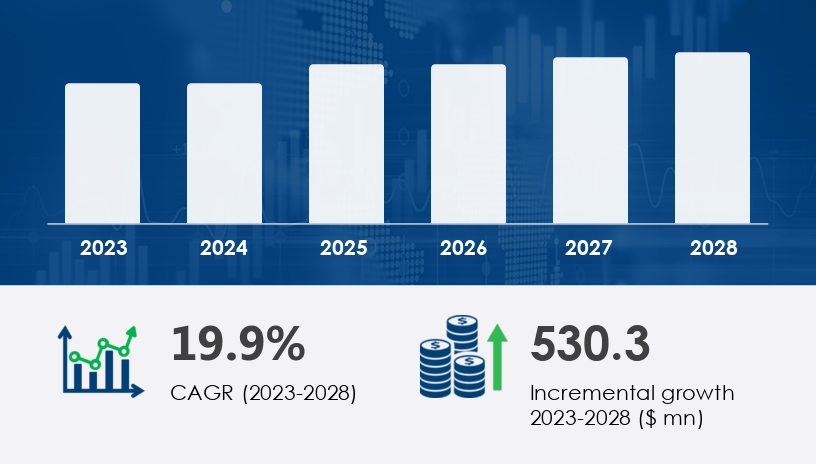

The Europe LNG bunkering market is undergoing rapid transformation as the maritime industry increasingly embraces cleaner fuel alternatives. Driven by stringent environmental regulations and the need to reduce greenhouse gas emissions, the market is expanding significantly across the region. LNG (Liquefied Natural Gas) has emerged as a cleaner, cost-efficient, and scalable solution for marine fuel, especially in major seaborne trade routes. The Europe LNG bunkering market it is forecast to grow by USD 530.3 million between 2023 and 2028, registering a CAGR of 19.9% during the forecast period.

For more details about the industry, get the PDF sample report for free

A pivotal driver for the Europe LNG bunkering market is the implementation of environmental regulations, such as the Global Sulfur Cap, which limits sulfur content in marine fuel to 0.1% from a previous 3.5%. This has triggered a surge in demand for cleaner fuels like LNG that emit lower levels of nitrogen oxides, sulfur oxides, and particulate matter. According to analysts, this shift is particularly impactful in the tanker segment, where chemical and oil tankers, along with liquefied gas carriers, are transitioning to LNG to align with compliance mandates and reduce operational emissions. This regulation-induced shift is reshaping fleet composition and bunkering infrastructure across Europe.

One of the most prominent trends in the Europe LNG bunkering market is the increasing adoption of multiple LNG transfer methods—including Port-to-Ship, Ship-to-Ship, and Truck-to-Ship. This diversification supports more flexible and efficient fueling operations, particularly benefiting larger vessels that may not have direct port access. Additionally, the growing availability of bulk LNG storage facilities in major European ports is enabling seamless and scalable bunkering operations. These developments reflect a broader transition in maritime transport toward LNG as a strategic fuel of choice for environmental compliance and operational efficiency.

The Europe LNG Bunkering Market is undergoing transformative growth as maritime industries shift toward eco-friendly fuel alternatives to meet stringent fuel regulations and reduce marine pollution. LNG fuel—known for its high fuel efficiency and reduced greenhouse emissions—is gaining significant traction over traditional bunker fuel and marine fuel. Ports across Europe are actively enhancing LNG infrastructure, including bunkering facilities, LNG terminals, and LNG distribution networks. The rise of dual-fuel ships, LNG-powered ships, and the expansion of the tanker fleet, ferry fleet, and cargo fleet underscore the increasing demand for reliable LNG bunkering services.

By End-user:

Tanker

Ferry and Ro-Ro

Container

Others

By Geography:

Europe

Norway

Denmark

The tanker segment is the leading contributor to the Europe LNG bunkering market and is forecasted to maintain this position through 2029. In 2018, the segment was valued at USD 73.80 million, with steady growth observed during the base period. Analysts note that this growth is driven by the increased use of Aframax and Suezmax oil tankers, many of which now feature dual-fuel engines and are being constructed as ice-class 1A vessels for year-round operation in Northern Europe. The expansion of the LNG-powered tanker fleet, combined with stricter emissions caps, continues to solidify the segment's dominance in the market.

Europe itself remains the top regional market for LNG bunkering due to regulatory leadership and investment in clean fuel infrastructure. In the North Sea, shuttle tankers are frequently used to transport crude oil from offshore facilities to refineries, while Baltic Sea operations increasingly rely on LNG-powered vessels. New vessels built in 2020—notably 114,000 DWT tankers—highlight the trend toward LNG integration with enhanced cold-weather capabilities. Analysts point out that ongoing investments in LNG storage, refueling, and fleet upgrades are key to maintaining Europe’s leadership in clean maritime fuel solutions.

Despite robust growth, the Europe LNG bunkering market faces a notable challenge in the form of high capital expenditure requirements. Equipping a 1,000 DWT oil tanker with an LNG fuel system incurs costs upwards of USD 104,000, with an additional USD 17,000+ for engine modifications and USD 9,700+ for yard costs. LNG tanks are 2.5 times larger than conventional HFO tanks, which significantly increases vessel design and build costs. Furthermore, dual-fueled ships are about 20% more expensive than their traditionally fueled counterparts, creating financial hurdles for smaller operators and new entrants.

Fueling operations in the region now include versatile methods such as ship-to-ship, truck-to-ship, and port-to-ship transfers, with the integration of portable tanks to enhance flexibility. Leading European ports are investing in bunkering vessels and bunkering infrastructure to support the steady rise in LNG adoption. The deployment of LNG tankers, LNG carriers, and enhancements in LNG logistics are accelerating the region’s fuel transition toward cleaner fuel. As sulfur cap mandates tighten globally, low sulfur options like LNG are helping vessel operators meet environmental compliance and emission control requirements.

The move toward LNG propulsion is not just regulatory-driven but also economically viable due to the long-term savings in natural gas over heavy fuel oils. The market is also witnessing innovation in LNG storage and bunkering operations to support various fleet types including offshore vessels, container fleet, and ferry fleet. With growing pressure to limit sulfur emissions and promote sustainability in maritime transport, the Europe LNG Bunkering Market is set to become a benchmark for global marine decarbonization strategies. The future growth will be shaped by enhanced LNG supply chains, robust port connectivity, and integrated LNG refueling systems.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The competitive landscape in the Europe LNG bunkering market is evolving through technological innovation and strategic infrastructure expansion. Key players are focusing on:

Deploying portable LNG tanks for smaller vessels and port bunkering operations

Enhancing automation and interface systems in bunkering stations to streamline operations

Expanding bulk storage facilities at critical ports in Norway and Denmark, enabling cost-effective refueling options

These strategies reflect a deliberate industry push toward sustainability, efficiency, and regulatory compliance.

The Europe LNG bunkering market is on a rapid growth trajectory, with market size projected to grow by USD 530.3 million from 2023 to 2028, reflecting a CAGR of 19.9%. As environmental regulations tighten and maritime operators shift toward sustainable fuels, LNG is cementing its role as a preferred marine fuel. The tanker segment leads market growth, supported by modern vessel construction and emissions mandates. Despite capital cost challenges, strategic investments and infrastructure development are laying a strong foundation for long-term growth. Europe is poised to remain at the forefront of the global LNG bunkering landscape.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 End-user

6.1.1 Tanker

6.1.2 Ferry and Ro-Ro

6.1.3 Container

6.1.4 Others

6.2 Geography

6.2.1 Norway

6.2.2 Denmark

6.2.3 Rest of Europe

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted