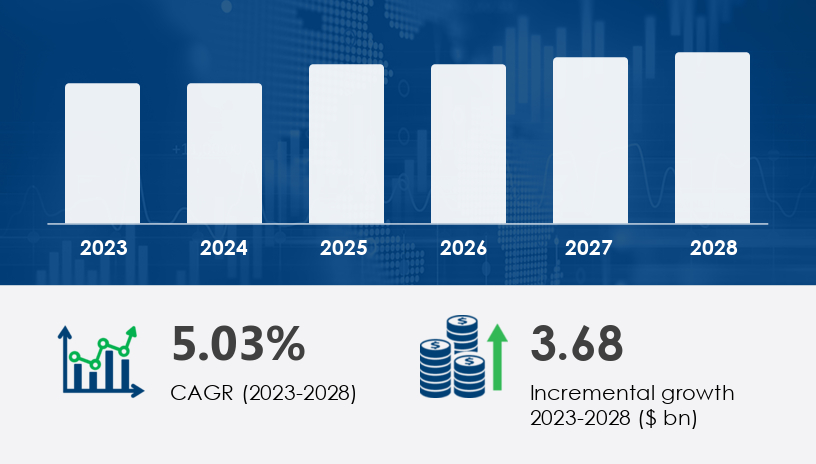

The industrial insulators market is undergoing a dynamic transformation, driven by growing demands for energy efficiency, digital innovation, and sustainable infrastructure. According to market analysis, the global industrial insulators market is projected to increase by USD 3.68 billion between 2023 and 2028, growing at a CAGR of 5.03%. This signals a pivotal shift toward advanced insulation technologies that optimize operational performance, minimize heat loss, and adhere to evolving regulatory mandates.

For more details about the industry, get the PDF sample report for free

Thermal Insulator

Thermal insulators remain the backbone of the market, driven by their role in maintaining optimal temperatures in machinery, boilers, pipes, storage tanks, and heat exchangers. These insulators are widely used in sectors such as power generation, oil and gas, and steel manufacturing, where heat transfer efficiency directly impacts productivity and energy costs.

Backed by R&D advancements, the thermal insulator segment has seen innovations in materials like aerogel, perlite, dolomite, and elastomeric foam, which are now favored for their ease of application, cost-effectiveness, and dimensional stability.

Acoustic and Vibration Insulator

While not the dominant segment, acoustic solutions are gaining ground due to noise reduction requirements in high-decibel industrial environments.

Electric Insulator

Though specialized, electric insulators continue to see steady adoption in electrical and power distribution systems, especially as smart grids and automation expand.

Oil and Gas

A top consumer of insulation due to high-temperature processes and infrastructure requiring fire and corrosion protection.

Power Generation

Increasing focus on thermal efficiency has accelerated insulation adoption in turbines, generators, and auxiliary systems.

Chemicals and Petrochemicals

Energy-intensive processing operations make this a key vertical for smart, sustainable insulation systems.

Cement

Significant usage of thermal insulation to maintain kiln temperatures and reduce emissions.

Others

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

APAC

China: Major driver due to expansive construction projects, petrochemical investments, and its status as both a producer and consumer of insulation materials.

India: Gaining momentum from infrastructure expansion and energy regulation mandates.

North America

United States: Experiencing strong market activity through smart insulation technologies, digital retrofitting, and increased adoption of sustainable insulation solutions in petrochemical and manufacturing sectors.

Europe

Germany and France: Leaders in sustainable construction and green building regulations, pushing demand for low-energy retrofitting solutions.

Middle East and Africa: Rising insulation needs in infrastructure and energy projects, though hindered by installation complexities.

South America: Emerging opportunities amid gradual industrial modernization.

Rising Demand for Energy Efficiency

Industrial insulation is central to reducing energy loss and lowering costs. With the volatility in crude oil prices and global push for decarbonization, companies are investing in insulation to optimize thermal performance, reduce environmental pollution, and meet regulatory benchmarks.

