When a niche chemical becomes a cross-industry cornerstone, markets shift. In the words of an APAC chemical strategist at a 2024 industry roundtable, “Allyl chloride has quietly become the backbone of materials innovation—its role is now foundational, not auxiliary.” The allyl chloride market is undergoing a fundamental redefinition as rising global demand for epichlorohydrin-based products meets intensifying regulatory and environmental pressures.

From its chemical roots in propylene chlorination to its expanded role in pharmaceuticals, aerospace, and water treatment, the next-gen outlook for the allyl chloride market is far from incremental—it's evolutionary.

For more details about the industry, get the PDF sample report for free

In 2019, the allyl chloride market was largely seen as a support act in the chemical industry. It served as a crucial intermediate for producing epichlorohydrin, but its broader relevance remained relatively unrecognized outside specialty sectors. By 2023, however, market demand was rising steadily, fueled by industrial growth in APAC and increasing applications in electronics and coatings.

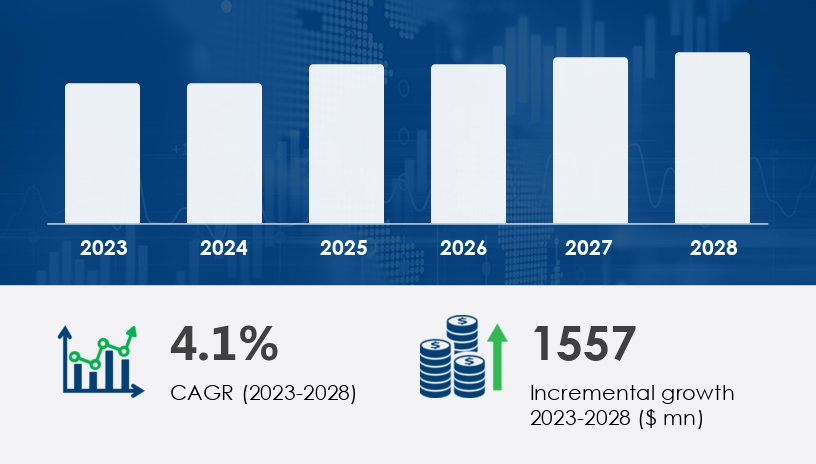

In 2024, the market is at a strategic pivot. Valued at just under USD 4 billion, the market is forecasted to grow by USD 1.56 billion at a CAGR of 4.1% through 2028. This growth reflects an urgent push for cleaner production methods, increased applications in the pharmaceutical, electronics, and construction sectors, and heavy investment in epichlorohydrin derivatives for water-safe resins.

By 2028, expect the allyl chloride landscape to be redefined by bio-based chemical innovation, regulatory transformation, and Asia-Pacific’s (APAC) continued dominance, contributing 72% of global growth. The industry is shifting from volume-driven commodity production to value-added specialty applications, opening up new paths for differentiation and competitive advantage.

Legacy Disruption: Historically, epichlorohydrin production was purely petrochemical-based and faced scrutiny for its hazardous by-products.

New Strategy: Companies are shifting to bio-based epichlorohydrin, integrating sustainability into core processes.

Analyst Insight: "The epichlorohydrin segment is leading this transformation with its integration into water treatment and electronics, setting the tone for allyl chloride’s future," notes a Technavio market analyst.

Business Case: A Chinese manufacturer leveraged increased demand in India’s construction boom to supply epichlorohydrin-derived coatings, resulting in a 27% increase in cross-border revenue between 2022–2024.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Legacy Disruption: Plasticizers and PVC resins were viewed as unsustainable and environmentally taxing.

New Strategy: Firms are pivoting to chlorinated PVA and allylic ether resins that offer durability with lower environmental impact.

Analyst Insight: Construction growth in South Korea and Taiwan is making allyl chloride-based emulsifiers standard in coatings.

Business Case: A Japanese construction firm transitioned 60% of its coating materials to allyl chloride-based alternatives by 2023, reducing VOC emissions by 40% year-over-year.

Legacy Disruption: Use of allyl chloride in pharma was often overshadowed by broader chemical alternatives.

New Strategy: As generic medicine production scales, allylamine-based APIs derived from allyl chloride are becoming key differentiators. In electronics, epoxy resins made from allyl chloride are central to PCB insulation.

