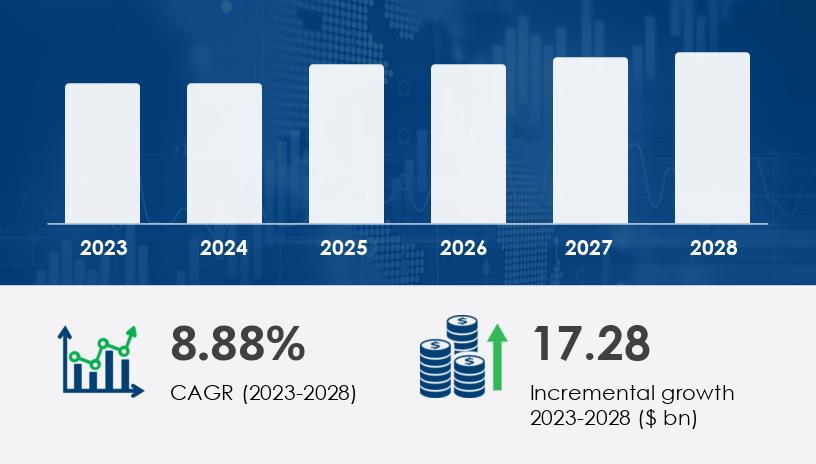

The Middle East and Africa (MEA) renewable energy market is poised for transformative growth, projected to expand by USD 17.28 billion at a compound annual growth rate (CAGR) of 8.88% from 2023 to 2028. This surge is driven by escalating energy demands, a shift toward renewable energy solutions, and the region's abundant natural resources. In this comprehensive guide, we delve into the market's segmentation by end-user and energy type, offering strategic insights for stakeholders navigating this dynamic landscape.

For more details about the industry, get the PDF sample report for free

The MEA renewable energy market is experiencing significant expansion, fueled by increasing energy consumption, government initiatives, and a global pivot towards decarbonization. Solar power leads the charge, bolstered by vast sun-rich terrains, while wind, hydropower, and emerging technologies like green hydrogen and energy storage are gaining momentum.

| Segment Type | Key Drivers | Challenges | Leading Countries |

|---|---|---|---|

| Residential | Off-grid solutions, cost savings | High upfront costs, regulatory hurdles | Egypt, South Africa, Kenya |

| Industrial | Energy security, sustainability goals | Infrastructure limitations | Saudi Arabia, South Africa |

| Commercial | Corporate sustainability mandates | Policy inconsistency | UAE, Morocco, Egypt |

| Solar Energy | Abundant sunlight, declining costs | Land acquisition, environmental impact | Egypt, Morocco, UAE |

| Wind Energy | Favorable wind corridors, scalability | Intermittency, high initial investment | Egypt, Morocco, South Africa |

| Hydropower | Established technology, storage benefits | Environmental concerns, site suitability | Ethiopia, Uganda, Kenya |

Growth Drivers & Challenges: The residential segment is experiencing significant growth, driven by the need for energy independence and cost savings. However, challenges such as high initial investment costs and regulatory hurdles impede widespread adoption.

Expert Insight: "The residential sector's shift towards renewable energy is pivotal for achieving national sustainability goals," says an Energy Policy Expert.

Case Study: In Kenya, the adoption of solar home systems has enabled rural households to access reliable electricity, improving quality of life and economic opportunities.

Key Facts: The residential segment was valued at USD 16.57 billion in 2018, showing a gradual increase during the forecast period.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges: Industries are increasingly turning to renewable energy to enhance energy security and meet sustainability targets. Challenges include infrastructure limitations and the need for substantial capital investment.

Expert Insight: "Industrial adoption of renewable energy is crucial for reducing carbon footprints and ensuring long-term energy resilience," states an Industrial Energy Consultant.

Case Study: In South Africa, large-scale wind farms are powering industrial operations, reducing reliance on the national grid and lowering operational costs.

Key Facts: The industrial sector dominates the MEA Wind Power Market, driven by high energy demands and the push for enterprises to employ renewable energy to lessen their carbon footprint.

