand in tourism-driven economies. AI integration and data analytics will shape rental strategies, while environmental pressures will accelerate electric fleet adoption.

Expert Prediction: “By 2029, nearly 1 in 3 urban motorcycle rentals will be electric, and 60% of all rentals will be digitally initiated,” forecasts Senior Technavio Expert.

Are companies ready to pivot to a tech-first, e-bike-forward future—or will legacy systems hold them back?

The Motorcycle Rental Market has gained significant traction in recent years, driven by growing interest in urban mobility, motorcycle tourism, and adventure tourism. Travelers increasingly seek flexible options like motorcycle rental, bike sharing, and scooter rental to navigate cities or embark on scenic road trips. The market includes a diverse range of offerings—from commuter motorcycles, cruiser bikes, and touring motorcycles to more niche categories like electric motorcycles, luxury motorcycles, and adventure bikes. Brands offering Harley-Davidson rental, superbike rental, and E-bike rental are expanding their reach through digital rental platforms and easy bike reservation systems. Features like helmet rental, motorcycle insurance, and motorcycle accessories enhance convenience and safety for riders. To attract customers, companies leverage rental discounts, optimized motorcycle pricing, and strong local SEO strategies supported by user-generated customer reviews.

For Commuter Motorcycle Operators:

Optimize pricing with dynamic fare models tailored to urban commuters.

Collaborate with public transport systems to capture last-mile demand.

Focus on fleet standardization to reduce maintenance and enhance user confidence.

For Luxury Motorcycle Rental Businesses:

Introduce curated tour packages aligned with travel trends (e.g., wine country tours, national park trails).

Invest in AI-based trip planning tools to elevate the rider experience.

Build loyalty programs for repeat tourists and tour operators.

For Subscription-Based Services:

Implement ride usage analytics to personalize customer offerings and reduce churn.

Offer flexible tiers to cater to part-time and full-time riders.

Ensure predictive maintenance via IoT sensors for higher fleet uptime.

For OEMs & Tech Enablers:

Design lightweight electric models specifically for rental use.

Deploy machine learning algorithms for predictive demand modeling.

Integrate contactless verification and booking via mobile apps to streamline UX.

From a technology and operations standpoint, the market is evolving through integrated rental software, multi-channel booking channels, and fleet-level motorcycle leasing models. Operators rely on efficient fleet management to handle a wide motorcycle fleet, ensuring timely motorcycle maintenance and availability of premium bikes for different customer needs. Events like motorcycle tours, motorcycle events, and community motorcycle commutes further fuel interest in temporary two-wheeler access. Advanced driver assistance, motorcycle safety, and active safety features are becoming key differentiators, especially as artificial intelligence, machine learning, and robotic efficiency reshape operational logistics. As competition intensifies, attention to seamless bike hire, popular motorcycle brands, and unique experiences like guided rides continues to define success in this dynamic mobility sector.

Get more details by ordering the complete report

The motorcycle rental market from 2025 to 2029 presents a dynamic blend of opportunity and disruption. Driven by tourism, urban mobility, and digital transformation, the sector offers fertile ground for innovation in commuter bikes, luxury tours, and subscription models alike. As companies align with sustainability and tech-forward strategies, the key to success will lie in customer-centric solutions, operational efficiency, and adaptive business models

Safe and Secure SSL Encrypted