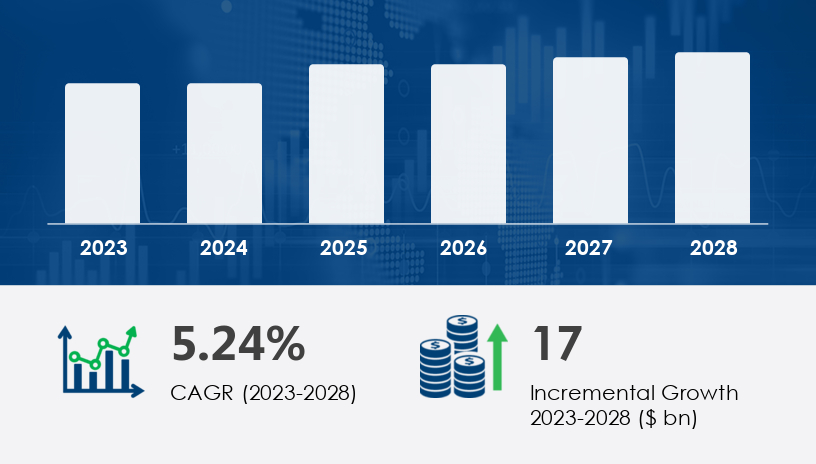

The Europe transmission and distribution (T&D) equipment market is poised for a major transformation, with its size forecast to grow by USD 17 billion between 2023 and 2028 at a CAGR of 5.24%. Driven by infrastructure modernization, renewable energy integration, and smart grid innovations, this sector is becoming a cornerstone of Europe’s energy transition. In this 2025 Outlook and Comprehensive Guide, we delve into the driving forces, emerging challenges, and strategic imperatives shaping the European T&D equipment market. Drawing from market data, expert perspectives, and sector-specific developments, this article offers a 360-degree analysis tailored for industry stakeholders, policymakers, and investors.

For more details about the industry, get the PDF sample report for free

“Infrastructure development is no longer an option—it’s an imperative,” notes Elena Fischer, a European energy systems analyst. “As grids are strained by the dual pressure of electrification and decarbonization, Europe is rapidly investing in T&D systems to bridge that gap.”

Renewable Energy Integration: Wind, solar, biomass, and hydroelectric sources are increasingly contributing to grid loads, requiring advanced T&D infrastructure to handle variability and intermittency.

Smart Grids and IoT: Real-time monitoring, digital meters, and connected devices are optimizing grid operations and improving energy efficiency.

Electric Vehicles: The surge in EV adoption demands robust charging infrastructure, further pushing T&D equipment demand.

Aging Infrastructure: Much of Europe’s grid is decades old. Upgrading transmission lines, substations, and transformers is now critical.

According to historical data, the distribution segment dominated the market with a valuation of USD 33.10 billion in 2018 and is projected to maintain momentum through 2028. This growth is fueled by strategic investments in urban and suburban networks, targeting bottlenecks, congestion, and grid reliability.

By Application: Distribution (largest, fastest growing), Transmission

By Product: Power Cables, Transformers, Switchgear

By Geography: Germany, UK, Italy, Spain

Get more details by ordering the complete report

“Data is the new energy currency,” remarks Dr. Luca Berger, a grid digitalization expert. The implementation of smart meters, AI-powered fault detection, and IoT-connected devices is redefining operational capabilities. These technologies not only streamline energy flow but also reduce T&D losses and enhance outage management.

A smart grid-enabled system can reduce outage duration by up to 50%, according to industry modeling.

Emerging Trends: Digital Monitoring & Control Systems: Real-time telemetry improves fault isolation and service restoration.

Flexible Power Cables & Modular Switchgear: Support dynamic load balancing.

Energy Storage Integration: Enhances grid resilience and renewable energy uptake.

While modernization delivers benefits, it also introduces vulnerabilities.

Key Challenge: The integration of digital tech has exposed T&D systems to cybersecurity risks, threatening grid stability and consumer trust.

Vulnerabilities include:

Legacy systems with outdated software

Increased entry points via IoT devices

Fragmented cybersecurity protocols across vendors

“Grid reliability now depends as much on cybersecurity posture as on physical hardware,” warns Karen Löwen, cybersecurity advisor to the EU Energy Directorate.

