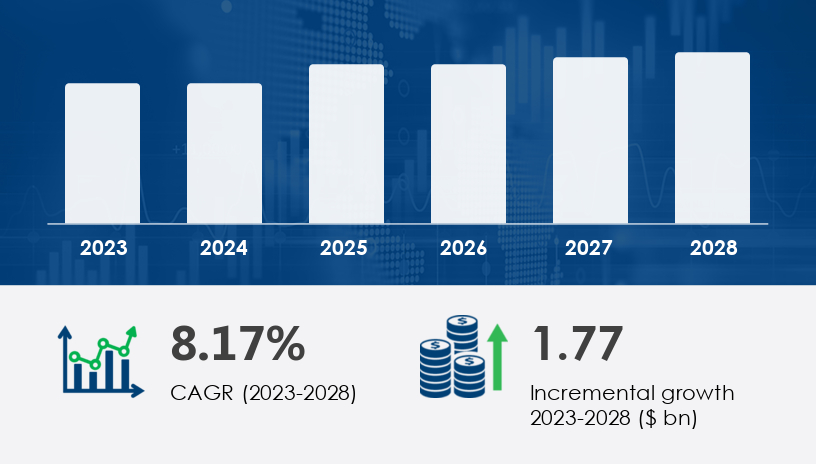

As the spotlight intensifies on energy efficiency and indoor air quality, the heat and energy recovery ventilation (HERV) system market is projected to grow by USD 1.77 billion from 2024 to 2028, achieving a CAGR of 8.17%. This growth trajectory is fueled by a confluence of policy, technology, and human health imperatives. At the heart of this market's momentum lies an accelerating demand for energy-efficient building solutions that deliver not only reduced carbon footprints but also measurable improvements in occupant well-being and productivity.HERV systems—encompassing energy recovery ventilators (ERVs), air exchangers, and air handling units—are gaining prominence as essential infrastructure for green and smart buildings. These systems facilitate fresh air exchange without significant heat or energy loss, and are increasingly being adopted in commercial, residential, and industrial settings. More importantly, they play a pivotal role in mitigating pollutants, pollen, and airborne contaminants—especially in polluted urban environments like Los Angeles, Delhi, and Beijing. The long-term value proposition of these systems includes reduced energy bills, superior indoor air quality, and compliance with evolving sustainability mandates.

For more details about the industry, get the PDF sample report for free

The Heat and Energy Recovery Ventilation System Market is experiencing a surge in adoption as demand for advanced heat recovery and energy recovery solutions grows across residential and commercial sectors. Central to this shift are modern ventilation system configurations including ceiling-mounted, wall-mounted, and cabinet-mounted units that incorporate both air exchangers and heat exchangers. These systems are designed to optimize indoor air conditions and maintain superior air quality while enhancing overall energy efficiency. Integration with broader HVAC system infrastructure and alignment with green technology goals have positioned these solutions as a core part of sustainable development. Supported by innovations in building automation and deployment in smart buildings, the latest ventilation unit designs emphasize air filtration, energy conservation, and compliance with stringent building standards. The emergence of eco-friendly ventilation has prompted a greater focus on airflow management, ensuring maximum thermal efficiency through cutting-edge ventilation technology and regular energy audit practices.

Drivers:

Indoor Air Quality Awareness: Growing recognition of the health implications associated with poor indoor air quality is propelling the demand for HERV systems. These systems facilitate the exchange of indoor and outdoor air while conserving energy, thereby improving air quality and occupant health.

Energy Efficiency Mandates: Stringent environmental regulations and a global push towards sustainability are encouraging the adoption of energy-efficient solutions, including HERV systems, in both new constructions and retrofits.

Smart Building Integration: The incorporation of Internet of Things (IoT) technologies into HERV systems allows for real-time monitoring and control, enhancing system performance and user convenience.

Restraints:

High Initial Investment: The upfront costs associated with purchasing and installing HERV systems can be substantial, potentially deterring adoption, especially in residential sectors.

Installation Complexity: Retrofitting existing buildings with HERV systems may require significant modifications, adding to the overall cost and complexity.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Ceiling-Mounted Systems dominate the market and are forecast to witness the highest growth over the forecast period. Valued at USD 1.28 billion in 2018, this segment continues its upward trajectory due to several compelling factors. These systems are discreet, energy-efficient, and easy to integrate into modern interiors, especially in commercial applications where floor space is limited. Centralized placement allows efficient air dispersion and optimized performance. Their growing presence in both high-end residential and commercial buildings speaks to their versatility.