Growth Drivers & Challenges: Commercial entities are adopting renewable energy solutions to comply with sustainability mandates and reduce operational expenses. Policy inconsistencies and initial investment costs remain significant challenges.

Expert Insight: "The commercial sector's transition to renewable energy is a strategic move towards corporate responsibility and operational efficiency," notes a Corporate Sustainability Advisor.

Case Study: In the UAE, commercial buildings are integrating solar photovoltaic systems, leading to significant reductions in energy costs and carbon emissions.

Key Facts: The commercial sector is the fastest-growing end-user in the MEA Wind Power Market, driven by increased adoption among firms seeking to accomplish sustainability goals and lower operational expenses.

Opportunities:

Emerging Markets: Countries like Kenya and Ethiopia are investing heavily in renewable energy, presenting new avenues for growth.

Technological Advancements: Innovations in energy storage and smart grid technologies are enhancing the efficiency and reliability of renewable energy systems.

Policy Support: Government incentives and favorable policies are encouraging investments in renewable energy projects.

Risks:

Regulatory Challenges: Complex and inconsistent policies can delay project implementation and increase costs.

Infrastructure Constraints: Limited grid capacity and outdated infrastructure can hinder the integration of renewable energy sources.

Financial Barriers: High upfront costs and limited access to financing can impede the adoption of renewable energy solutions.

The MEA renewable energy market is projected to grow from USD 25.50 billion in 2025 to USD 54.49 billion by 2034, at a CAGR of approximately 8.80%. This growth is driven by increasing energy demand, technological advancements, and supportive government policies. Are companies ready to pivot towards a renewable energy future to stay competitive and sustainable?

Expert Prediction: "The integration of renewable energy into the MEA region's energy mix is not just a trend but a necessity for sustainable development," predicts an Energy Economist.

The MEA Renewable Energy Market is undergoing a transformative shift driven by increasing investments in solar photovoltaic, wind turbines, and hydropower plants. Countries across the region are advancing deployment of offshore wind, onshore wind, and geothermal energy to diversify their energy mix and reduce dependence on fossil fuels. The growing role of biomass energy and emerging solutions like green hydrogen are key to long-term sustainability, especially when paired with energy storage and battery storage systems for grid stability. Key developments include the installation of high-efficiency solar panels, concentrated solar technologies, and expansive solar farms, alongside strategically positioned wind farms to harness regional wind potential. Innovations in tidal energy and wave energy are also beginning to gain attention. Furthermore, bioenergy solutions, smart grids, and microgrids are enhancing regional electrification efforts, especially in remote areas. Investments in renewable fuels, including biogases and e-fuels, are helping drive the region's clean energy transformation.

Residential Sector:

Invest in affordable solar home systems to increase accessibility.

Collaborate with governments to streamline regulatory processes.

Promote community-based renewable energy projects to enhance adoption.

Industrial Sector:

Implement energy-efficient technologies to complement renewable energy sources.

Explore public-private partnerships to share investment risks.

Develop customized renewable energy solutions tailored to specific industrial needs.

Commercial Sector:

Adopt green building standards to integrate renewable energy systems.

Engage in corporate power purchase agreements (PPAs) to secure renewable energy supply.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Research analysis highlights the technological evolution within the MEA Renewable Energy Market, especially the role of solar inverters, precision-engineered wind blades, and next-generation hydro turbines. Development of geothermal plants, biomass boilers, and hydrogen electrolyzers is reinforcing energy diversification across the region. Strategic incorporation of carbon capture technologies aligns with broader decarbonization goals. The rise of solar modules, integration of wind nacelles, and seamless grid integration are critical in scaling renewable adoption. Enhancing energy efficiency across all sectors is being prioritized through innovative renewable projects and deployment of solar trackers, floating solar, and hybrid systems. The expansion of distributed generation and smart power inverters further accelerates the region’s energy transition. These developments are central to achieving decarbonization and aligning national strategies with net-zero emissions targets. As a result, the MEA region is steadily increasing its renewable capacity, marking significant progress in global sustainability efforts.

Safe and Secure SSL Encrypted