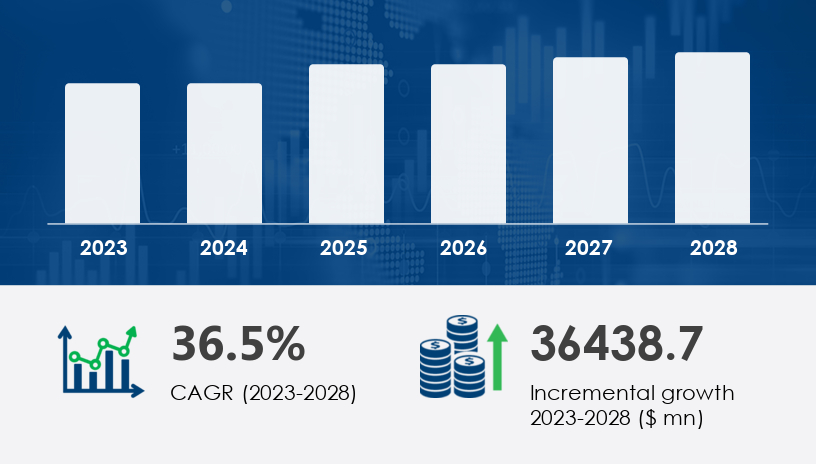

The Machine Learning Chips Market is witnessing explosive growth driven by the increasing integration of machine learning technologies across industries. With the need for faster and more efficient data processing, businesses are turning to specialized chips designed to handle high-performance AI tasks.The Machine Learning Chips Market is projected to grow by USD 36.44 billion between 2023 and 2028, at a CAGR of 36.5%. This growth is fueled by the rapid adoption of AI in sectors such as healthcare, autonomous vehicles, and quantum computing

For more details about the industry, get the PDF sample report for free

A major driver of the Machine Learning Chips Market is the increasing adoption of AI-powered solutions in data centers. Traditional CPUs are no longer sufficient for modern AI workloads such as natural language processing, fraud detection, or real-time medical imaging. Specialized chips like GPUs and ASICs are being adopted to boost efficiency and reduce power consumption. This shift allows data centers to handle larger workloads while lowering operational costs—a competitive necessity in today's digital economy.

One significant trend is the surge in semiconductor investments. For instance, Intel’s $20 billion investment in new U.S. chip manufacturing facilities under its IDM 2.0 strategy is aimed at meeting the growing demand for advanced semiconductors. These chips are essential for technologies like quantum computers, autonomous robotics, and smart infrastructure, underscoring a robust long-term market trajectory.

The Machine Learning Chips Market is transforming rapidly with the integration of advanced AI techniques such as Deep learning, Neural networks, Predictive analytics, and Computer vision. These applications are supported by innovations in Natural language processing, Reinforcement learning, and emerging technologies like Generative AI, Automated ML, and Explainable AI. Hardware components play a critical role, with GPUs, CPUs, FPGAs, and ASICs serving as the backbone of ML acceleration. Emerging designs such as System-on-chip, Multichip module, High-bandwidth memory, and Tensor processing are engineered to deliver performance efficiency, supporting massive parallelism and reducing latency. Trends such as Edge computing, Cloud computing, and exploratory frontiers like Quantum computing are reshaping where and how ML workloads are processed.

Segmentation Overview

By End-user

BFSI

IT and Telecom

Media and Advertising

Others

By Technology

System-on-Chip (SoC)

System-in-Package

Multi-Chip Module

Others

By Geography

North America (U.S.)