Wall-Mounted and Cabinet-Mounted Systems also contribute to the market but are more niche, catering to installations where ceiling access is limited or wall integration is preferred for design or mechanical reasons.

Commercial Segment: This segment leads in market share, driven by stringent indoor air quality regulations, energy cost concerns, and the growing footprint of smart buildings. Enterprises are investing in HERV systems to align with green building certifications and operational excellence.

Residential Segment: Though currently trailing commercial in volume, residential adoption is gaining traction—especially in urban environments—due to heightened awareness of the health implications of poor air quality.

Industrial Segment: In manufacturing and production environments, HERV systems offer a double benefit—protecting sensitive processes from contaminants and reducing HVAC operational costs.

North America: This region is expected to contribute 38% of total market growth by 2028. The U.S. and Canada are at the forefront of smart building implementation and sustainable development. Increasing environmental regulations, including those on indoor climate control and energy conservation, are accelerating HERV system deployment. Major players such as Lennox, Carrier, and Trane are headquartered here, and their innovations in smart HVAC integration are setting global benchmarks.

Europe: With UK regulations emphasizing energy efficiency and decarbonization, Europe remains a mature yet fertile ground for advanced HERV systems. Regional policy directives like the European Green Deal bolster this trend.

Asia-Pacific (APAC): China and Japan are key growth engines. China’s urban development boom and Japan’s energy efficiency culture are fueling demand for both residential and commercial installations.

South America: Though still an emerging market, green building awareness is rising, especially in larger urban centers. Infrastructure investments are beginning to incorporate sustainability criteria, which include ventilation system efficiency.

Middle East and Africa: High temperatures and urban development are creating fertile ground for HERV deployment, particularly in commercial buildings and luxury residential developments.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The HERV market is defined by a mix of diversified industrial giants and specialized ventilation companies. Prominent names include:

Airxchange Inc.

Carrier Global Corp.

Daikin Industries Ltd.

Dais Corp.

Fujitsu General Ltd.

Greenheck Fan Corp.

Johnson Controls International Plc

Lennox International Inc.

LG Electronics Inc.

Loren Cook Co.

Mitsubishi Electric Corp.

Munters Group AB

Nortek Air Solutions LLC

Ostberg Group AB

Panasonic Holdings Corp.

Paschal Air Plumbing and Electric

S and P SISTEMAS DE VENTILACION S.L.U.

Trane Technologies plc

Zehnder Group AG

KARYER Heat Transfer San. and Tic. Inc.

Each of these companies is pursuing aggressive innovation agendas. Strategic alliances, geographic expansions, and the rollout of IoT-integrated ERV systems are common themes. The competition is intensifying, particularly as newer entrants offer AI-powered air management systems with predictive maintenance and self-learning algorithms.

The Heat and Energy Recovery Ventilation system market is on a robust growth trajectory, driven by factors such as increasing awareness of indoor air quality, the push for energy efficiency, and technological advancements. While challenges like high initial costs exist, the long-term benefits of HERV systems present a compelling case for their adoption across various sectors.

At the forefront of this market's evolution is a commitment to intelligent climate control and effective air circulation, both essential for high-performance heat transfer and the development of sustainable buildings. Growing investment in ventilation equipment and advanced air handling technologies is driving efficiencies in energy recovery units and overall indoor environment optimization. Building ventilation strategies now frequently incorporate air purifiers and systems capable of precise humidity control to meet the demands of modern ventilation design. From an energy-saving system standpoint, manufacturers are innovating in air distribution and thermal recovery technologies to improve ventilation efficiency and reduce carbon footprints. Key focus areas include air quality management, smart ventilation controls, and energy-efficient HVAC systems that adjust dynamically based on indoor climate changes. With improvements in heat exchange mechanisms and the rise of connected systems, the market is well-positioned to support the next generation of intelligent, sustainable indoor environments.

For more details about the industry, get the PDF sample report for free

The heat and energy recovery ventilation system market is moving from a niche sustainability solution to a foundational infrastructure component in both new builds and retrofits. As stakeholders—from policymakers to property developers—coalesce around ESG goals and climate targets, the role of HERV systems will become even more critical. With leading manufacturers doubling down on IoT and automation, and buyers increasingly factoring in lifecycle costs and health impacts, this market offers fertile ground for B2B innovation and investment.

Safe and Secure SSL Encrypted