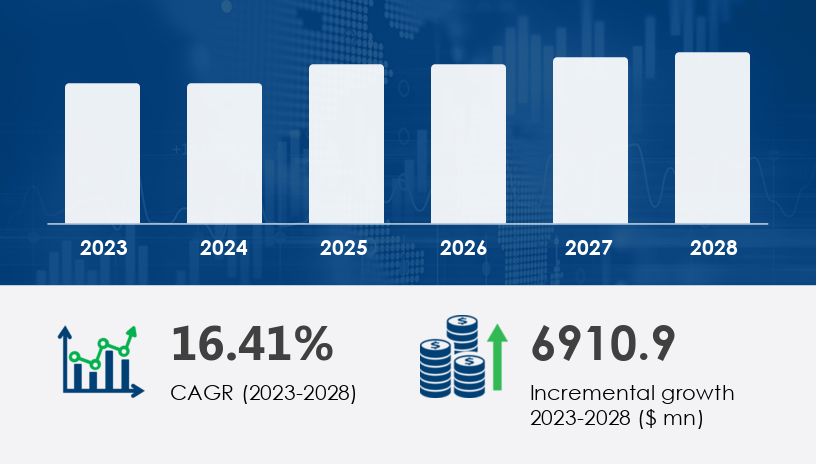

The hemp-based foods market is poised to surge by USD 6.91 billion from 2023 to 2028, reflecting a robust CAGR of 16.41% — a growth curve fueled by rising health awareness, veganism, and demand for allergen-free nutrition. In this comprehensive guide, we explore what’s driving this momentum, what risks lie ahead, and what stakeholders should prioritize in 2025 and beyond.For more details about the industry, get the PDF sample report for free

Once confined to niche health stores, hemp-based foods are now commanding mainstream attention. The fusion of vegan lifestyle trends, gluten-free necessities, and wellness-centric diets has elevated hemp from novelty to necessity. Experts suggest this shift is more than a fad — it's a structural pivot in consumer behavior.

“Hemp isn’t just an ingredient; it’s an answer to multiple dietary crises — from protein deficiency to chronic inflammation,” says Dr. Rina Morales, a food scientist specializing in plant-based nutrition.

Over 9.7 million Americans now identify as vegan. In Europe, 3.2% of the population has made the switch. Hemp-based foods serve as nutrient-dense, plant-based alternatives that don’t compromise on essential amino acids, omega-3s, or fiber.

Hemp foods are naturally gluten-free and lactose-free, making them ideal for people with celiac disease or dairy intolerance. They are also rich in magnesium, vitamin E, and iron — nutrients essential for those managing chronic diseases like insulin resistance and joint pain.

The regulation and safety protocols surrounding hemp cultivation have made these foods more acceptable in mainstream retail environments. Unlike THC-rich cannabis, hemp used for food contains negligible psychoactive compounds.

Get more details by ordering the complete report

The hemp-based foods market has seen a notable evolution in product formats:

Hemp seed-based foods like granola, bread, and bars are leading the charge.

Hemp protein powders are favored in athletic and wellness circles.

Hemp oil-based items have found their way into sauces, salad dressings, and even ice creams.

In 2024, startup brand PlantFuel launched a line of prebiotic hemp smoothies targeted at Gen Z consumers. Leveraging TikTok influencers and clean-label branding, the company sold out its initial inventory within weeks — validating both consumer interest and retail viability.

Despite the e-commerce boom, offline channels remain the dominant force, thanks to the experiential nature of food purchasing. Supermarkets, health food stores, and even local farmers' markets are expanding shelf space for hemp-based offerings.

Offline Segment Value in 2018: USD 2.7 billion

Key Sales Drivers: Taste sampling, visual product education, and in-store promotions.

“Consumers still trust physical retail for validating unfamiliar products — and hemp foods often need that trust bridge,” notes marketing strategist Alex Tan.

For more details about the industry, get the PDF sample report for free

The U.S. and Canada are at the forefront, driven by strong wellness cultures and regulatory support for hemp cultivation. Product innovation and large-scale distribution networks have cemented the region’s leadership.

Countries like Germany and France are seeing organic hemp-based foods climb in popularity, especially in urban health-conscious enclaves.