Strategic Recommendation: Vendors and utilities must adopt unified cybersecurity frameworks, including real-time threat detection and compliance with ISO/IEC 27001 standards.

In 2024, Germany initiated a €3.5 billion national initiative to modernize its T&D systems with:

AI-based fault detection

Renewable integration zones

Decentralized battery storage

The result? A 13% reduction in transmission losses and a 17% improvement in grid uptime.

This initiative underscores the value of coordinated investment, technology adoption, and regulatory support in building future-ready infrastructure.

For more details about the industry, get the PDF sample report for free

Siemens AG

Schneider Electric SE

Mitsubishi Electric Corp.

General Electric Co.

Prysmian Spa

Hitachi Ltd.

Nexans SA

LS Corp.

These players are investing heavily in strategic alliances, mergers, and smart equipment innovations to consolidate market share and tap into emerging economies within Europe.

Market Classification Snapshot: Dominant Players: Siemens, GE, Schneider

Innovators: Vertiv Holdings, NKT AS

Category-focused: Southwire, Dubai Cable Company

The Europe Transmission and Distribution (T&D) Equipment Market is projected to grow by USD 17 billion between 2023 and 2028, at a CAGR of 5.24%, fueled by increasing investments in infrastructure modernization and renewable integration. The adoption of technologies like smart appliances, electric vehicles (EVs), and smart grids is reshaping the market landscape. Key components such as transformers, cables and lines, switchgear, conductors, circuit breakers, insulators, and meters play a crucial role in ensuring energy reliability. Rising electricity demand, the need for electrical efficiency, and the integration of offshore wind power, biomass, solar energy, hydroelectric power, geothermal energy, and other emission-free energy sources are driving deployment of advanced T&D infrastructure. Distribution is the largest application segment, with Europe focusing on upgrading aging networks to alleviate grid congestion. Countries like Germany, UK, Italy, and Spain are ramping up investments to enhance grid flexibility and reduce T&D losses. As energy demand continues to rise, smart digital solutions and energy storage solutions are being adopted to improve system resilience and power management.

Get more details by ordering the complete report

The European T&D equipment market is not just expanding—it’s evolving. With nations aligning their grid infrastructure with climate targets and digital capabilities, 2025–2028 will be pivotal years.

Electrification and decarbonization are converging, driving long-term demand for advanced T&D systems.

Interoperability and cybersecurity must be prioritized to ensure seamless and secure operations.

Smart grid implementation will be the litmus test of market adaptability and utility innovation.

Utilities: Prioritize digital transformation and invest in modular, scalable T&D systems.

OEMs and Manufacturers: Develop cybersecurity-integrated products and partner with cloud platforms.

Governments: Standardize regulations across the EU to facilitate cross-border energy exchange.

Investors: Focus on firms with strong R&D pipelines and exposure to both renewable and smart grid segments.

For more details about the industry, get the PDF sample report for free

In-depth analysis of the Europe T&D Equipment Market reveals that the ecosystem comprises essential components such as capacitors, protective devices, relays, contractors, flexible power cables, transmitters, interconnecting lines, and converters, which are critical to achieving grid reliability and performance optimization. The integration of digital monitoring and control systems enhances grid intelligence, while the adoption of automation reduces operational bottlenecks. The market is segmented by product (e.g., power cables, transformers, switchgear) and application (transmission and distribution), with the distribution segment showing the strongest growth trajectory. However, challenges such as cybersecurity risks, supply chain vulnerabilities, and lack of standardization pose threats to market stability. Companies like Schneider Electric, Siemens AG, Prysmian Spa, NKT AS, Hitachi Ltd., and General Electric Co. are leveraging strategies like mergers, product launches, and geographic expansion to strengthen their market presence. As the market continues to digitalize, data is playing a pivotal role in driving performance, enabling real-time analytics, and fostering predictive maintenance. This shift, combined with growing electricity demand and aging infrastructure, underscores the critical need for continued innovation in the Europe T&D equipment sector.

With Europe’s energy landscape rapidly transforming, stakeholders must move beyond passive participation and embrace strategic foresight. Whether you are a policymaker, technology provider, or investor, understanding the nuanced dynamics of the T&D equipment market will be crucial to capturing growth in this high-potential sector.

Safe and Secure SSL Encrypted