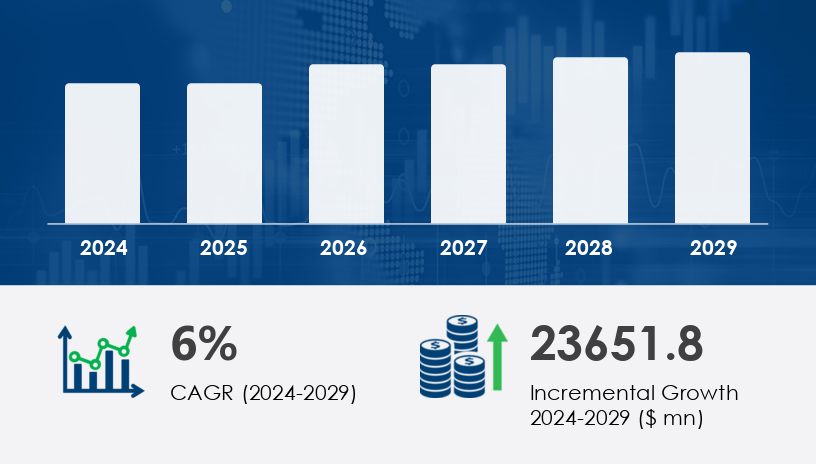

The Water and Wastewater Treatment Equipment Market is projected to grow by USD 23.65 billion between 2024 and 2029, accelerating at a CAGR of 6%. This expansion is driven by increasing water scarcity, industrial pollution, and stringent global environmental regulations.

This article provides a comprehensive overview of what you’ll learn:

Key industry drivers and health-related trends

Segment and regional insights through 2029

Profiles of major players and competitive strategies

Challenges and infrastructure gaps

Equipment and technology innovations like membrane filtration and UV disinfection

From municipal wastewater challenges to cutting-edge treatment solutions, here’s your 2025 forecast and free report-style breakdown.For more details about the industry, get the PDF sample report for free

Water and wastewater treatment equipment includes technologies, machinery, and systems designed to purify water for reuse, human consumption, or safe discharge into the environment. These systems serve municipal utilities and industrial applications such as power generation, manufacturing, and desalination.

Equipment types span from:

Primary treatment: physical processes like sedimentation

Secondary treatment: biological degradation using activated sludge

Tertiary treatment: advanced chemical and membrane processes

Major industry participants are pursuing mergers, tech upgrades, and geographic expansions to remain competitive. Here's a snapshot of key players:

Xylem Inc. – Focused on smart water infrastructure and digital solutions.

Veolia Water Technologies – Expanding global presence with advanced filtration and biological systems.

SUEZ SA – Known for sustainability-driven desalination and industrial reuse solutions.

Accesstech Engineering Pte Ltd – Specializes in reverse osmosis and multi-media filtration systems.

Other notable names: Thermax Ltd., Sulzer Ltd., Kuraray Co. Ltd., Aries Chemical Inc., Ingersoll Rand Inc., Samco Technologies Inc., and DeZURIK Inc

Get more details by ordering the complete report.

The market is segmented by application and treatment type:

Municipal Segment: Largest and fastest-growing. Estimated to grow significantly due to rising demand for potable water and public health initiatives.

Industrial Segment: Includes manufacturing, power, and chemical sectors facing strict effluent discharge norms.

Primary Treatment: Basic filtration and sedimentation.

Secondary Treatment: Activated sludge and biofilm reactors.

Tertiary Treatment: UV disinfection, ozonation, membrane filtration—technologies seeing increased adoption due to stricter environmental regulations.

The rising incidence of waterborne diseases like cholera and dysentery has significantly increased demand for safer water infrastructure. According to the Food and Agriculture Organization, by 2025, 1.8 billion people will live in water-scarce regions.