Analyst Insight: “Allyl chloride’s role in both generic drugs and high-performance insulators is now indispensable,” states a senior chemical analyst.

Business Case: A US-based electronics OEM doubled epoxy resin imports from APAC in 2023 to meet increased demand for 5G-compatible circuit boards.

APAC's 72% contribution to market growth reflects not just scale but strategic depth. With rising demand from China, India, and South Korea, regional players like Mitsubishi Chemical and Sumitomo Chemical are becoming gatekeepers of raw material supply.

With allyl chloride’s toxicity under regulatory scrutiny, companies pursuing bio-based epichlorohydrin are emerging as leaders. Solvay SA’s recent pilot plant for green epichlorohydrin in Europe reflects this shift.

From pharmaceuticals to coatings, allyl chloride’s expanding use has made it a magnet for cross-sector M&A. As one fictional DuPont executive noted in a recent panel: “Allyl chloride isn’t just a chemical—it’s a portfolio play.”

The Allyl Chloride Market is gaining momentum due to its versatile applications as a chemical intermediate in industries such as plastics, pharmaceuticals, and agrochemicals. A key feedstock for epichlorohydrin and allyl alcohol, allyl chloride plays a crucial role in producing epoxy resins, ether resins, and resin synthesis processes. The propylene chlorination method is widely used in its production, facilitating the development of allyl ethers, allylic esters, and allyl monomers for use in coating resins, adhesive binders, and paper resins. Its growing relevance in agrochemical production, pharmaceutical synthesis, and pesticide formulation showcases its industrial diversity. Additionally, the shift toward bio-based epichlorohydrin and eco-friendly coatings aligns with global sustainability trends. Allyl chloride is also instrumental in glycerol production, particularly in the manufacture of synthetic glycerine, further expanding its importance across downstream chemical sectors.

With regulatory pressure mounting, expect companies to adopt AI-driven safety monitoring systems for real-time emissions control in allyl chloride production.

By 2028, bio-based allyl amines and esters will likely comprise 15–20% of global production, changing pricing models and supply chains.

The rise of miniaturized electronics will drive demand for custom-formulated allyl chloride-based epoxy resins, especially in wearable tech.

Company Example: INOVYN has announced a strategic partnership with an Indian water tech firm to co-develop resins compliant with zero-VOC standards—a clear sign of where the market is heading.

Will your supply chain be ready when allyl chloride moves from intermediate to innovation driver?

Get more details by ordering the complete report

Adopt Sustainable Chemistry First

Prioritize bio-based epichlorohydrin production and green feedstock strategies to comply with evolving regulations.

Invest in AI-Driven Inventory Optimization

Enable predictive planning in high-risk sectors like electrical insulation materials and pharma-grade derivatives.

Diversify End-Use Applications

Expand into growth areas such as allylic ether resins for marine coatings and flame retardants.

Strengthen Regional Partnerships

Deepen supplier networks in APAC—especially in India and China, which are fast becoming innovation hubs for downstream uses.

Embed ESG into R&D

Turn environmental compliance into a competitive moat by leading eco-friendly epoxy resin development.

Scenario-Test Regulatory Risk

Use dynamic modeling to assess the impact of chemical safety laws on production and logistics.

Research into the Allyl Chloride Market is centered on enhancing chemical reactivity and expanding its use in advanced materials and specialty applications. The compound is critical in the creation of allyl silane, allylamine, and allyl isothiocyanates, which are essential allyl derivatives in fine chemical synthesis. It also contributes to the development of organochlorine compounds and epoxide compounds used in industrial catalysts, emulsifier agents, and surfactant chemicals. Its utility in producing polymer additives, plasticizers, and high-strength polymers supports the manufacturing of lightweight materials, directly impacting sectors focused on fuel efficiency and corrosion resistance. Applications in water treatment, elastomer production, and specialty chemicals highlight its value in high-performance and functional materials. Moreover, innovations in chlorohydrination processes and the incorporation of allyl chloride in chemical reactivity studies further demonstrate its critical role in advancing modern industrial chemistry.

The transformation of the allyl chloride market from a utility compound to a strategic enabler of innovation is underway. Its growth from 2024 to 2028 will be shaped not only by volume but by vision—of cleaner chemistry, smarter supply chains, and a broader industry role.

Are we thinking big enough about what a legacy compound like allyl chloride can become in a bio-based, AI-optimized future?

Safe and Secure SSL Encrypted