Europe (Germany, UK)

APAC (China)

South America

Middle East and Africa

Among end-users, the BFSI sector is expected to see notable growth. In 2018, the segment was valued at USD 1.79 billion and has steadily increased. The use of machine learning chips in this segment supports applications like fraud detection and customer behavior analytics. Analysts suggest that the integration of AI into marketing technologies like Customer Data Platforms (CDPs) is revolutionizing customer targeting, enhancing personalization, and boosting revenue opportunities.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Repo

Covered Regions

North America

Europe

APAC

Latin America

Middle East and Africa

Rest of World (ROW)

APAC is projected to contribute 40% of global market growth during the forecast period. However, North America is rapidly expanding, particularly due to its investments in the autonomous vehicle industry. Key players in the U.S. are integrating machine learning chips into ADAS, HUDs, and LiDAR/RADAR systems to process real-time driving data. Additionally, the gaming industry in North America is increasingly using AI-optimized chips to enhance gameplay experiences. These trends underscore the region’s dynamic adoption of machine learning technology across both industrial and consumer markets.

A notable market challenge is the global chip shortage, which has disrupted supply chains since 2020. This has extended chip delivery lead times to over 28 weeks and increased production costs. Many companies have begun placing inflated orders to hedge against future shortages, further straining the manufacturing ecosystem. This shortage affects key industries including data centers, network security, media, and smart gadgets, prompting urgent investments in R&D and capacity expansion among chipmakers.

Driven by advances in Data analytics, the market supports critical use cases including Image recognition, Speech recognition, Anomaly detection, and Pattern recognition, along with advanced Recommendation systems and interactive AI tools like Virtual assistants and Chatbots. In industrial and enterprise contexts, chips optimized for Predictive maintenance, Fraud detection, Risk assessment, and Customer segmentation enable real-time insights and improved security. Behavioral applications like Behavioral analytics, Text mining, and Video analytics further amplify demand for computational power. As the market expands, the proliferation of IoT devices, Autonomous vehicles, and Robotics drives the need for high-performance, low-power chips. Key differentiators include Supercomputers, Energy efficiency, Parallel processing capabilities, and advanced AI integration via Knowledge graphs and Semantic search technologies.

The Machine Learning Chips Market is at the intersection of data-driven innovation and hardware acceleration, driving progress across AI applications. Research continues to focus on optimizing performance-per-watt, reducing inference time, and enabling scalable architectures. As the demand for real-time intelligence and decentralized AI grows, the development of versatile and energy-efficient chipsets will be crucial to enabling the next generation of smart systems

Innovations and Recent Developments

Chipmakers are responding to market demands with increased innovation and capacity building. Companies like Advanced Micro Devices Inc. (AMD) are offering products like AMD Instinct, designed to handle high-compute AI workloads efficiently. Meanwhile, Intel Corporation’s IDM 2.0 strategy and NVIDIA’s advancements in GPU architecture demonstrate a growing focus on delivering power-efficient, high-performance machine learning chips.

Top players are also expanding geographically and investing in ASICs, FPGAs, SoCs, and high-bandwidth memory technologies. These innovations are essential to support applications such as autonomous vehicles, medical imaging, quantum computing, and smart homes.

Advanced Micro Devices Inc.

NVIDIA Corp.

Intel Corp.

Alphabet Inc.

Baidu Inc.

MediaTek Inc.

Qualcomm Inc.

Samsung Electronics Co. Ltd.

Taiwan Semiconductor Manufacturing Co. Ltd.

Graphcore Ltd.

Tesla Inc.

IBM Corp.

Cerebras

Fujitsu Ltd.

Huawei Technologies Co. Ltd.

SenseTime Group Inc.

Microchip Technology Inc.

NXP Semiconductors NV

Broadcom Inc.

SambaNova Systems Inc.

These firms are classified based on their market strength into dominant, leading, strong, tentative, and weak players, with strategies ranging from mergers and acquisitions to R&D investments and AI-specific chip innovations.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 End user

6.1.1 BFSI

6.1.2 IT and Telecom

6.1.3 Media and Advertising

6.2 Technology

6.2.1 System on Chip

6.2.2 System in Package

6.2.3 Multichip module

6.2.4 Others

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Safe and Secure SSL Encrypted