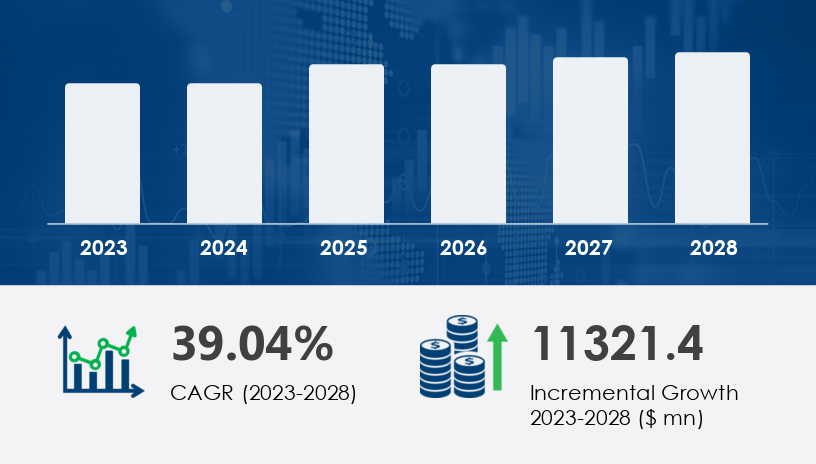

The Light-Emitting Diode (LED) Grow Lights Market is experiencing rapid expansion due to rising demand for indoor farming and sustainable agriculture solutions. These systems provide optimized light spectrums for plant growth in controlled environments, including greenhouses and vertical farms. The market's trajectory reflects growing environmental concerns and the global push toward energy-efficient technologies.In 2024, the LED grow lights market is estimated to be valued significantly, with projections indicating an increase of USD 11.32 billion by 2028 at a CAGR of 39.04%. This impressive growth is propelled by technological innovation and urban food production needs..For more details about the industry, get the PDF sample report for free

A significant driver fueling the Light-Emitting Diode (LED) Grow Lights Market is the expansion of indoor farming. With rising urbanization and the decreasing availability of arable land, controlled environment agriculture (CEA) is gaining momentum. LED grow lights enable optimized growth conditions for crops in greenhouses and vertical farms, offering customizable light spectrums, higher energy efficiency, and longer life compared to traditional lighting. As a result, LED grow lights are being rapidly adopted for both new installations and retrofitting existing agricultural setups. The energy-saving benefits and enhanced crop yields make them indispensable for sustainable farming.

One of the emerging trends is the surge in investments in greenhouse horticulture startups and smart farming technologies. Innovations such as WiFi-enabled LED systems, hydroponic integrations, and spectrum-tuned lighting are shaping the future of agriculture. These advancements allow real-time monitoring and adjustment of lighting conditions, supporting optimal crop growth. In the U.S., increased focus on vertical farming and urban food security is contributing to the trend. As urban centers prioritize locally grown produce, LED grow lights offer a sustainable path forward, accelerating their integration in commercial agricultural facilities.

The Light-Emitting Diode (LED) Grow Lights Market is experiencing significant growth driven by the increasing adoption of indoor farming, greenhouse lighting, and vertical farming practices. As a core component of horticultural lighting systems, LED grow lights provide artificial lighting solutions that enable efficient plant growth across all stages, from vegetative growth to the flowering stage. The shift toward controlled environment agriculture emphasizes the importance of energy efficiency, spectrum control, and full spectrum lighting to optimize crop yield and improve photosynthetic efficiency. Emerging trends in urban agriculture and zero-acreage farming further bolster demand, particularly for the cultivation of microgreens, leafy greens, and fruiting crops

The LED grow lights market is segmented by:

Application:

Commercial greenhouses

Vertical farming

Indoor farming

Others

Power Rating:

Low power (<100 W)

Medium power (100–300 W)

High power (>300 W)

Geography:

North America (U.S., Canada)

Europe (U.K., others)

APAC (China)

South America

Middle East and Africa

Among application segments, commercial greenhouses are projected to lead the market. In 2018, this segment was valued at USD 541.80 billion and has shown consistent growth since. Commercial greenhouses leverage LED lighting for precise control over temperature, light, and irrigation, enhancing productivity and crop yield. Analysts highlight that LED lighting systems offer significant advantages over traditional options, including energy savings and improved spectral performance, making them a preferred choice for year-round crop cultivation in transparent-roof facilities.

