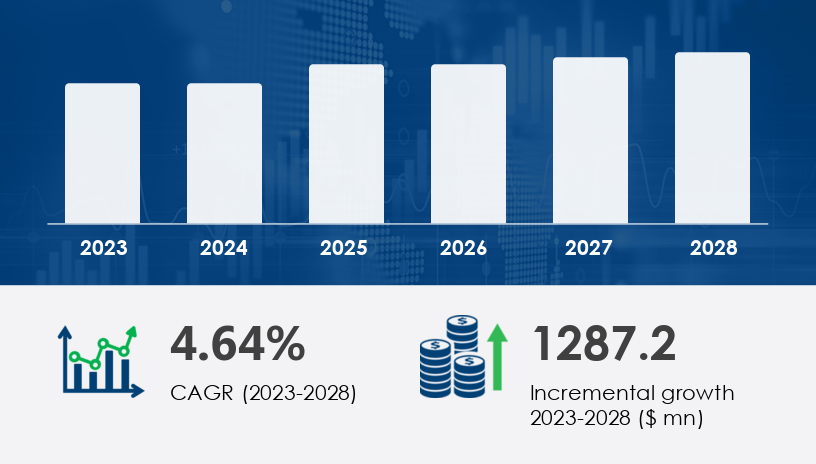

The HVAC terminal units market is poised for significant growth between 2024 and 2028, with a projected increase of USD 1.28 billion and a compound annual growth rate (CAGR) of 4.64%. This growth is driven by escalating construction activities, stringent energy efficiency regulations, and the rising adoption of smart building technologies. As we look ahead to 2025, this comprehensive guide delves into the market's key segments—product types and regional dynamics—to provide strategic insights for stakeholders.

For more details about the industry, get the PDF sample report for free

The HVAC terminal units market encompasses devices that regulate airflow and temperature within buildings, ensuring optimal indoor environments. These units are integral to HVAC systems, offering solutions that enhance energy efficiency and indoor air quality. The market's expansion is fueled by increasing construction activities, stringent energy efficiency regulations, and the growing demand for smart building technologies.

| Segment | Key Drivers | Challenges | 2025 Outlook |

|---|---|---|---|

| Single Duct | High demand in residential applications | Cost sensitivity in emerging markets | Steady growth |

| Dual Duct | Flexibility in commercial buildings | Higher installation costs | Moderate growth |

| Fan Powered | Energy efficiency in commercial sectors | Maintenance complexity | Robust growth |

| APAC Region | Urbanization and infrastructure growth | Regulatory compliance costs | Dominant market share |

| North America | Adoption of smart building technologies | Skilled labor shortages | Sustainable growth |

Growth Drivers & Challenges:

Single duct units are favored in residential applications due to their cost-effectiveness and simplicity. However, price sensitivity in emerging markets poses challenges to widespread adoption.

Expert Insight:

"The single duct segment's growth is closely tied to the expansion of residential construction, particularly in urban areas," notes an industry analyst. "Affordability remains a key factor in emerging markets."

Case Study:

In a residential development project in India, the integration of single duct units resulted in a 15% reduction in HVAC system costs, making the project more feasible for developers.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges:

Dual duct units offer flexibility in commercial buildings by providing separate ducts for heating and cooling. However, their higher installation costs can deter adoption.

Expert Insight:

"Dual duct systems are ideal for mixed-use developments where varying temperature zones are required," explains a building systems consultant. "The initial investment is offset by long-term energy savings."

Case Study:

A mixed-use development in Germany implemented dual duct units, leading to a 20% improvement in energy efficiency across the building.

Growth Drivers & Challenges:

Fan powered units are increasingly adopted in commercial sectors for their energy efficiency and ability to maintain consistent airflow. Maintenance complexity remains a challenge for some users.

Expert Insight:

"Fan powered units are becoming the standard in high-occupancy commercial buildings due to their energy-saving capabilities," states a sustainability expert. "Regular maintenance is crucial to ensure optimal performance."

Case Study:

A corporate office in the United States upgraded to fan powered units, resulting in a 25% reduction in energy consumption and a 15% decrease in maintenance costs over two years.

Opportunities:

Green Building Initiatives: The increasing emphasis on sustainable construction practices presents significant opportunities for HVAC terminal unit manufacturers.

Technological Advancements: Integration of IoT and AI technologies into HVAC systems enhances energy efficiency and user control.

Emerging Markets: Urbanization and infrastructure development in regions like APAC drive demand for advanced HVAC solutions.

Risks:

Regulatory Compliance: Stricter environmental regulations may increase manufacturing costs and complexity.

Supply Chain Disruptions: Fluctuations in raw material prices and supply chain challenges can impact production timelines and costs.

Skilled Labor Shortages: The HVAC industry faces a shortage of qualified technicians, affecting installation and maintenance services.

The HVAC Terminal Units Market is witnessing steady growth due to rising demand for energy-efficient and comfort-focused building climate control systems. Key components driving this market include fan coil units, variable air volume (VAV) systems, chilled beams, and air handling units, which form the backbone of modern HVAC infrastructures. The integration of terminal unit controls, duct silencers, and heat recovery units enhances operational efficiency and supports energy conservation goals. Advanced airflow management is facilitated by ventilation dampers, grilles and registers, and hydronic systems, ensuring optimal performance of air distribution systems. The demand for improved indoor comfort is further met with fan-powered terminals, induction units, and displacement ventilation technologies, all essential to thermal comfort systems. Moreover, the growing use of zone control units, airflow regulators, and static pressure controls contributes to precise environmental control in commercial and residential buildings.

The HVAC terminal units market is expected to reach a value of USD 6.5 billion by 2028, growing at a CAGR of 4.64% from 2024 to 2028. This growth is driven by advancements in smart building technologies, increasing demand for energy-efficient solutions, and stringent indoor air quality standards.

Expert Prediction:

"The integration of AI and IoT technologies into HVAC systems will revolutionize the industry, leading to smarter, more efficient buildings," predicts a leading industry analyst.

Rhetorical Question:

As the demand for sustainable and intelligent building solutions rises, are companies prepared to innovate and lead in the evolving HVAC terminal units market?

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Invest in Smart Technologies: Adopt AI and IoT-enabled HVAC systems to enhance energy efficiency and meet evolving consumer expectations.

Focus on Sustainability: Develop products that align with green building standards and environmental regulations to attract eco-conscious consumers.

In-depth research on the HVAC Terminal Units Market highlights the importance of adaptability and innovation, particularly with the integration of bypass terminals, retrofit terminal units, and both active and passive chilled beams. The inclusion of radiant cooling units, ceiling diffusers, slot diffusers, and perforated diffusers ensures customizable air dispersion solutions across varied architectural layouts. For enhanced air delivery, systems employ swirl diffusers, jet nozzles, and underfloor air distribution strategies. Efficiency-focused innovations like demand control ventilation, energy recovery ventilators, and smart air terminal devices are increasingly implemented to align with sustainable building standards. Performance optimization continues with VAV diffusers, constant volume units, dual duct systems, and mixing boxes, while sound control is addressed through attenuators, plenum boxes, and airside economizers. Lastly, advancements in thermal dispersion units and low-profile terminals underline the market's commitment to compact, high-performance terminal unit solutions tailored to modern HVAC design challenges.

Safe and Secure SSL Encrypted