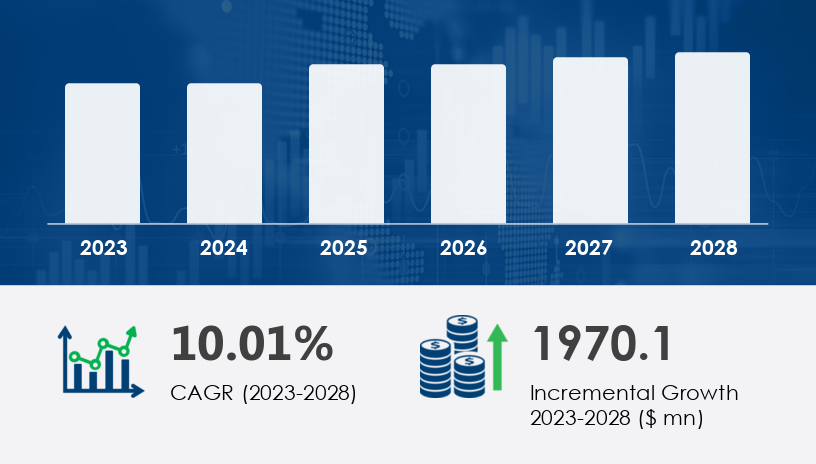

The Home Energy Management Systems (HEMS) market is poised for transformative growth, projected to increase by USD 1.97 billion at a CAGR of 10.01% between 2023 and 2028. Driven by smart grid integration, sustainability mandates, and rising investments in smart cities and homes, the sector is witnessing robust innovation and adoption across geographies. For stakeholders—utilities, smart tech vendors, infrastructure providers—this forecast signals emerging demand for scalable, interoperable, and intelligent energy solutions that optimize residential consumption while ensuring grid resilience.

For more details about the industry, get the PDF sample report for free

The Home Energy Management Systems (HEMS) market is expanding rapidly, driven by the growing need for energy efficiency, cost savings, and eco-friendly technology in residential settings. Core components include the smart thermostat, lighting controls, and programmable thermostats, which allow precise control over energy use. Innovations such as intelligent HVAC systems, advanced controllers, and self-monitoring systems are improving user engagement and system responsiveness. Key devices like the energy monitor, smart grid connectivity, and energy analytics tools provide valuable insights into household energy dynamics. Integration with solar inverters and battery storage ensures better alignment with renewable sources. The adoption of smart meters, comprehensive energy management platforms, and home automation systems further streamlines energy use. Additional technologies such as smart sensors, solar batteries, charge controllers, power optimizers, and smart plugs help homeowners optimize energy consumption. Visual tools like the energy dashboard and systems like smart lighting and HVAC controllers round out the technological portfolio reshaping the residential energy landscape.

The competitive landscape of the Home Energy Management Systems market includes a mix of industrial conglomerates, tech giants, and energy solution innovators:

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Hardware (smart plugs, sensors, hub devices)

Software

Services

Lighting controls

Programmable thermostats

Self-monitoring systems

Advanced central controllers

Wireless Protocols

Wired Protocols

Hybrid

New Construction

Retrofit

On-premises

Cloud

Countries: US, Canada

North America contributes 34% to global HEMS growth.

High focus on energy efficiency and demand response drives U.S. market leadership.

Widespread adoption of solar and wind energy, energy audits, and remote energy control systems.

Increasing energy awareness and rising income levels support broader market penetration.

Countries: France, Germany, Italy, UK

Backed by regulatory frameworks such as the EU’s Energy Performance of Buildings Directive (March 2025).

Accelerated adoption of cloud-based energy dashboards, mobile access, and building automation.

Countries: Egypt, Oman, UAE

Emerging adoption driven by infrastructure modernization and sustainability goals.

Countries: China, India, Japan

Rapid urbanization, government-led smart city initiatives, and energy optimization algorithms fuel demand.

Countries: Argentina, Brazil

Rise in green building certifications and energy efficiency policies encouraging HEMS deployment.

Niche markets gaining traction through renewable energy integration and grid modernization.

Smart Grid Implementation: Core to the market’s expansion, enabling two-way communication between utilities and residential infrastructure.

Energy Efficiency & Sustainability: Integration with smart thermostats, energy dashboards, and management software supports cost reduction and carbon footprint minimization.

Smart Homes & Cities: Investments in connected living environments elevate demand for intelligent energy control systems.

Regulatory Support: Incentives and mandates push for energy infrastructure optimization and load management systems.

Smart Cities & Smart Homes: Integration of IoT, cloud, and AI-powered analytics driving energy forecasting and real-time decision-making.

Renewable Energy Integration: Compatibility with solar, wind, and battery storage systems enhances grid resiliency and promotes sustainable living.

Consumer Empowerment: Tools like mobile apps, data analytics, and remote access control increase user engagement.

Cybersecurity & Privacy: Emphasis on data encryption and secure platforms safeguards user data and fosters trust.

High Implementation Cost: Upfront expenses for sensors, control hubs, and integration software hinder widespread adoption.

Interoperability Issues: Fragmented technology ecosystem complicates seamless integration across devices and platforms.

Complex Installation: Technical expertise required for integrating various home appliances and renewable sources remains a barrier.

February 2024: Schneider Electric launched the Wiser Air Smart Thermostat, enhancing HVAC efficiency and supporting integration with EV charging and renewables.

August 2024: Amazon and Google formed a strategic partnership to integrate Alexa and Google Assistant with HEMS, simplifying voice-enabled energy control.

October 2024: Siemens Smart Infrastructure acquired Enbala, bolstering virtual power plant (VPP) capabilities and energy optimization tools for HEMS platforms.

March 2025: The European Union revised the Energy Performance of Buildings Directive, requiring all new buildings to be nearly zero-energy by 2020 and existing ones by 2040—substantially boosting HEMS demand.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Research into the HEMS market highlights the critical role of intelligent technologies and connectivity in driving performance. Features such as energy controllers, smart appliances, and real-time power consumption monitoring enhance operational efficiency. These systems support seamless renewable integration and are key components in building a smart home environment. Strategic tools for load management, demand response, and energy optimization are increasingly deployed to reduce utility bills and environmental impact. Emphasis on carbon reduction is leading to widespread adoption of wireless protocols and secure cloud platforms that support remote access and scalability. Data analytics, combined with IoT devices, are enabling more adaptive energy systems, while fostering greater energy savings. Integration with building automation and solar panels allows for more effective grid integration, especially during peak load periods. Devices like smart switches, energy trackers, thermal storage, and power monitors provide additional layers of control and insight, reinforcing the HEMS market's position as a cornerstone in the shift toward smarter, greener living.

The Home Energy Management Systems market is entering a pivotal phase, led by a convergence of sustainability goals, smart technology integration, and regulatory mandates. As cloud-based platforms, user analytics, and energy-efficient hardware become central to smart living, enterprises operating in the U.S. energy, infrastructure, and technology sectors must align with this momentum to capture a share of the projected USD 1.97 billion market expansion by 2028.

Safe and Secure SSL Encrypted