Sustainability in Construction and Manufacturing

Low-energy building design, use of natural fibers, and green retrofitting practices are gaining traction. Industrial facilities are integrating insulation solutions that also deliver corrosion protection, freeze protection, and condensation control.

Heat Transfer Management in Industrial Applications

Industrial assets such as cooling towers, pipes, and heat exchangers depend on insulation to maintain process stability. Materials like calcium silicate, dolomite, diabase, and basalt are used for high-temperature resistance and moisture control.

Integration of Smart Technologies and Digitalization

The market is embracing smart insulation systems embedded with sensors for real-time monitoring of temperature, humidity, and system performance. These innovations enable early detection of thermal losses and support predictive maintenance strategies.

Insulation Retrofitting and Infrastructure Expansion

As the industrial sector modernizes, retrofitting old systems with cost-effective insulation solutions is becoming mainstream. Adherence to standards such as ASTM C518 and ASTM C1113 ensures compliance and performance.

Material Innovation and Substitutes

With rising environmental scrutiny, manufacturers are shifting to asbestos alternatives like CMS fibers. These substitutes enhance fire resistance, smoke control, and toxic gas mitigation, critical in oil, gas, and chemical settings.

Technical Expertise and Installation Complexity

Improper installation leads to thermal bridging, condensation issues, and even fire hazards. Skilled labor shortages and inconsistent adherence to standards are slowing the effective deployment of insulation systems in the U.S.

Cost Constraints

Though long-term savings are well-documented, the initial costs of high-performance insulation—particularly smart systems—can deter adoption, especially in small to mid-sized facilities.

Pandemic Aftershocks and Fiscal Constraints

Disruptions from COVID-19 and strained fiscal resources in oil-dependent economies continue to weigh on capital investment in insulation upgrades.

Get more details by ordering the complete report

The insulation market is witnessing strong growth driven by increased demand for energy efficiency, noise reduction, and environmental compliance across multiple sectors. Applications in building insulation, pipe insulation, boiler insulation, and tank insulation are expanding due to rising awareness about energy conservation and low-energy design. The use of advanced insulation materials such as mineral wool, fiberglass insulation, foam insulation, and calcium silicate has significantly improved thermal insulation, acoustic insulation, and corrosion protection. In particular, sustainable insulation and eco-friendly materials are gaining traction as governments emphasize green materials and insulation standards. Industries such as power generation, oil and gas, and petrochemical insulation are increasingly adopting retrofit insulation solutions to enhance insulation durability, fire resistance, and thermal performance in existing infrastructures.

Several multinational and regional companies are competing on material innovation, digital capabilities, and regional expansion:

API Group Corp.

Armacell International SA

Aspen Aerogels Inc.

Berkshire Hathaway Inc.

Cabot Corp.

Compagnie de Saint Gobain

Etex NV

Grasim Industries Ltd.

Ibiden Co. Ltd.

IPCOM NV

Kingspan Group Plc

Knauf Insulation

Modern Insulators Ltd.

Morgan Advanced Materials Plc

Nichia Corp.

Owens Corning

Rath Aktiengesellschaft

ROCKWOOL International AS

TECHNONICOL Group of Companies

Yoshino Gypsum Co. Ltd.

These companies are actively pursuing strategic alliances, M&A activity, and geographic diversification to meet rising demand across core markets like the U.S., China, and Germany.

Ongoing research in the insulation market is focused on developing innovative insulation systems that offer superior thermal performance, vibration damping, and heat resistance. Technological advancements are enabling smart insulation with sensor integration to monitor insulation efficiency and ensure electrical safety in critical areas using ceramic insulators and electric insulators. Specialized soundproofing materials and acoustic insulation are enhancing interior environments, particularly in industrial and commercial buildings. Innovations also target condensation control, heat storage, and applications for high-temperature insulation in industrial applications. The push for heat storage capabilities and greater adaptability in extreme conditions is driving a shift toward intelligent, data-integrated systems. Collectively, these advances support a new era of performance-driven, smart, and compliant insulation solutions tailored for the modern energy-conscious world.

Safe and Secure SSL Encrypted