Europe is projected to contribute 35% to the global market growth during the forecast period. Countries like the Netherlands are pioneering vertical farming and climate-controlled horticulture. Europe’s dominance is attributed to its advanced commercial greenhouse infrastructure and leadership in horticultural exports such as tomatoes and onions. European growers are heavily investing in LED systems due to their energy efficiency and ability to boost yields. Additionally, indoor farming initiatives and hydroponic systems are becoming increasingly prevalent across the region, driven by limited arable land and the demand for eco-friendly food production.

For more details about the industry, get the PDF sample report for free

Despite the benefits, the high installation and setup costs of LED grow lights remain a significant barrier. The upfront investment in LED systems, including smart controls and high-powered diodes, is often cost-prohibitive for small-scale or emerging farmers. Although long-term energy savings and reduced maintenance offer cost advantages, the initial financial outlay can deter adoption. Manufacturers are responding with R&D investments aimed at improving luminous efficiency and lowering production costs, but affordability remains a concern in the short term.

Modern grow light technologies include various light forms such as COB LEDs, SMD LEDs, and quantum boards, offering enhanced canopy penetration, optimal light spectrum, and precise light wavelength delivery. These lighting systems support applications in hydroponics lighting, aeroponics systems, and cannabis cultivation, each requiring unique PAR output and light intensity configurations. Innovations like smart controls, dimmable LEDs, and effective cooling systems for heat dissipation are improving system durability and operational control. With customizable light fixtures and integration of UV lighting, IR lighting, blue light, red light, and white light, growers can tailor solutions for specific growth stages and conditions.

Technological advancements in the LED grow lights sector are revolutionizing spectrum control for precise daily light integral management, allowing for fine-tuning of lighting cycles for various crop types. Applications in cannabis cultivation, which require rigorous environmental parameters, benefit from high photosynthetic efficiency and targeted light wavelength deployment. Demand for optimized vegetative growth and maximized flowering stage outputs is driving innovation in smart controls and cooling systems. Whether used in urban agriculture or expansive greenhouse lighting, LED grow lights play a critical role in boosting efficiency, sustainability, and profitability in next-generation farming systems

Innovations or Recent Developments

Leading companies are focusing on product innovation, strategic alliances, and regional expansion to gain competitive advantages. Advanced Grow Lights American Co., for example, offers high-performance models like the FC 4800 and FC 8000, tailored for commercial use. These systems support a range of applications from home gardens to large-scale operations.

Other notable players include:

Heliospectra AB

Black Dog Grow Technologies Inc.

Kind LED Grow Lights

Bridgelux Inc.

Samsung Electronics Co. Ltd.

Signify NV

OSRAM Licht AG

These companies are adopting smart lighting solutions, including WiFi control, spectrum tuning, and integration with hydroponic systems. Analysts note that smart LED systems are particularly effective in reducing electricity consumption while enhancing crop performance, a key factor in commercial growers’ purchasing decisions.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Application

6.1.1 Commercial Greenhouses

6.1.2 Vertical Farming

6.1.3 Indoor Farming

6.1.4 Others

6.2 Power Rating

6.2.1 Low Power (<100 W)

6.2.2 Medium Power (100–300 W)

6.2.3 High Power (>300 W)

6.3 Geography

6.3.1 North America

6.3.2 Europe

6.3.3 APAC

6.3.4 South America

6.3.5 Middle East and Africa

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted