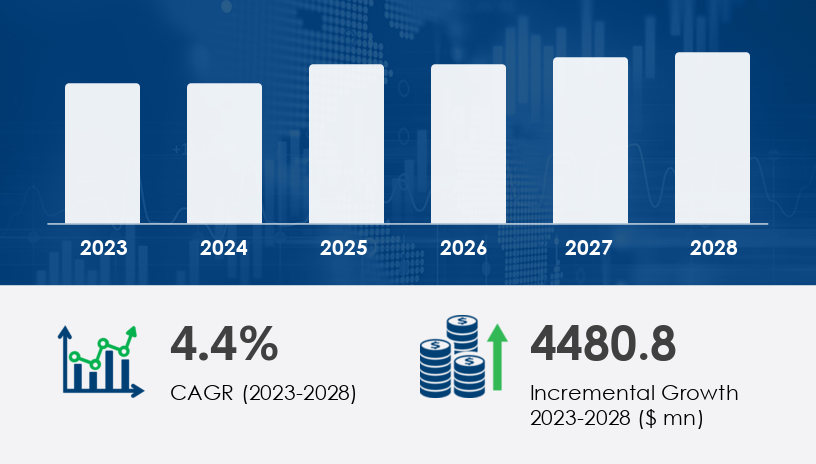

The global heat exchanger market is on a robust trajectory, projected to grow by USD 4.48 billion at a CAGR of 4.4% between 2023 and 2028. This growth is being powered by a surge in demand from the water and wastewater industry, increasing emphasis on energy efficiency, and evolving technologies that optimize heat transfer across sectors.

For more details about the industry, get the PDF sample report for free

Leading companies are intensifying their focus on R&D, product differentiation, and market expansion. Prominent players include:

Alfa Laval AB

API Heat Transfer Inc.

Barriquand Technologies Thermiques

Danfoss A/S

Doosan Corporation

Funke Warmeaustauscher Apparatebau GmbH

Guntner GmbH & Co. KG

Hisaka Works Ltd.

HRS Heat Exchangers Ltd.

Kelvion Holding GmbH

Koch Heat Transfer Company

Linde Plc

Modine Manufacturing Company

SPX FLOW Inc.

SWEP International AB

Thermax Limited

THT Heat Transfer Technology Inc.

Tranter Inc.

Vahterus Oy

Xylem Inc.

These firms are strategically forming partnerships, acquiring new technologies, and expanding geographically to stay competitive.

Key Driver: Expansion of Water and Wastewater Industry

Heat exchangers are pivotal in enhancing thermal efficiency in the water and wastewater sector, where they recover waste heat and integrate it into heating systems. Technologies like sewer heat exchangers—such as the Therm-Liner system by UHRIG Group—are revolutionizing how buildings meet heating and cooling requirements, offering up to 60% coverage through wastewater energy.

Notable Trend: Technological Advancements

Companies are pushing the envelope on innovation. The Alfa Laval Compabloc plate heat exchanger, for instance, demonstrates how corrugated plate patterns can increase turbulence and overall heat transfer coefficients by 3–5 times compared to conventional models. These innovations also minimize fouling and support the use of exotic corrosion-resistant metals, which reduces long-term costs and boosts efficiency.

Key Challenge: Fouling of Heat Exchangers

Despite advancements, fouling—the buildup of deposits on heat exchanger surfaces—remains a persistent issue. This phenomenon reduces thermal efficiency, increases operational costs, and heightens the risk of system downtime. Industries with high mineral content or organic matter, such as power generation and petrochemicals, are particularly affected.

To address this, companies are investing in predictive maintenance systems, smart monitoring, and new materials and coatings that resist fouling. Simulation tools for heat transfer analysis and optimization are gaining prominence, enabling engineers to foresee performance issues before they occur.

Get more details by ordering the complete report

By End-User Industry

Chemical

Fuel Processing

HVAC

Others

The chemical segment is expected to see substantial growth, driven by complex heating and cooling demands across process stages. These systems must be resistant to corrosion and cross-contamination, prompting manufacturers to produce TEMA and ASME-certified models.

By Product Type

Shell and Tube

Plate and Frame

Cooling Tower

Air Cooled

Others

By Material

Metal

Alloys

Others

By End User

Industrial

Commercial

Residential

Heat exchangers are widely used across power generation, chemical processing, and oil and gas, contributing to enhanced thermal efficiency, heat transfer optimization, and reduced carbon footprints.

Europe is projected to contribute 38% to global market growth during the forecast period.

Key countries include:

France

Germany

Italy

UK

Europe’s strong position is fueled by the replacement of outdated systems, expansion of nuclear and renewable energy infrastructure, and innovations in the food and beverage and automotive industries. Germany is particularly prominent due to its leadership in food processing.

Other regions include:

North America

US

Canada

Middle East and Africa

Egypt

Oman

UAE

APAC

China

India

Japan

South America

Argentina

Brazil

Rest of World (ROW)

Each region brings distinct needs and regulatory landscapes, encouraging customization and localized innovation in heat exchanger designs and services.

February 2024: Spirax Sarco launched the EandT EcoStor Compact plate heat exchanger series, emphasizing energy efficiency and water conservation.

October 2024: Alfa Laval acquired Thermal Care, expanding its North American footprint and product range.

March 2025: The EU initiated the Heat Roadmap Europe 4 project, aimed at increasing renewable energy integration in heating and reducing GHG emissions through optimized use of heat exchangers.

July 2025: Shell and Siemens Energy formed a strategic partnership to integrate Siemens' heat exchanger technologies into Shell’s carbon capture utilization projects, bolstering decarbonization efforts.

For more details about the industry, get the PDF sample report for free

The Heat Exchanger Market is expanding steadily due to increasing demand across diverse industries such as chemical processing, the petrochemical industry, and oil and gas. Prominent product types include shell and tube, plate and frame, air-cooled exchanger, and microchannel exchanger, each tailored to specific thermal transfer requirements. Specialty systems such as scraped surface, cooling tower, brazed plate, gasketed plate, and welded plate are gaining prominence for their efficiency and reliability in various industrial settings. In sectors like power generation, HVAC systems, refrigeration units, food processing, and the beverage industry, these technologies are crucial for maintaining optimal performance. The rise in environmental concerns has driven adoption in wastewater treatment, nuclear power, solar thermal, and geothermal energy, with biomass plants and marine applications also relying on advanced exchangers for effective thermal management and energy efficiency.

Heat exchanger manufacturers are increasingly turning to simulation and design software to optimize performance, particularly in industries with complex thermal requirements. From cooling towers to heat pump systems, cutting-edge tools help identify optimal heat transfer coefficients, area utilization, and media flow.

The focus on durability, automation, and predictive maintenance is also growing, with compact, lightweight units equipped with smart sensors now gaining market share. Companies are investing heavily in corrosion-resistant coatings, especially for U-tube and spiral designs, where downtime and replacement costs can be high.

Meanwhile, waste heat recovery and solar thermal integration are reshaping energy strategies for industrial clients looking to cut emissions and lower energy bills.

Research trends in the heat exchanger market reveal growing interest in high-performance materials like stainless steel, carbon steel, nickel alloy, titanium exchanger, copper exchanger, and aluminum exchanger, which offer durability and resistance under extreme conditions. Technological innovations include double pipe, spiral exchanger, finned tube, graphite exchanger, and ceramic exchanger models, each designed for specific use cases, such as automotive cooling, battery thermal systems, and district heating infrastructure. Moreover, modern applications emphasize heat recovery and enhanced energy efficiency, prompting investments in compact exchanger and smart exchanger solutions. Analytical insights show how industries are integrating exchangers into broader decarbonization and electrification strategies, particularly in clean energy ecosystems. This has positioned the market as a vital component in sustainable industrial operations and global energy transformation initiatives.

Safe and Secure SSL Encrypted