Key driving trends:

Renewable energy integration in treatment plants (solar, wind)

Growing demand for plant-based and plastic-free packaging

Membrane technologies and ultraviolet disinfection replacing traditional chemical methods

Health regulations pushing for zero-contaminant thresholds

For more details about the industry, get the PDF sample report for free

The Water and Wastewater Treatment Equipment Market is undergoing transformative growth driven by increasing demand for sustainable infrastructure, mirroring advances in precision-driven sectors like the Blood-Grouping Reagents Market. At the core of this market are processes such as water treatment, wastewater treatment, and their progressive stages—primary treatment, secondary treatment, and tertiary treatment—each designed to remove increasingly complex contaminants. Technologies like membrane filtration, reverse osmosis, ultrafiltration, and nanofiltration are integral to improving water quality for both municipal and industrial usage. Complementary methods such as ion exchange, activated sludge, and biological treatment address specific pollutants effectively. To bolster these biological systems, chemical treatment, disinfection systems, UV disinfection, and ozone treatment are employed to ensure pathogen-free output. Critical infrastructure includes filtration equipment, sedimentation tanks, clarifiers, and sludge dewatering units, supported by mechanical components like aeration systems and water pumps. Additionally, niche equipment such as dewatering equipment, water softeners, desalination systems, boiler feedwater conditioning units, cooling towers, and condensate polishing systems reinforce the industry's versatility. As the sector expands, innovations in water reuse and wastewater recycling continue to position this market as a parallel to the rigorous standards and innovation seen in immunohematology and blood compatibility diagnostics.

The Asia-Pacific region, led by China, India, Japan, and South Korea, will contribute 44% of global market growth.

Enforcement of environmental laws such as China’s Water Pollution Prevention Law

Rapid urbanization and industrialization

Government-funded projects on water reuse and desalination

High population density driving massive clean water demand

United States: Investment in replacing aging infrastructure

Canada: Focus on clean drinking water for indigenous and rural communities

Germany, UK, France: Advancing tertiary treatment for industrial effluents

Heavy investment in desalination plants due to freshwater scarcity

Government partnerships with European equipment vendors for technology transfer

South America

Get more details by ordering the complete report

Membrane-based systems such as reverse osmosis, nanofiltration, and ultrafiltration are gaining traction for their energy efficiency and low environmental impact.

Chlorine disinfection systems

Activated sludge systems

UV disinfection units

Biological wastewater reactors

These systems are vital for managing rising effluent volumes and treating saline water in desalination.

2025 Market Size Increase: USD 23.65 billion

Forecasted CAGR: 6% (2024–2029)

Municipal Segment in 2019: Valued at USD 37.87 billion

APAC Share of Market Growth: 44%

Top Technologies: Membrane filtration, activated sludge, UV disinfection

For more details about the industry, get the PDF sample report for free

In-depth research into the Water and Wastewater Treatment Equipment Market reveals advanced technologies and integrated solutions driving operational efficiency and regulatory compliance, much like in the Blood-Grouping Reagents Market. Among these, effluent treatment and zero liquid discharge systems are critical for industries aiming to eliminate environmental discharge. Advanced sludge treatment technologies—including biofiltration, sand filtration, and carbon filtration—enable optimal separation and contaminant capture. Automation in dosing systems and chemical processes like coagulation and flocculation further enhances treatment precision. Mechanical systems such as dissolved air flotation, anaerobic digestion, and water purifiers offer reliable purification and waste reduction. Infrastructure components such as grit removal and screening systems ensure the elimination of large solids early in the treatment cycle, enhancing overall system efficiency. Finally, odor control technologies have become increasingly vital in urban installations, where proximity to residential zones demands enhanced environmental standards. These developments reflect the market’s convergence with high-standard diagnostics industries, where accuracy, safety, and system integrity are paramount—paralleling the precision of antigen detection, cross-match testing, and reagent-based diagnostics found in blood group testing systems.

The outlook for the water and wastewater treatment equipment market remains highly promising. Infrastructure upgrades, public health campaigns, climate adaptation strategies, and industry-specific treatment needs are expected to sustain demand. The rise of digital water technologies—including IoT sensors and predictive analytics—will further optimize performance and reduce waste. Companies that invest in modular systems, green technologies, and AI-based diagnostics are likely to capture long-term market share.By 2029, this market is not just about treating water—it's about building resilience, ensuring health, and enabling sustainable growth across regions. The increasing alignment of government regulations, consumer expectations, and technological innovation ensures that water and wastewater treatment equipment will remain at the forefront of environmental and industrial transformation

Safe and Secure SSL Encrypted