China and India show long-term potential, particularly as awareness of hemp’s medicinal and nutritional properties grows.

Consumers are growing wary of pesticides and GMOs. Naturally grown, organic hemp products are now viewed as premium offerings — commanding higher margins and brand loyalty.

Beyond simple nutrition, brands are positioning hemp products as solutions for stress relief, heart health, and cognitive clarity — often with CBD-infused functional foods.

From burgers and dips to desserts and shakes, hemp is proving itself as a culinary chameleon, adaptable across cuisines and formats.

Get more details by ordering the complete report

High in protein and fiber

Gluten- and lactose-free

Sustainable, low environmental impact

Rich in essential fatty acids

Limited consumer awareness in developing regions

Supply chain disruptions from weather and crop failure

Persistent stigma around cannabis-derived products

Invest in Education: Break stigma through content marketing that highlights the health benefits and differentiates hemp from THC-rich cannabis.

Go Organic: Align with consumer demands by avoiding pesticides and GMOs.

Capitalize on Offline Presence: Use in-store promotions and health food partnerships to increase market penetration.

Target Niche Segments: Vegan athletes, gluten-intolerant consumers, and wellness-focused millennials are prime adopters.

For more details about the industry, get the PDF sample report for free

Natural Disasters: Major producers like China and France are vulnerable to floods and droughts, which could strain global supply.

Perception Gaps: Despite regulation, hemp still suffers from association with cannabis — a barrier for conservative markets.

Regulatory Hurdles: Inconsistent international laws regarding CBD and hemp usage can impede market entry and scaling.

The hemp-based foods market is gaining significant momentum due to increasing demand for plant-based protein and gluten-free foods among health-conscious consumers. Products such as hemp seeds, hemp oil, and hemp protein are rich in essential fatty acids, dietary fiber, and other hemp nutrients, making them key components in the rising trend of vegan foods and organic hemp offerings. The popularity of hemp milk and protein powder is also growing, serving as nutritious alternatives in plant-based milk categories. Innovation in this sector has led to the development of functional foods like cheese replacements, hemp snacks, and gluten-free snacks, aligning with the surge in vegan diet adoption and growing interest in organic foods. As consumers prioritize health consciousness, hemp-based products are also being promoted for their potential role in preventing chronic diseases, improving heart health, and supporting joint health, further reinforcing their appeal.

Get more details by ordering the complete report

By 2028, the hemp-based foods market is expected to emerge as a cornerstone of the global plant-based ecosystem. Analysts predict increased integration into functional foods, meal kits, and school lunch programs.

“We’re witnessing a nutrient revolution — hemp will be as common as soy or almond in the next five years,” predicts Priya Chandar, a global nutrition policy advisor.

Launch New SKUs: Innovate with hemp-based desserts, energy bars, and beverages.

Focus on Transparency: Highlight sourcing, cultivation practices, and health claims clearly.

Expand Retail Partnerships: Work with organic chains and wellness-focused retailers for strategic shelf space.

Monitor Climate Risks: Diversify sourcing regions to mitigate weather-related supply disruptions.

Market analysis indicates a rising inclination toward hemp-derived functional foods due to their association with stress reduction, insulin management, and suitability for individuals with celiac disease. Product diversity continues to expand, featuring offerings like hemp flour, hemp granola, hemp bars, hemp cereals, hemp bread, hemp pretzels, and hemp chips, as well as condiments like hemp sauces. Moreover, indulgent items such as hemp desserts, hemp burgers, hemp shakes, and hemp ice cream are capturing the attention of consumers looking for allergen-free foods without compromising taste. As the market continues to embrace sustainable foods, the use of eco-friendly crops like hemp supports environmental goals while ensuring rich hemp-based nutrition. The presence of phytoestrogens in hemp is also being explored for its benefits to mental health, and the increasing demand for vegan protein continues to shape new product development and marketing strategies within this dynamic segment.

Ready to get ahead in the hemp revolution? Download our Free Strategic Report for in-depth data, competitor benchmarking, and go-to-market strategy tailored for the hemp-based foods sector.

Safe and Secure SSL Encrypted