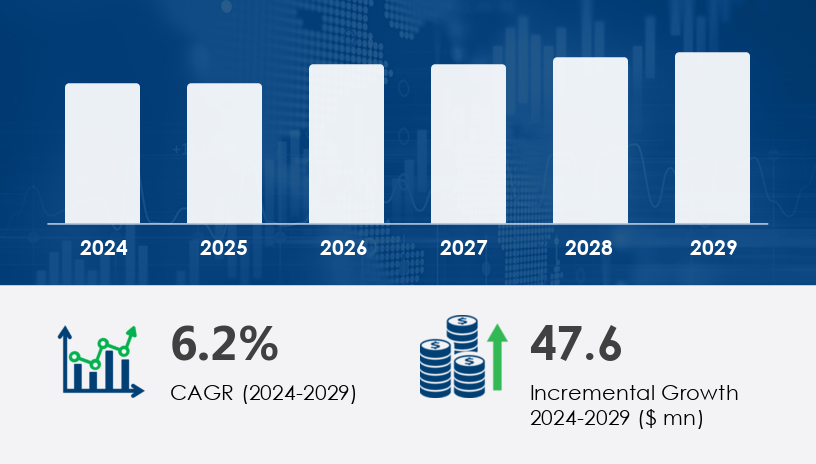

The Integrated Stepper Motor Market is poised for robust growth between 2025 and 2029, driven by the rising demand for industrial automation and smart manufacturing solutions. In 2024, the market was valued at approximately USD 766.4 million and is projected to increase by USD 47.6 million by 2029, growing at a CAGR of 6.2% during the forecast period.

For more details about the industry, get the PDF sample report for free

A key driver propelling the growth of the Integrated Stepper Motor Market is the increasing demand for automation across industrial sectors. These motors are essential components in machinery used in packaging, semiconductor equipment, robotics, and medical devices. The integration of control electronics simplifies installation and enhances usability, making integrated stepper motors a preferred solution over conventional systems. Their precise motion control capabilities enable improved operational efficiency in process and discrete industries. This demand is reinforced by the adoption of Industry 4.0 technologies and the growing need for high-performance motion systems in automation, positioning integrated stepper motors as indispensable across a range of applications from 3D printers to CNC machines.

One of the most transformative trends in the Integrated Stepper Motor Market is the increased integration of Internet of Things (IoT) technology into motors and drives. IoT integration allows for real-time monitoring, predictive maintenance, and remote control, which significantly boosts productivity and minimizes equipment downtime. This trend is influencing adoption across both industrial and office automation segments, where integrated stepper motors are deployed in equipment like printers, infusion pumps, and synthesis machines. As a result, industries are shifting toward smarter systems that provide enhanced control and data analytics, reinforcing the motor's role in next-generation automation infrastructure.

The Integrated Stepper Motor Market is witnessing strong growth, fueled by its essential role in precision motion applications across industries. Core technologies such as integrated stepper motors, unipolar motors, and bipolar motors provide highly controlled motion through electrical pulses that regulate rotation angle. These motors are widely used in CNC machines, 3D printers, robotics, and packaging machinery, offering high-precision control in compact designs. The adoption of hybrid stepper, permanent magnet, and variable reluctance motors enables versatility in applications requiring varying torque and resolution. With increasing demand in medical equipment, food processing, and automotive manufacturing, the push toward energy efficiency, compact motors, and smart manufacturing continues to shape the market's future.

The Integrated Stepper Motor Market is segmented by the following categories:

End-user:

Process industries

Discrete industries

Type:

NEMA17

NEMA23

Product:

Rotary stepper motors

Linear stepper motors

Application:

Industrial automation

Medical devices

Automotive

Consumer electronics

Among all market segments, process industries are expected to witness the most significant growth through 2029. In 2019, this segment was valued at USD 70.3 million and has continued to expand steadily due to increasing automation in sectors like packaging machinery, experimental apparatus, and industrial automation. According to market analysts, the integration of IoT technology and the need for high-precision systems in operations such as conveyors, robotics, and cranes are catalyzing adoption in this segment. These motors provide the precision and reliability required for critical processes, making them a core component of automation in process-heavy environments.

The report covers the following regions:

North America

Europe

APAC

South America

Middle East and Africa

Europe is projected to contribute the largest share to the global Integrated Stepper Motor Market, accounting for 43% of total growth between 2025 and 2029. This expansion is attributed to rising industrial automation efforts across countries like Germany, France, and Italy, especially in semiconductor equipment, experimental apparatus, and packaging machinery sectors. Europe’s emphasis on energy security and reducing dependency on oil imports has led to increased investment in automated industrial systems. Analysts highlight that the adoption of smart city initiatives, IoT-based devices, and robotics is rapidly increasing in the region, which is expected to maintain a consistent demand for integrated stepper motors over the forecast period.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Despite positive growth prospects, the Integrated Stepper Motor Market faces a significant challenge from intense competition by low-cost Asian manufacturers. Companies from regions like China are able to offer competitively priced products due to lower labor and raw material costs, disrupting pricing dynamics particularly in the U.S. and European markets. This situation puts pressure on established manufacturers to either reduce prices or increase value through innovations. As price-sensitive customers seek affordable solutions, maintaining profitability while delivering advanced, reliable stepper motors remains a central challenge for market participants.

Recent market research highlights rising adoption of stepper motors in advanced automation and intelligent systems. Integration with IoT, closed-loop control, and open-loop control capabilities is driving innovation, especially in industries like semiconductor equipment, infusion pumps, and camera platforms. These motors are also becoming integral in smart city projects, enabling automated infrastructure solutions through automation systems and smart electronics. Technologies like micro-stepping technology, feedback systems, and optimized driver circuits allow for smoother motion and reduced vibration, which are critical for modern motion control applications. Furthermore, the versatility of these motors extends to sectors like solar tracking and material handling, where they support both large-scale and miniature motor configurations.

Research analysis indicates that integrated stepper motors are increasingly used in advanced industrial automation settings, where precision and reliability are non-negotiable. Their implementation in pick-and-place robots, automated conveyors, and industrial robots is enhanced by adaptive control algorithms that adjust for system dynamics in real time. In precision engineering, these motors deliver exceptional accuracy required for tasks involving delicate assemblies. The use of predictive maintenance technologies further ensures minimal downtime and extended operational life. The convergence of smart technologies, feedback mechanisms, and real-time analytics is positioning integrated stepper motors as a key component in future-ready automation solutions across industries.

Companies operating in the Integrated Stepper Motor Market are actively pursuing strategic alliances, product innovation, and regional expansion to maintain competitiveness. Notably, ABB Ltd. offers integrated stepper motors under the DSMS series, featuring second-generation current control that ensures smooth and quiet operation. These motors are designed for high precision and energy efficiency. Across the board, leading manufacturers are also incorporating microcontroller capabilities and advanced control algorithms to enhance functionality and customization. This evolution reflects a strategic response to growing industry demands for compact, intelligent, and reliable motion control systems across diverse applications.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 End-user

6.1.1 Process industries

6.1.2 Discrete industries

6.2 Type

6.2.1 NEMA17

6.2.2 NEMA23

6.3 Product

6.3.1 Rotary stepper motors

6.3.2 Linear stepper motors

6.4 Application

6.4.1 Industrial automation

6.4.2 Medical devices

6.4.3 Automotive

6.4.4 Consumer electronics

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted